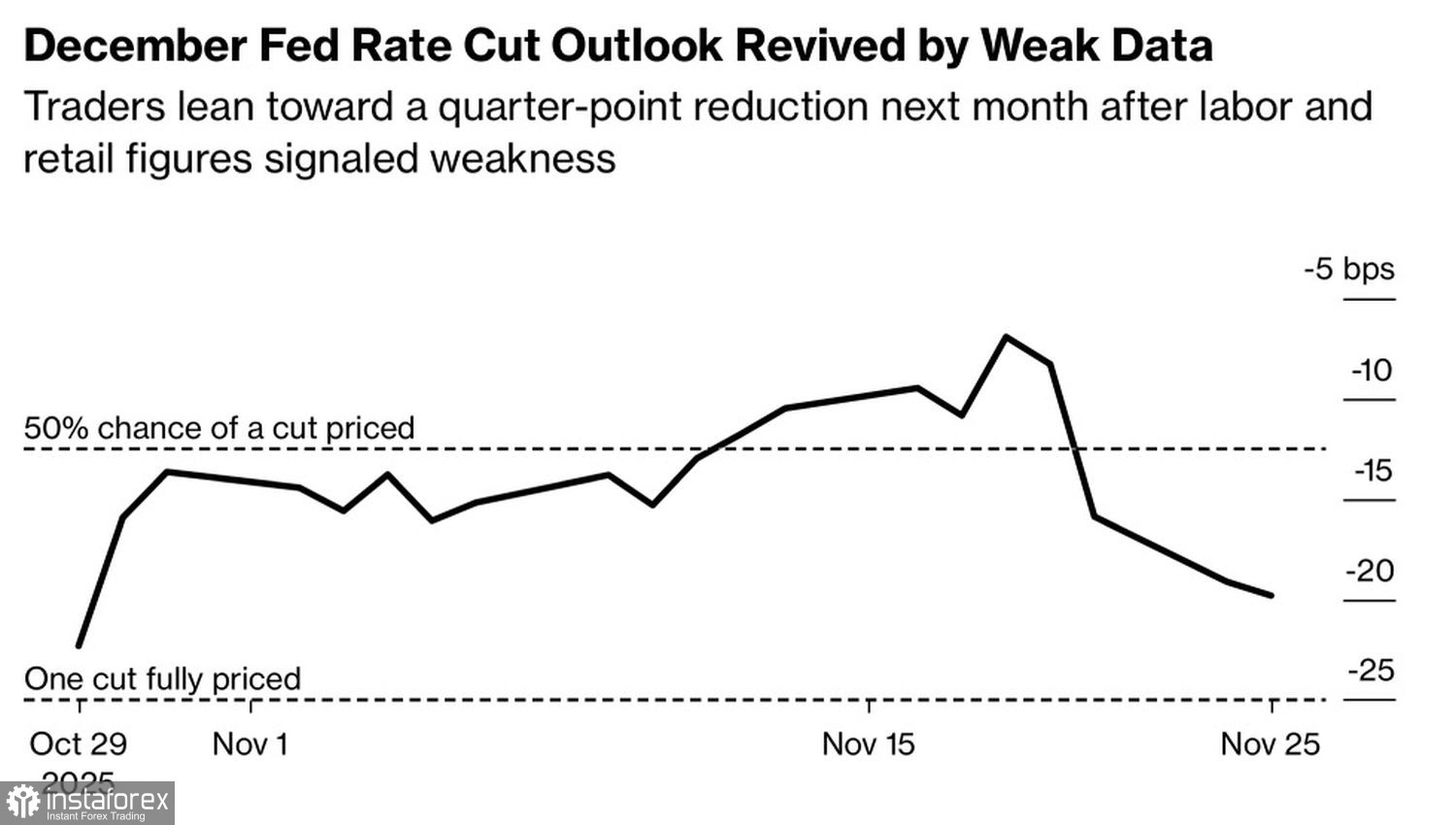

How do you make the market happy? Take away its favorite toy and then give it back. For the S&P 500, this toy has been the expectation of a Fed rate cut in December. Following the release of the minutes from the October FOMC meeting, these expectations fell to 28%, prompting the broad stock index to undergo a correction. Rumors about Kevin Hassett's imminent appointment as the head of the central bank have spiked the chances of monetary expansion by the end of the year to 85%. It is no surprise that the stock market is up for the third day in a row.

Dynamics of Market Expectations Regarding Federal Reserve Monetary Expansion

The director of the National Economic Council will be as dovish as Stephen Miran. This duo will demand aggressive rate cuts from the FOMC. Such a scenario weakens the US dollar and leads to lower Treasury yields, creating a favorable tailwind for the S&P 500. The cost of borrowing for companies declines, while their overseas profits increase.

