In recent weeks, I have been writing regularly in my reviews that market participants are currently ignoring many important factors. As a rule, these factors do not concern the U.S. dollar's strength — but rather its weakness. In other words, in situations where a decline in the U.S. currency would be natural and raise no questions, the decline simply does not occur. As a result, the market first ignored the resumption of the Fed's monetary easing cycle, then the government "shutdown," then the second consecutive Fed rate cut, and then Donald Trump's new tariffs. At the same time, it ignored the weakness of the labor market. And I've listed only the "hottest" factors of recent days. To this list, one could easily add the trade war and Trump's pressure on the Fed.

I understand that without corrections, there is no trend movement. But when a correction moves completely against the news backdrop, one cannot help but ask — why? In just the last two weeks, the probability of a Fed rate cut in December has risen from 40% to 80%. So why is demand for the U.S. currency not decreasing, if this is a clearly "bearish" factor?

After quite a bit of thought, I can make an assumption: it's all about the upcoming U.S. Supreme Court decision regarding Donald Trump's trade tariffs. I do not believe the tariffs will be completely overturned and the issue closed. If the Court rules that the tariffs are illegal and cancels them, Trump will immediately reinstate the same tariffs under different U.S. laws. After all, the Emergency Powers Act contains no provisions regarding trade tariffs. Therefore, one can take practically any law granting the U.S. president expanded authority and impose tariffs based on it.

Nevertheless, if the Supreme Court does overturn Trump's tariffs, the U.S. government would be forced to refund all collected import duties. This would be a blow to the economy, a blow to the budget, and a blow to Trump's ambitions and his economic program. Perhaps the market is not rushing events precisely because of this? The easing of monetary policy can be priced in successfully even in January, but the cancellation of large-scale tariffs — which have already broken all records — would be a landmark event.

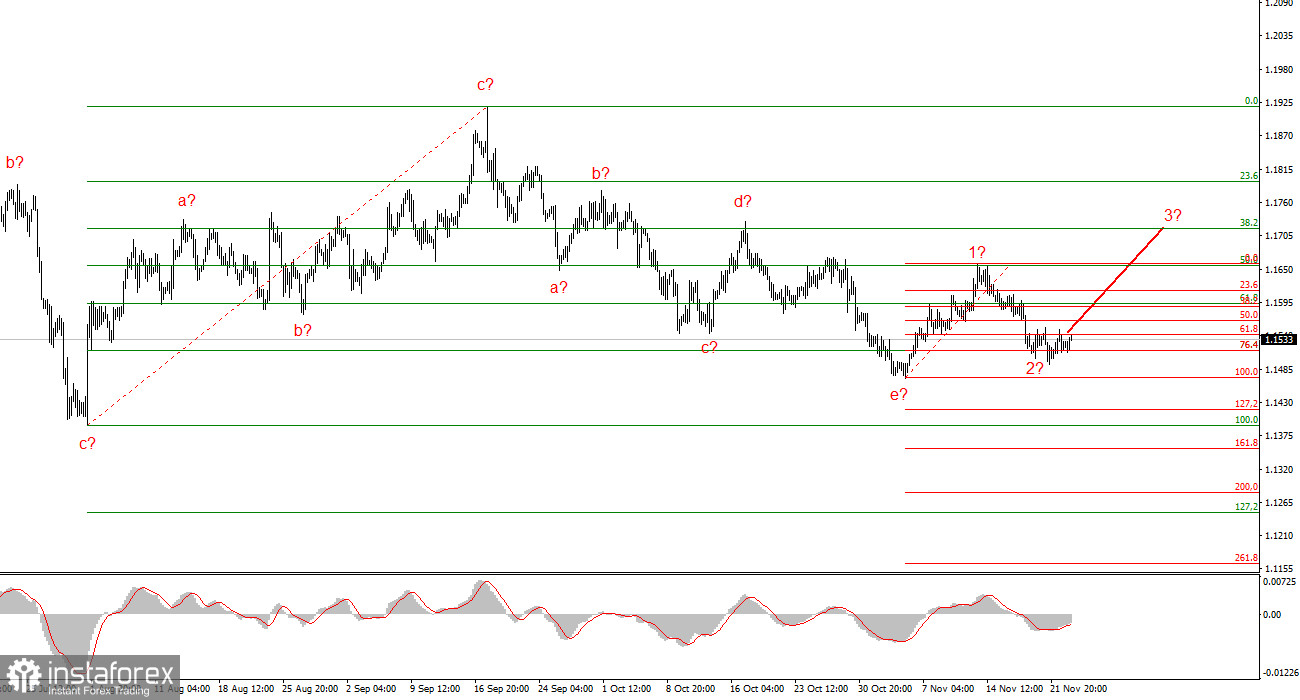

Wave pattern for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues forming an upward trend segment. In recent months, the market has taken a pause, but Donald Trump's policies and the Fed remain significant factors for the future decline of the U.S. currency. Targets of the current trend segment may extend up to the 1.25 level. At this time, the formation of an upward wave series may continue. I expect the third wave of this sequence — either wave c or 3 — to begin from current levels. I remain in long positions with targets near 1.1740, and the upward reversal of the MACD indicator provides slight confirmation of these expectations.

Wave pattern for GBP/USD:

The wave pattern for GBP/USD has changed. We are still dealing with an upward impulsive trend segment, but its internal wave structure has become complex. The downward corrective a-b-c-d-e structure in wave c of 4 appears fully complete. If this is indeed the case, I expect the main trend segment to resume with initial targets near the 1.38 and 1.40 levels. In the short term, one can expect the formation of wave 3 or c with targets around 1.3280 and 1.3360, corresponding to the 76.4% and 61.8% Fibonacci levels.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often bring changes.

- If you are not confident about what is happening in the market, it is better not to enter it.

- There is no — and can never be — 100% certainty about the direction of movement. Do not forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.