There will be no significant events taking place in the United Kingdom. This should be the starting point of the review so that my readers immediately understand that support for the pound will have to come only from America. However, British data in the last two weeks have been the reason for the absence of strengthening in the British currency. I remind you that first, unemployment and industrial production fell, and then inflation decreased, raising the probability of a "dovish" decision by the Bank of England in December. I also remind you that the Chancellor of the Exchequer, Rachel Reeves, speaks approximately every week, and the question of the budget for the next year remains unresolved, with her statements regarding the budget and taxes being perceived negatively by the market with enviable regularity. Therefore, almost any news from Britain right now could threaten the British pound.

As for the wave labeling, it is approximately the same as for the GBP/USD instrument. The global wave 4 could have completed its formation back in early August. The last downward wave set was completed in early November. However, a convincing upward wave set has not yet been observed. The news background in the United Kingdom has indeed been weak recently, but it should not be forgotten that that of the United States is equally weak. The market could have resumed selling the dollar back in early October, when Donald Trump imposed new tariffs and the "shutdown" resumed in America. However, throughout this time, the market has increased demand for the American currency.

Based on all of the above, my readers will need to analyze only data from America. There will also be a few of them, and many of them have long lost their relevance. I remind you that the U.S. Bureau of Statistics resumed its work only last week and is currently publishing reports that were not released on time, meaning they are September reports. What significance do September reports have at the end of November?

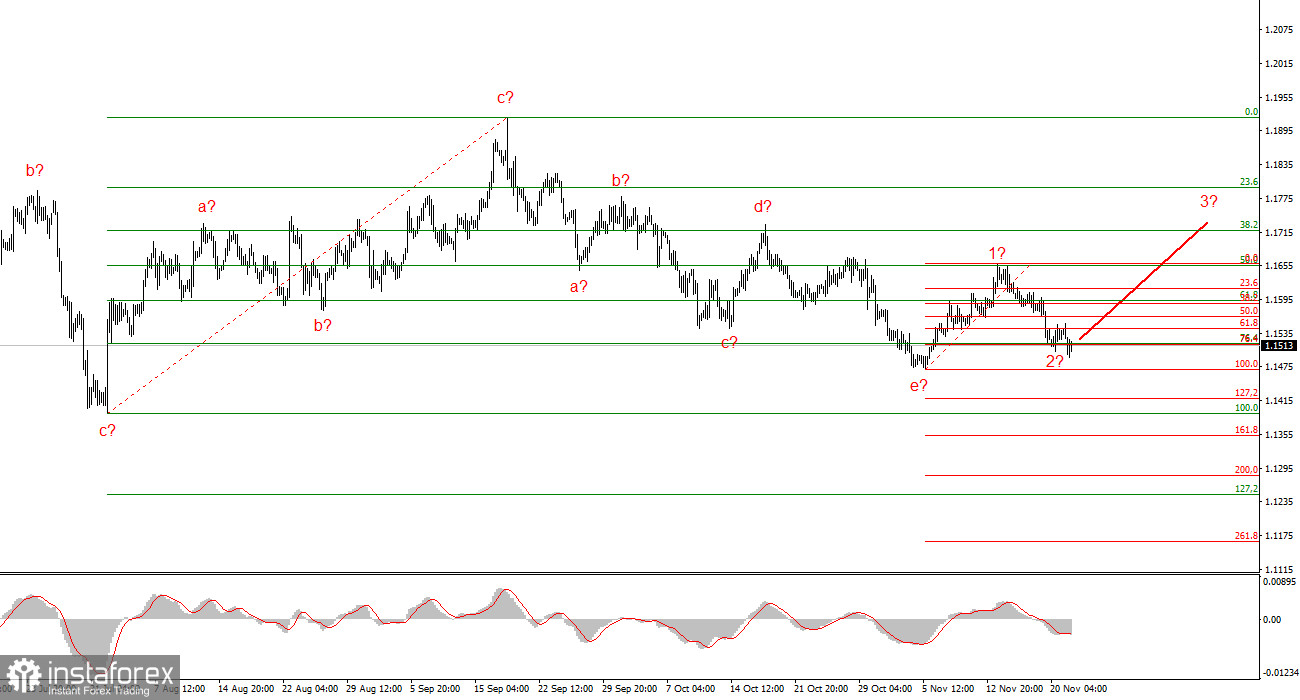

Wave Picture for EUR/USD:

Based on the analysis conducted for EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the future decline of the American currency. The current section of the trend may stretch as far as the 25th figure. At this time, the formation of an upward wave set may continue. I expect that from the current positions, the third wave of this set will begin to form, which may be either with or 3. In the coming days, I am considering long positions with targets around the 1.1740 mark, and a reversal of the MACD indicator upwards will confirm this signal.