The belief in a federal funds rate cut is not only a favorite toy but also a safety cushion for the S&P 500. Its presence allows the stock market to overlook the fundamental overvaluation of tech companies. According to Reuters research, their share of the broad stock index has risen from 30% to 31.1% since the beginning of the year, while their contribution to profits has decreased from 22.8% to 20.8%. Given the oversized size of the sector in investment portfolios, fears about its inability to generate substantial income could trigger a wave of sell-offs. No one will be able to withstand that.

Nonetheless, expectations for aggressive monetary expansion by the Fed help to mitigate the negative sentiment. The stock market regains its safety cushion—the belief that the central bank will throw a lifeline if it starts to sink. Therefore, investors are shifting their focus to other topics. For instance, the battle of tech giants for the crown of the world.

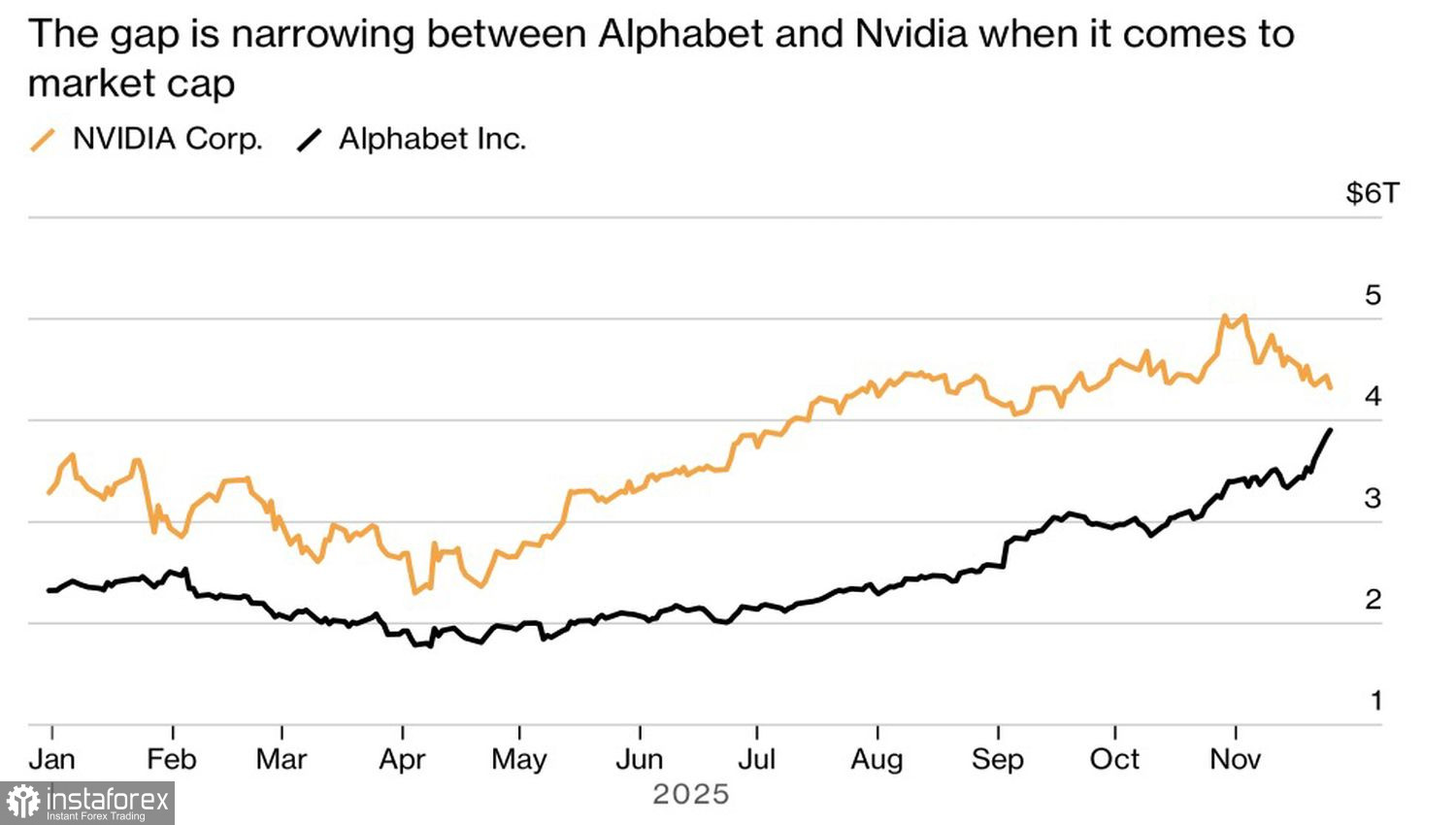

Dynamics of Alphabet and NVIDIA Stocks

According to IG, the dominant position of the world's largest company is unlikely to be threatened. However, a major competitor is ready to take a serious bite out of Jensen Huang's empire. Shares of Alphabet are rising on rumors that Meta Platforms is prepared to spend billions of dollars on Google's AI chips.

