As indicated by the minutes released from the Federal Reserve's October meeting on Wednesday, many policymakers expressed concerns that lowering interest rates could increase the likelihood of issues related to price stability, raising the risks of higher inflation levels. Nevertheless, some officials acknowledged that small steps toward reducing the funds rate by the end of the year might be justified, considering the overall economic backdrop. A significant share of voting members rejected the idea of additional easing in December. They insisted on maintaining the current monetary policy until clearer signals about the labor market and inflation rates emerge.

This division in opinions highlights the complexity of choosing the agenda at this stage. The decision to keep interest rates unchanged or to go ahead with policy easing depends on numerous factors, including inflation metrics, unemployment levels, and overall economic conditions. The consequences of premature or insufficient policy moves can affect the future trajectory of the US economy and global markets.

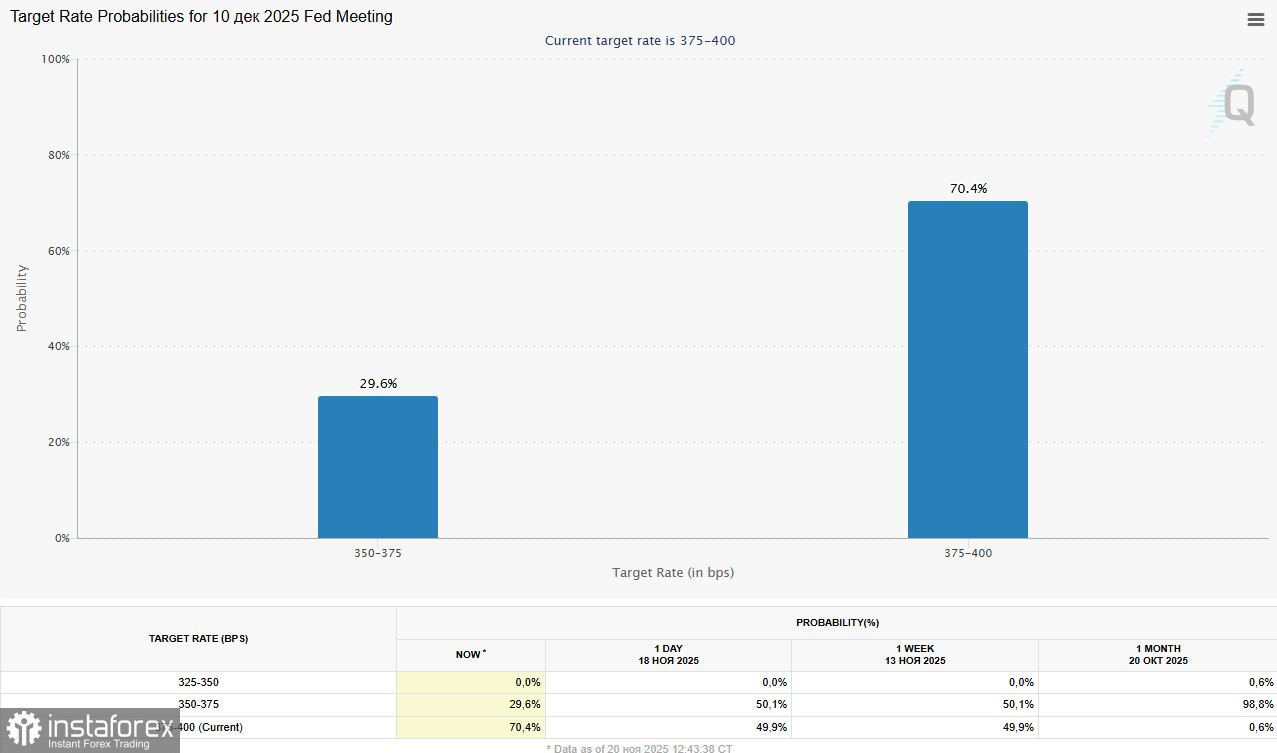

According to monitoring tools, such as the CME Group's FedWatch tool, the probability of a rate cut in December decreased significantly after the minutes were released, dropping to 30%. Previously, the chances were estimated at 50%, and just a week ago, they reached 65%. This sharp decline indicates that investors perceive the Fed's signals as signs of maintaining caution and a readiness to avoid radical easing in the near term.

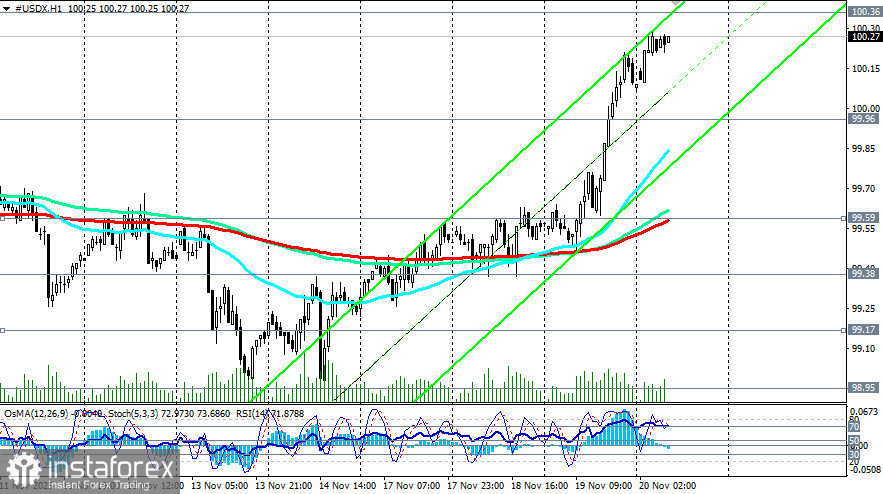

Following the publication of the FOMC minutes on Wednesday and in anticipation of the upcoming US labor market data (scheduled for 13:30 GMT), the UDS dollar is trading steadily. The US dollar index (USDX), which reflects the dollar's performance against a basket of six major currencies, shows a solid recovery following recent fluctuations.