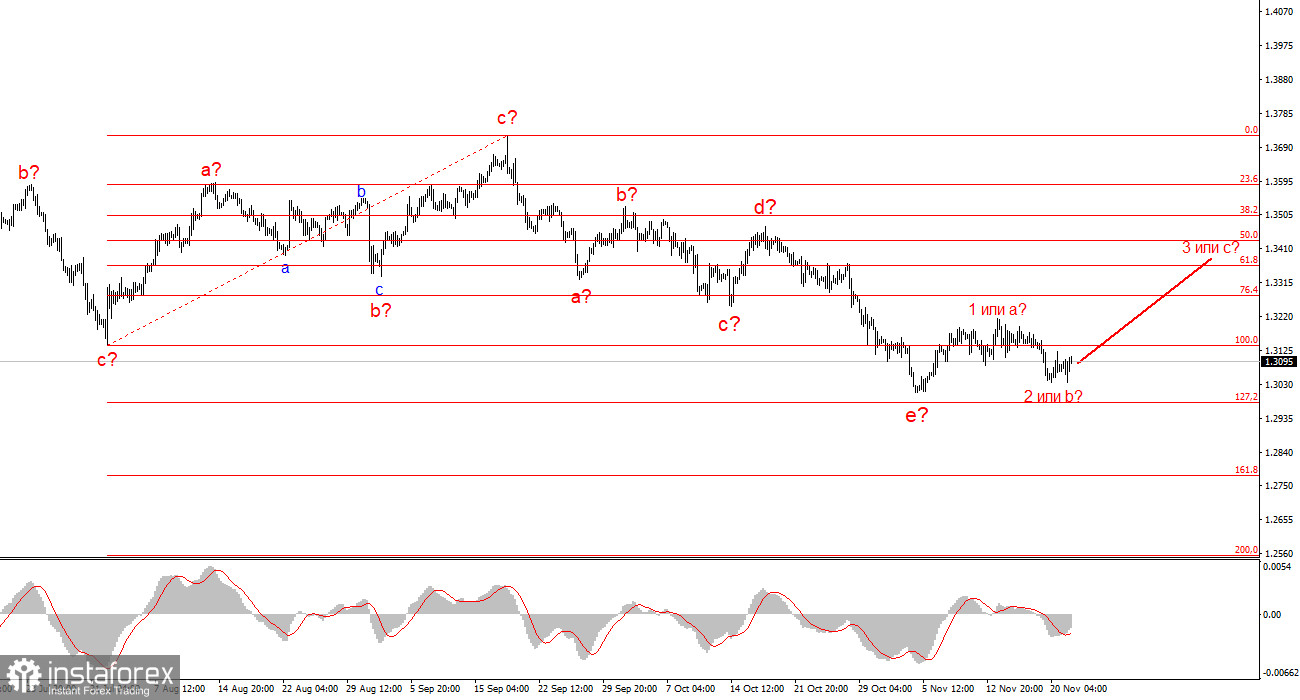

Wave Picture for GBP/USD:

The wave picture of the GBP/USD instrument has changed. We continue to deal with the upward, impulsive section of the trend, but its internal wave structure has become increasingly complex. The downward corrective structure a-b-c-d-e in c in 4 appears quite complete. If this is indeed the case, I expect that the main section of the trend will resume its formation with initial targets around the 38 and 40 figures. In the short term, it is possible to expect the formation of wave 3 or c with targets located around the 1.3280 and 1.3360 marks, which corresponds to 76.4% and 61.8% of Fibonacci.

Basic Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play out, as they often bring changes.

- If there is uncertainty about what is happening in the market, it is better not to enter it.

- There is never 100% certainty in the direction of movement. Do not forget about protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.