Retail investors are gradually moving away from the rout. In November, their attempts to immediately buy the dip in the S&P 500 ended in failure. However, the recovery of the broad stock index will allow them to recoup losses. Interestingly, in 2025, purchases of American stocks by retail investors surged by 50%. This marks more than a twofold increase in activity compared to the average over the past five years.

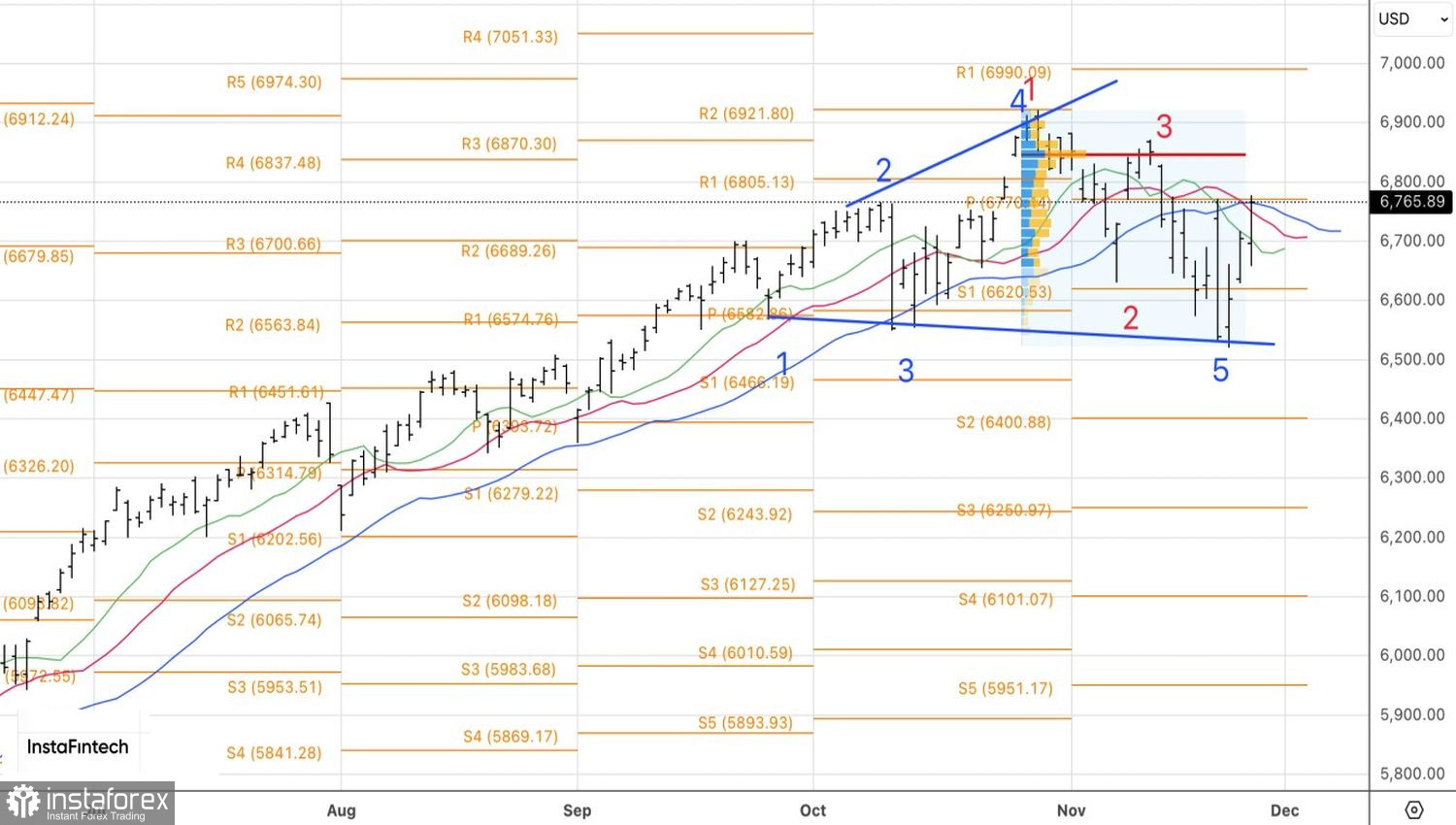

Technically, the daily chart of the S&P 500 indicates that the moment of truth is approaching. The market is testing the key level of 6,770. A successful breakout of this level will contribute to a resumed upward trend and provide a basis for long positions. Conversely, a retreat will lead to resumed selling.