Over the past month, the USDX has demonstrated slight growth, reaching 100.29 today, increasing by approximately 0.53%. Today marks the fifth consecutive day of growth for the USDX.

Bullish factors for US dollar:

- The outcome of the Fed meeting: The latest policy decisions confirmed a cautious approach amid uncertainty in financial markets.

- Employment data, including the Automatic Data Processing (ADP) report, recorded an increase of 42,000 jobs in the US private sector in October, exceeding analysts' modest forecasts (25,000).

- The ISM Services PMI index rose to 52.4 in October, despite a decline in the manufacturing sector.

These factors indicate sustained economic growth and support from the US central bank, encouraging the advance of the national currency.

Forecasts and prospects

Despite positive trends, the market braces for the report by the US Bureau of Labor Statistics, scheduled for today. Economists anticipate that the number of new jobs in the non-farm sector will rise by approximately 50,000 in October, compared to 22,000 in the previous month. Unemployment is expected to remain steady at 4.3%, and average hourly earnings are projected to rise by 0.3% month-over-month and +3.7% year-over-year. However, it is important to note that some uncertainty lingers regarding the potential influence of the corporate sector on the overall employment landscape.

An additional risk factor is inflation. Despite a slowdown in certain segments, the Federal Reserve remains sensitive to any signs of worsening inflationary pressure. Most Committee members believe that any further rate cuts should take into account the balance of risks regarding rising inflation and cooling labor market conditions.

Possible scenarios:

- Moderately positive scenario: An increase in job numbers and stable unemployment levels may reduce pressure on the US dollar, allowing the Fed to maintain interest rates unchanged.

- Negative scenario: A sharp decline in employment figures or a noticeable rise in inflation may force the Fed to lower interest rates, exerting pressure on the US dollar.

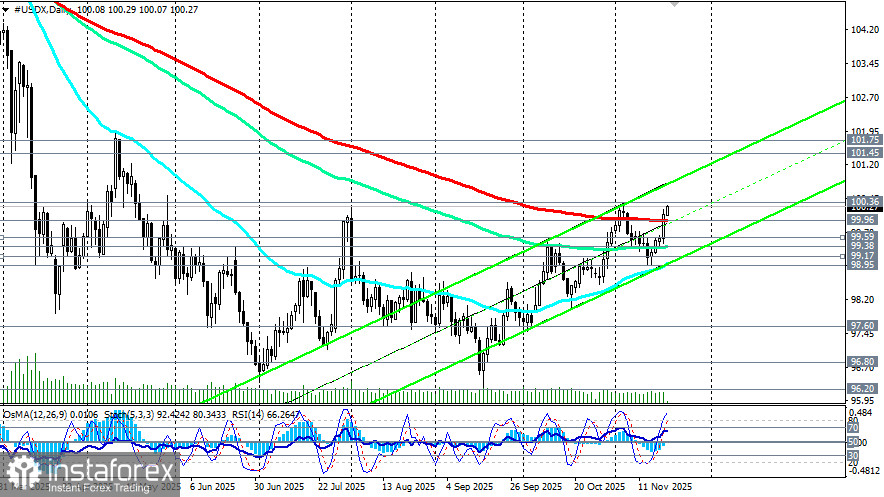

Technical picture At the time of publishing this article, the USDX was near its weekly and five-day high of 100.27, in proximity to a key resistance level at 100.36 (the 50-period moving average on the weekly chart).

The bullish momentum persists, supported by diminishing expectations of another rate cut by the Federal Reserve in December.

For a decisive breakthrough into a medium-term bull market, the dollar index must settle above key levels of 99.96 (the 200-period moving average on the daily chart) and 100.00. A break above 100.36 (the 50-period moving average on the weekly chart) would confirm a shift into a medium-term bullish market and open up the prospect for growth toward key long-term resistance levels of 101.45 (the 200-period moving average on the weekly chart) and 101.75 (the 144-period moving average on the weekly chart).

In the alternative scenario, a break below the key support level of 99.96 could signal a resumption of price declines. A breach of the support level at 98.95 (the 50-period moving average and the lower line of the ascending channel on the daily chart) could enable the instrument to return to the medium-term and long-term bearish markets.

Conclusion Thus, the dynamics of the US dollar depend on a comprehensive analysis of the macroeconomic situation and the decisions made by the Federal Reserve. Careful monitoring of key indicators such as employment and inflation will be a decisive factor for the greenback's future movements.

To sum up, the market sentiment on the US dollar remains quite stable; however, potential changes in the economy and the Fed's policies could bring significant adjustments to this trend. It is essential to keep an eye on economic data and signals from the Federal Open Market Committee to respond promptly to possible changes in market dynamics.