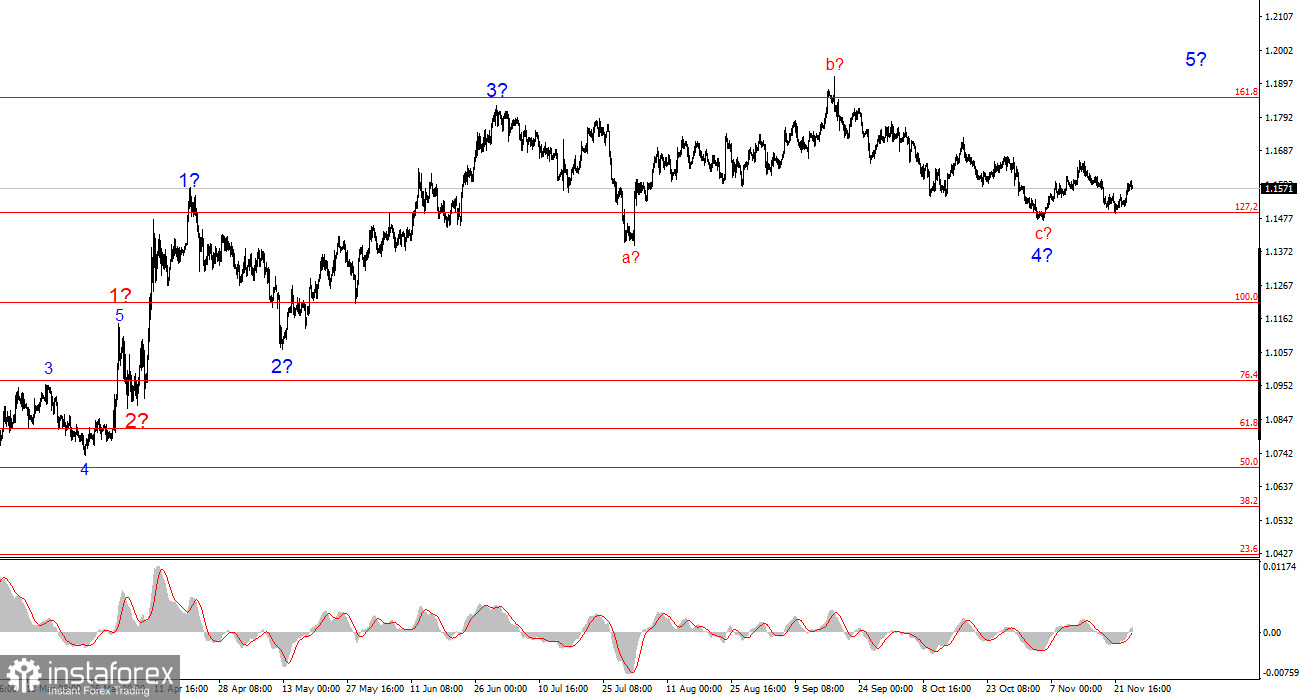

The wave pattern on the 4-hour chart for EUR/USD has transformed, but overall it remains quite clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure since July 1 has become significantly more complex and extended. In my view, the instrument is in the process of forming corrective wave 4, which has taken on an unconventional shape. Within this wave, we see only corrective structures, so there is no doubt about the corrective nature of the decline.

