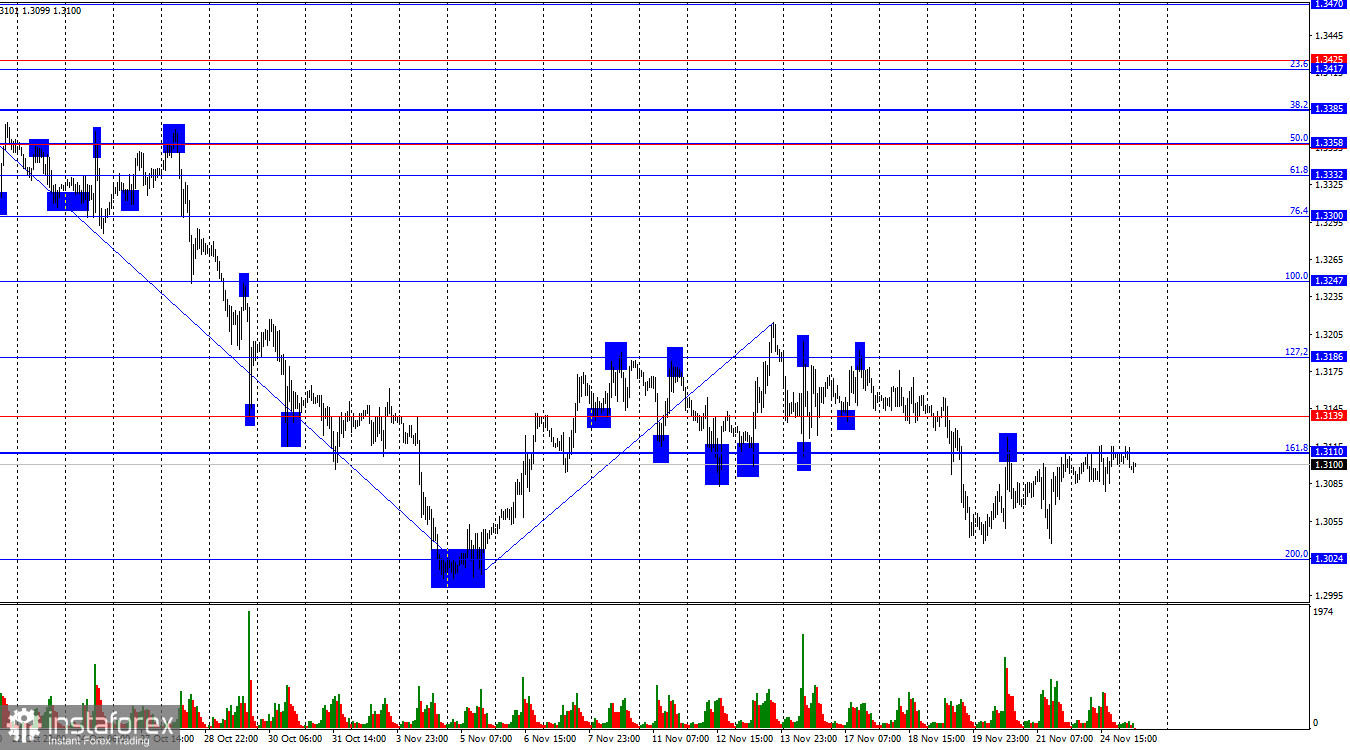

On the hourly chart, the GBP/USD pair on Monday made another return to the 161.8% corrective level at 1.3110. A rebound from this level will work in favor of the US dollar and a new decline of the pair toward the 200.0% Fibonacci level at 1.3024. Consolidation of the pair above the 1.3110–1.3139 level will allow traders to expect growth toward the 127.2% corrective level at 1.3186.

The wave situation remains fully "bearish." The last upward wave failed to break the previous peak, while the last downward (completed) wave broke the previous low. Unfortunately for the pound, the information background has worsened for it in recent weeks, and now the bulls are finding it extremely difficult to mount attacks, which were already quite weak before. However, I would note that euro-bulls are also not rushing to attack, although the news background for the euro is significantly better. To end the "bearish" trend, growth above 1.3213 is required.

