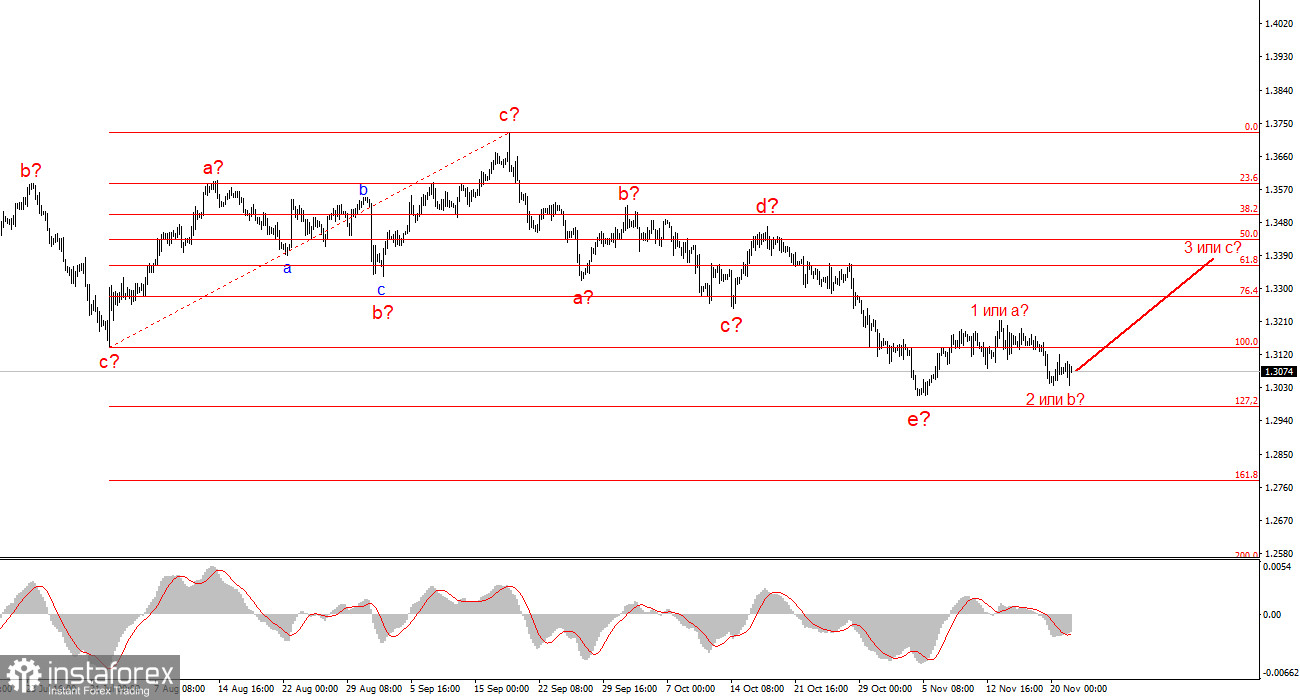

For GBP/USD, the wave pattern continues to indicate the formation of an upward trend segment (see lower chart), but over the past few weeks it has taken on a complex and extended form (see upper chart). The trend segment that began on July 1 can be considered wave 4 — or any large corrective wave, since it has a corrective rather than impulsive internal wave structure. The same applies to its internal subwaves. Therefore, despite the prolonged decline of the pound, I believe the upward trend remains intact.

The downward wave structure that began on September 17 has taken on a five-wave a-b-c-d-e form and may be complete. If this is indeed the case, the instrument is currently at the very beginning of forming a new upward wave sequence.

Of course, any wave structure can become more complex and extend at any moment. Even the presumed wave 4, which has been forming for almost five months, could take the shape of a five-wave pattern, and in that case we would continue observing a correction for several more months. However, at this stage, an upward wave sequence may begin to take shape. If this assumption is correct, then we have already seen its first wave, and the second wave may complete around current levels.

The GBP/USD rate rose by 10 basis points on Friday. In my EUR/USD review, I referred to 20–30-point moves as "noise," so what can be said about 10 points? Throughout the day, the trading direction changed several times, but neither buyers nor sellers managed to maintain control for more than 2–3 hours. This is actually a bit strange, since three reports were released in the UK today — and they mostly pointed to selling the pound rather than buying it. Selling indeed began when it became known that retail sales in October fell by 1.1% month-on-month versus the market's 0% expectation. But the decline did not last long.

At the moment, the market remains in a state of confusion across all timeframes. Yesterday's U.S. statistics remain puzzling — indicating both improvement and deterioration in the labor market at the same time. Yesterday the markets could not decide what to do with the dollar under such data, and today the situation became even worse, because the UK business activity indices also pointed simultaneously to improvement and deterioration.

Interestingly, according to the CME FedWatch tool, after yesterday's labor market reports, futures markets now estimate the probability of an interest rate cut in December at 73%. In other words, dovish sentiment in the market is rising again — but based on what? If the labor market recovered in September and October and November data are not yet available, why would the Fed deliver a third consecutive rate cut amid rising inflation? And if the probability of a rate cut is rising, then why isn't the dollar falling, as the wave pattern suggests?

General Conclusions

The wave structure for GBP/USD has transformed. We are still dealing with an upward impulsive trend segment, but its internal wave structure has become complex. Wave 4 has taken a three-wave shape, making it very extended. The downward corrective a-b-c-d-e structure within wave c of 4 appears complete. If this is indeed the case, I expect the main trend segment to resume with initial targets near the 1.38 and 1.40 levels. In the short term, the formation of wave 3 or c can be expected, with targets near 1.3280 and 1.3360.

The higher-degree wave pattern looks nearly perfect, even though wave 4 extended above the top of wave 1. But let me remind you: perfect wave patterns exist only in textbooks. In practice, everything is much more complicated. At this time, I see no reason to consider alternative scenarios to the upward trend segment.

The Main Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If you are not confident in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the market's direction. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.