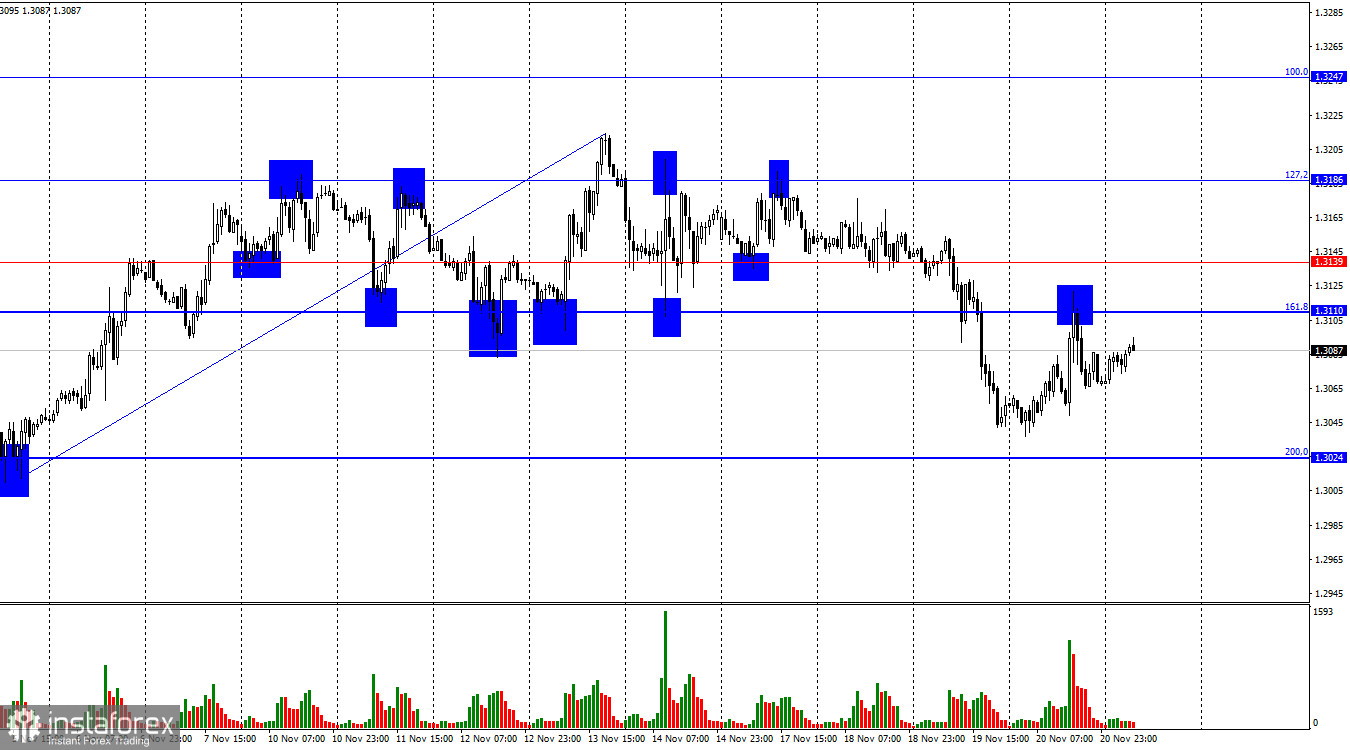

On the hourly chart, the GBP/USD pair on Thursday rose toward the 161.8% Fibonacci level at 1.3110, bounced off it, dropped slightly, and then resumed growth toward 1.3110. Today, another rebound from this level will again work in favor of the U.S. currency and a slight decline toward the 200.0% corrective level at 1.3024. A consolidation of the pair's rate above the 1.3110 level will return the pound into the sideways range of 1.3110–1.3186.

The wave situation remains "bearish." The latest upward wave failed to break the previous peak, while the most recent downward wave (completed) broke the previous low. Unfortunately for the pound, the news background has deteriorated recently, making it extremely difficult for the bulls to launch attacks. To complete the "bearish" trend, the price must rise above 1.3470 or form two consecutive "bullish" waves.

Yesterday, both the pound and the dollar had chances for growth. Everything depended not on U.S. statistics, but on how traders themselves would interpret it and whether they would take into account the blatantly outdated data. As yesterday showed, the market's reaction to the labor market and unemployment reports was fairly formal. Traders could not completely ignore the data, but their actions signaled that September's figures did not interest them much. The unemployment report came out worse than expected, and the Nonfarm Payrolls report was too contradictory. Thursday's general decline in the U.S. dollar was therefore logical overall. But will it continue on such shaky foundations? Let me remind you that in recent weeks a great deal of information from the UK has supported the bears more than the bulls. However, this information has already been priced in. Thus, expectations for yesterday's statistics were sky-high, but in reality traders drew no conclusions. We now await November labor market and unemployment data, as well as the FOMC decision in December.

On the 4-hour chart, the pair continues to decline within a downward trend channel. If a new "bullish" trend is beginning now, we will gradually receive confirmation of it. I will start expecting a strong rise in the pound once the price closes above the channel. A consolidation below the 1.3044 corrective level will allow us to expect further decline toward the 61.8% Fibonacci level at 1.2925. No emerging divergences are observed today.

