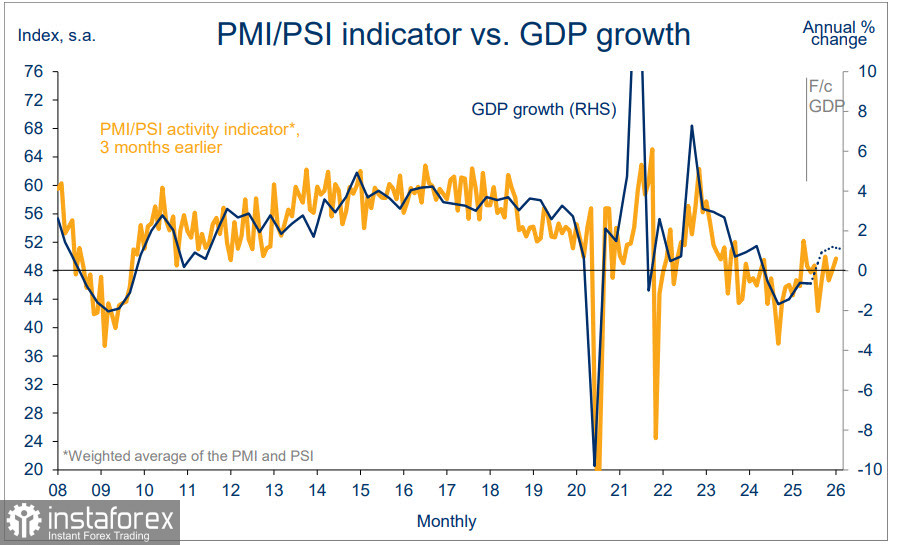

The economic situation in New Zealand continues to improve slowly, with indicators of economic activity generally rising. The PMI, net migration, tourist arrivals, and construction activity are all showing growth, while stable inflation expectations alleviate concerns about a resurgence in inflation.

Data for the fourth quarter is expected to confirm that inflation has already peaked and will not rise further.

After New Zealand's GDP unexpectedly contracted by 0.9% in the second quarter, further rate reductions from the Reserve Bank of New Zealand looked like a foregone conclusion. However, the situation has changed; market forecasts for the third quarter suggest growth of 0.5%, while the RBNZ's forecast is +0.6%, indicating that the current rate level is not hindering the economic recovery. The RBNZ meeting will take place next week, and the market is almost certain that the rate will be cut by a quarter of a point to 2.25%. The likelihood of a 50 basis point cut is low, reflecting that the easing cycle is nearing its end as the economy shows signs of improvement.

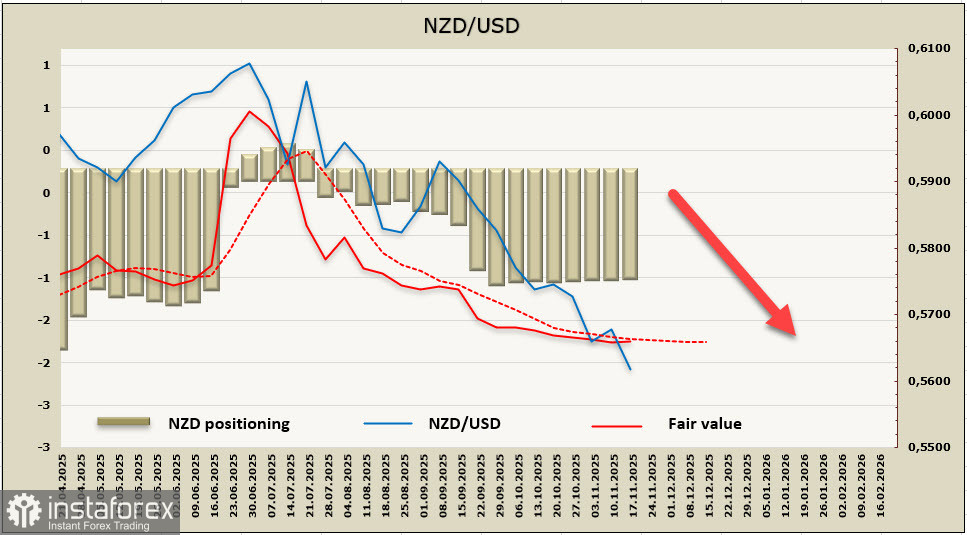

A significant factor in how the kiwi will react to the meeting's outcomes will be the tone of the accompanying statement. If the RBNZ leaves the door open to another cut in February, the kiwi will likely decline a bit further. Conversely, if the Bank expresses a less dovish stance, emphasizing the pace of recovery and achieving control over inflation, the kiwi could start to form a base and prepare for a recovery against the dollar.

Currently, the projected price remains below the long-term average, and there are no signs of a reversal yet.

The NZD/USD pair continues to decline, as we had previously anticipated. A seven-month low has been updated, and the long-term target of 0.5481 is getting closer. Given that the U.S. dollar is expected to strengthen further, at least through the end of the year, and that there are no factors supporting the kiwi, we anticipate continued decline. However, if the market concludes that the RBNZ has completed its rate cut cycle, the kiwi may begin to form a bullish reversal. In any case, until November 26, when the RBNZ meeting takes place, any attempts at growth are likely to be impeded.