Yesterday, stock indices closed lower. The S&P 500 fell by 1.56%, while the Nasdaq 100 plummeted by 2.15%. The Dow Jones Industrial Average decreased by 0.84%.

The indices are poised for their worst week in seven months, as concerns regarding high valuations and the profitability of large investments in artificial intelligence compel investors to pull back from risky assets. The MSCI All Country World Index has dropped by 3% this week, putting it on track for its sharpest weekly decline since April 4, when President Donald Trump's tariffs shook the markets. Asian indices also fell by 1.7%, nearing their largest weekly drop since April. Bitcoin traded below $86,000.

Market sentiment has noticeably deteriorated, as heavy clouds of pessimism have overshadowed the horizon of optimism. Investors, who previously eagerly bought shares of tech giants heavily investing in AI development and implementation, are now questioning whether the price for this promising yet still not fully understood technology is too high. It is clear that NVIDIA's report did not reassure traders, who returned to aggressive selling in the tech sector. High interest rates in the US and inflation concerns are also weighing on the market. Investors fear that elevated borrowing costs could slow economic growth and reduce corporate profitability. In this environment, they prefer to reduce their positions in riskier assets like stocks and move into more conservative instruments, such as bonds. Currently, the yield on 10-year Treasury bonds has risen by one basis point to 4.09%.

"The market has been under pressure this week as investor sentiment cooled on mounting questions around the sustainability of the AI boom," Federated Hermes Ltd stated. Although volatility has increased, most analysts view the pullback as a correction rather than the start of a prolonged decline, the company added.

Goldman Sachs Group Inc. noted that since 1957, there have been eight instances, including Thursday, when the S&P 500 opened up more than 1% but then reversed to close in the red. On the other hand, the average performance following these episodes was positive: gaining at least 2.3% the following day and week, and rising by 4.7% the next month.

Bitcoin also hit a fresh low, trading below $86,000.

Yesterday, the long-awaited government employment report was released, showing that job growth in the US accelerated in September, while the unemployment rate rose. The data indicates that the labor market was stabilizing before the government shutdown.

Regarding commodities, oil is expected to decline by more than 2% for the week, with Brent crude prices dropping below $63 per barrel.

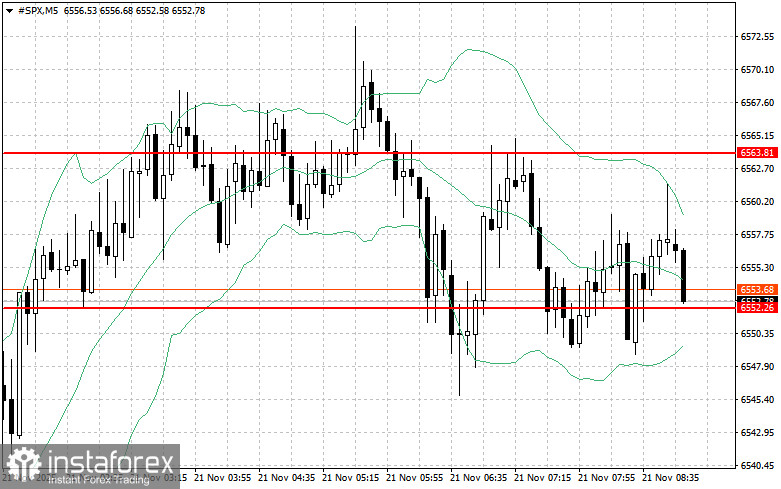

In terms of the technical picture for the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,563. This would help the index gain ground and pave the way for a potential move to a new level of $6,577. Another priority for bulls will be to maintain control over $6,590, which would strengthen buyer positions. If there is a downward movement amid reduced risk appetite, buyers must assert themselves around $6,552. A break below this level would quickly push the trading instrument back to $6,537 and open the way to $6,520.