There was no news background on Monday, which is clearly visible even from the intraday movements of the pair. Trader activity has been low recently, and when there is no news at all, it becomes even lower. Today, several important reports will be released in America, and their values will determine market sentiment. The ADP report on changes in private-sector employment is now released weekly, retail sales reflect the confidence of American consumers in economic prospects, and the Producer Price Index indirectly influences the inflation figure, which is very important for the FOMC—especially ahead of the December meeting. Thus, under certain circumstances, today may become quite active in terms of movement, but such active moves should be expected only in the second half of the day. The pound remains near the 1.3110–1.3139 level and has been circling around it for several weeks in a row.

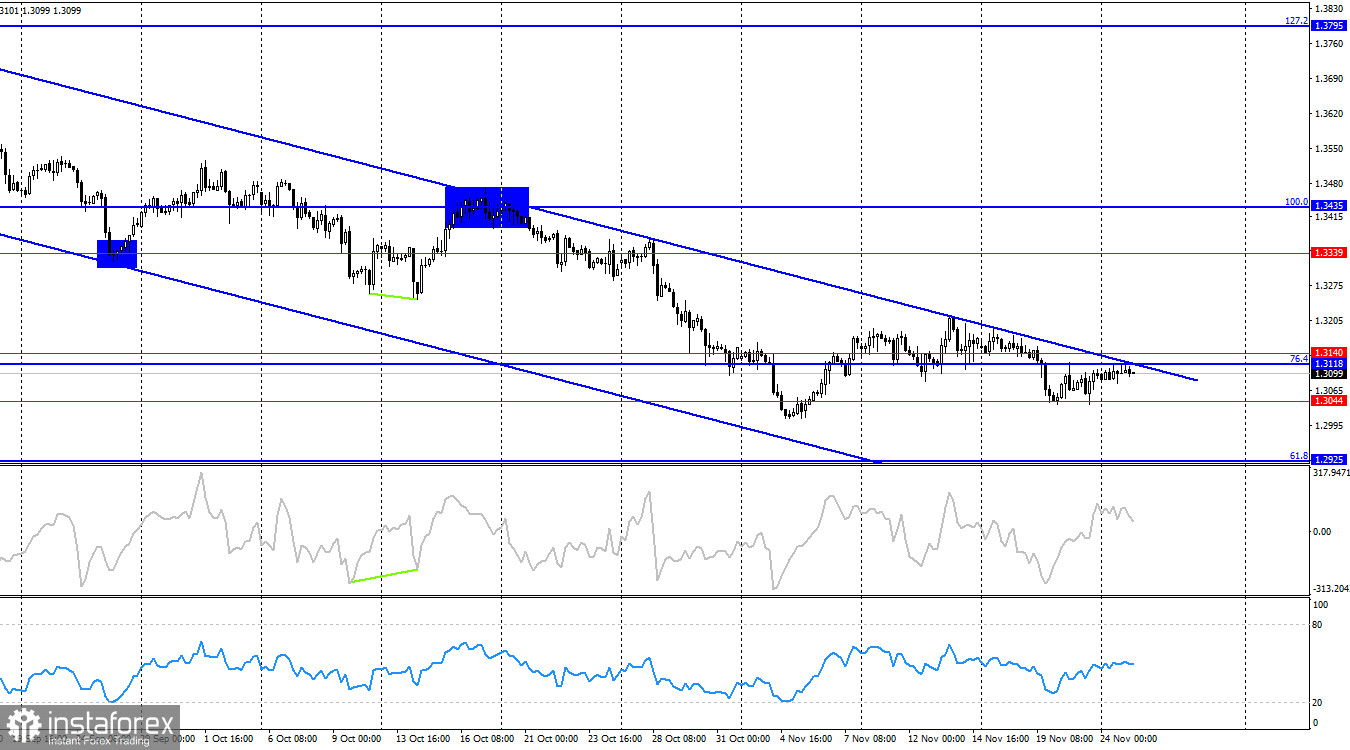

On the 4-hour chart, the pair continues to decline within a downward trend channel. If a new "bullish" trend is beginning now, we will gradually receive confirmations of this. I will begin to expect strong growth of the pound after the pair closes above the channel. Consolidation below the 1.3044 correction level will allow expectations of a continued decline toward the 61.8% Fibonacci level at 1.2925. No emerging divergences are observed today.