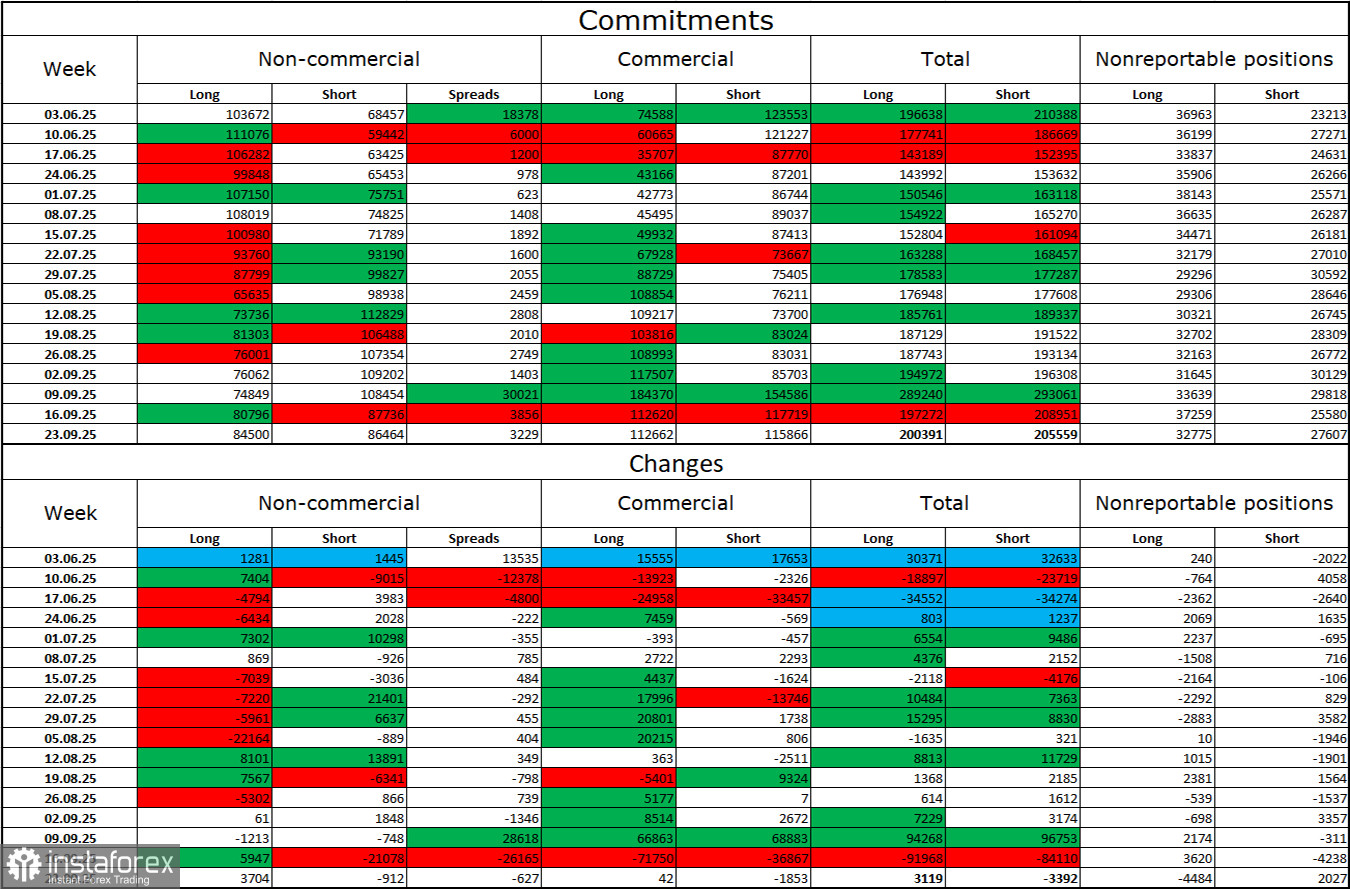

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" during the most recent reporting week, but that reporting week was a month and a half ago. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The current gap between long and short positions is essentially the following: 85,000 versus 86,000. Bullish traders are again tipping the scales in their favor.

In my view, the pound still has downward potential, but with each new month the U.S. dollar looks weaker and weaker. If previously traders were worried about Donald Trump's protectionist policies—without understanding what consequences they might bring—now they may be worried about the results of those policies: a possible recession, the constant introduction of new tariffs, and Trump's confrontation with the Federal Reserve, which could cause the central bank to become "politically biased." Thus, the pound looks far less dangerous than the U.S. currency.

News calendar for the U.S. and the UK:

- UK – Manufacturing PMI (09:30 UTC)

- UK – Services PMI (09:30 UTC)

- U.S. – Manufacturing PMI (14:45 UTC)

- U.S. – Services PMI (14:45 UTC)

- U.S. – University of Michigan Consumer Sentiment Index (15:00 UTC)

On November 21, the economic calendar contains five entries. The impact of the news background on market sentiment on Friday may be modest but sustained throughout the day.

GBP/USD Forecast and Trading Recommendations:

Selling the pair is possible today after a rebound from the 1.3110 level on the hourly chart with a target of 1.3024. Buying opportunities open if the price consolidates above the 1.3110 level with a target of 1.3186.

The Fibonacci grids are built from 1.3247–1.3470 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.