Today, gold is showing moderate intraday growth, although no active buying is observed as markets await news from the United States. Market participants continue to express concern about slowing economic growth caused by the longest government shutdown in U.S. history, which is worsening investor sentiment and boosting demand for gold as a safe-haven asset.

Earlier, Ukrainian forces reported strikes on targets inside Russian territory using U.S.-supplied ATACMS missiles. In the context of the ongoing crisis, Ukrainian President Volodymyr Zelensky plans to visit Turkey in an attempt to revive stalled peace talks with Russia. U.S. Special Representative Steve Witkoff is expected to join the discussions. However, Kremlin spokesperson Dmitry Peskov announced that the Russian side does not intend to participate in these consultations. This increases geopolitical uncertainty and further strengthens the position of the precious metal.

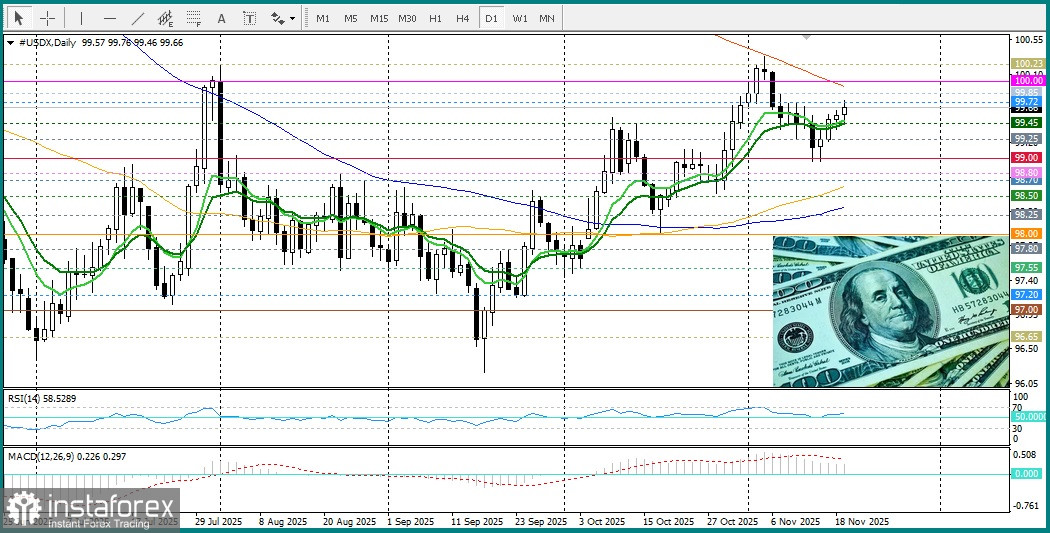

The U.S. dollar is struggling to attract significant buyers, even though it remains near a weekly high thanks to less pessimistic Federal Reserve forecasts. In addition, several Fed officials recently advocated a cautious approach to further monetary easing in the near future.

Federal Reserve Vice Chair Philip Jefferson earlier this week emphasized the need for gradual action by the central bank. Meanwhile, Fed Governor Christopher Waller argued for another rate cut due to concerns about the labor market and slowing hiring. The U.S. Department of Labor announced that continuing unemployment claims — an indirect indicator of employment — rose to 1.957 million for the week ending October 18, indicating a higher unemployment level in October.

Therefore, the delayed release of the U.S. nonfarm payrolls report for September, expected on Thursday, is generating broad interest. This report, along with the FOMC meeting minutes scheduled for release later today, will provide insight into the trajectory of Fed rate cuts and influence the U.S. dollar and the XAU/USD pair.

From a technical standpoint, the price rebound from the 200-SMA on the 4-hour chart favors the bulls. However, the mixed oscillators on the same chart call for caution before preparing for further upside.

On the other hand, the $4,045 level, or the 100-SMA, may offer immediate downside protection ahead of the 200-period EMA on the 4-hour chart, which sits just above the key $4,000 level. A decisive break below the latter would expose the price to vulnerability and accelerate its decline.