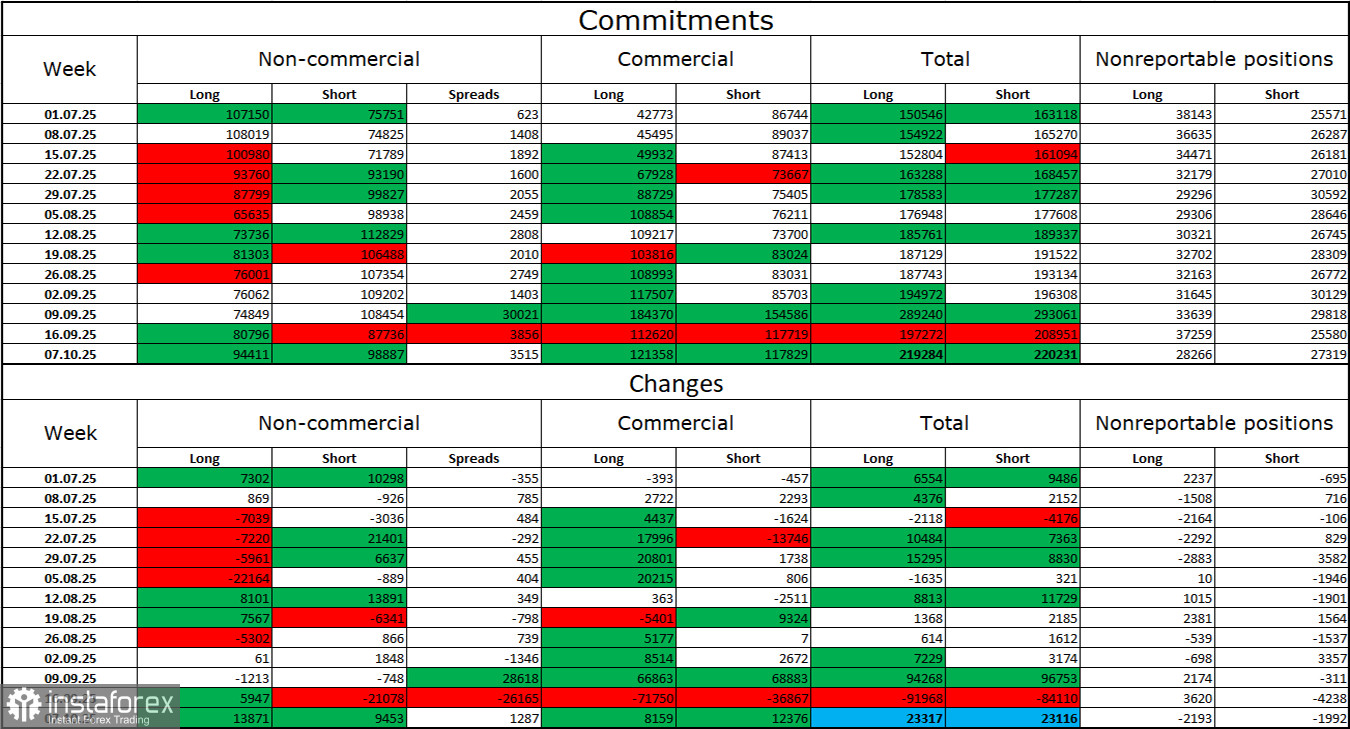

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more "bullish" during the last reporting week, but that week was one and a half months ago—October 7. The number of long positions held by speculators increased by 13,871, and the number of short positions increased by 9,453. The gap between long and short positions now looks like this: 94,000 versus 98,000—practically equal.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the US currency is in demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Fed is forced to pursue monetary easing to stop rising unemployment and stimulate job creation. Thus, if the Bank of England can cut rates one more time, the FOMC may continue easing throughout 2026. The dollar weakened significantly by the end of 2025, and 2026 may be no better for it.

News calendar for the US and the UK:

- USA – Change in ADP private-sector employment (13:00–15:00 UTC).

- USA – Producer Price Index (13:30 UTC).

- USA – Retail Sales (13:30 UTC).

The economic calendar for November 25 contains three entries. The influence of the news background on market sentiment on Tuesday will be present in the second half of the day.

GBP/USD forecast and trading advice:

Selling the pair is possible today if the price rebounds from the 1.3110 level on the hourly chart with a target of 1.3024. Buying can be considered if the price consolidates above the resistance level at 1.3110–1.3139 with a target of 1.3186.

The Fibonacci grids are built from 1.3247 to 1.3470 on the hourly chart and from 1.3431 to 1.2104 on the 4-hour chart.