The strength of the U.S. dollar is also influencing gold's dynamics. A stronger dollar typically puts pressure on gold prices, making the precious metal more expensive for buyers using other currencies. Given that the U.S. dollar index has shown resilience lately—linked to a reassessment of expectations regarding Fed policy—the decline in gold isn't surprising.

Analysts are closely monitoring upcoming economic data, including inflation and employment figures, which could provide additional clues regarding the trajectory of Fed interest rates. However, with the October employment report not being published, this places Fed members and traders in a challenging position. The October data will be released alongside the November report, which will come out after the final FOMC meeting of the year.

Meanwhile, the minutes from the October meeting indicated that many officials likely deemed it appropriate to keep rates unchanged until the end of 2025.

It's worth noting that gold has risen significantly this year, gaining over 50% and reaching record levels in October. This increase has been supported by two previous rate cuts by the Fed, as well as heightened purchases of gold by central banks and inflows into gold-backed exchange-traded funds.

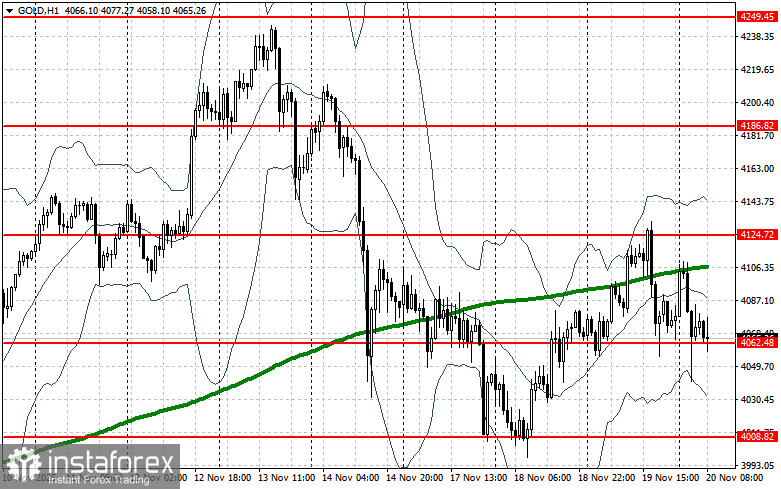

As for the current technical picture for gold, buyers need to conquer the nearest resistance at $4124. Achieving this will allow targeting $4,186, above which it will be quite challenging to break through. The furthest target will be around $4,249. In the event of a decline in gold, bears will attempt to take control below $4,062. If successful, breaking through this range will deal a significant blow to bullish positions and could push gold down to a low of $4,008, with the potential to reach $3,954.