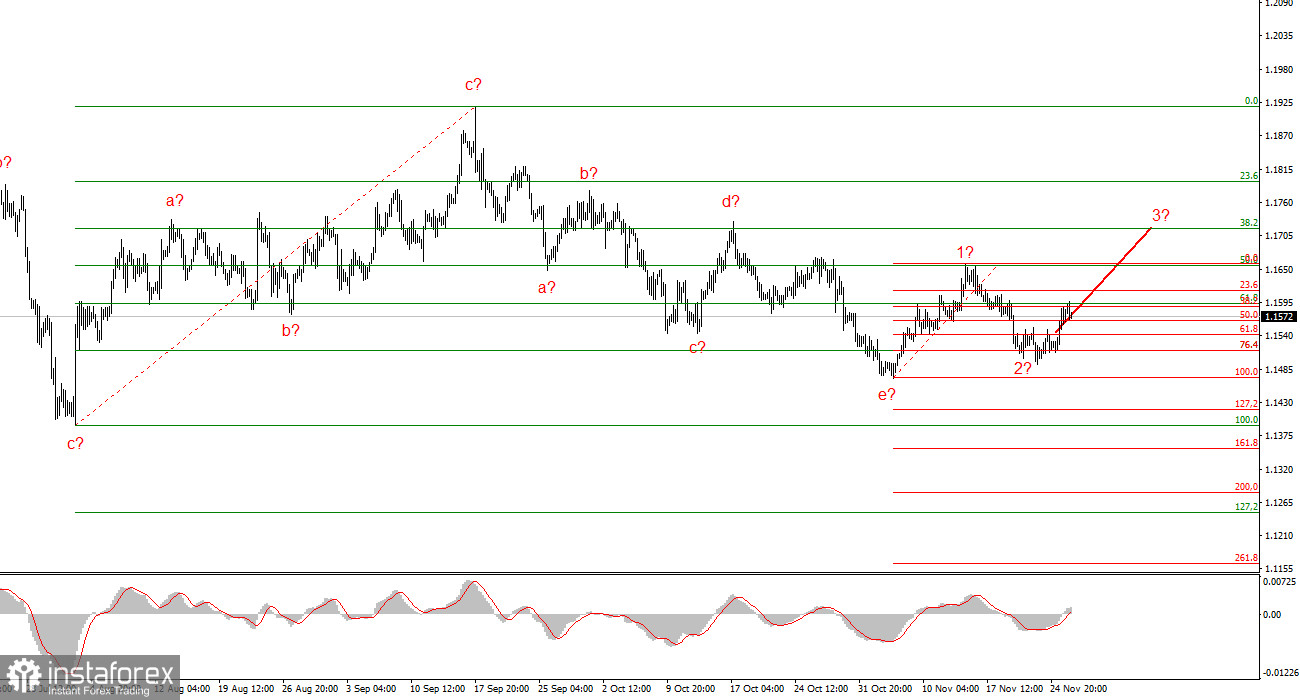

In my opinion, the upward trend segment is not yet complete, and its targets stretch all the way to the 1.25 level. The a-b-c-d-e series of waves looks complete, and therefore I expect the formation of a new upward wave sequence in the coming weeks. We have already seen the presumed wave 1 or a, and the instrument is now in the process of forming wave 2 or b. I expected the second wave to end in the 38.2%–61.8% Fibonacci level relative to wave 1, but the quotes dropped as far as the 76.4% level. Such a decline still allows for the formation of wave 3 or c.

The EUR/USD exchange rate remained unchanged through Wednesday as the U.S. session began. After an active Tuesday, the trading range has again collapsed almost to zero—but we should not despair. Almost all major movements yesterday occurred during the U.S. session, which has always been the most active. Therefore, we are likely to see the same scenario today.

In the first half of the day, the market did not want to trade. Recently, it rarely wants to trade at all, but this morning neither Europe nor the UK produced a single noteworthy event. However, in the second half of the day at least two events will draw attention across all markets. First, the long-awaited UK budget for 2026 will finally be presented. Second, the U.S. durable goods orders report will be released. We will discuss the UK budget in the GBP review, and the U.S. report is as simple as it gets: a strong number boosts demand for the U.S. dollar; a weak one reduces demand.

What interests me now is not the two-hour movement caused by some news event, but the broader trend. At present, EUR/USD is again at a difficult crossroads: either the corrective wave structure becomes even more complicated, or we finally transition to forming the logical upward wave 5. And the longer the price stagnates in one place, the more the scales tip toward the first option.

Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues building an upward trend segment. In recent months, the market has paused, but Donald Trump's policy direction and the Federal Reserve remain strong factors for the future weakening of the U.S. dollar. The targets for the current trend segment may stretch all the way to the 1.25 level. At this stage, the formation of an upward wave sequence may continue. I expect wave 3 (or wave c) to develop from current levels, with targets around 1.1740.

On the smaller scale, the entire upward trend segment is visible. The wave count is not the most standard, since the corrective waves vary in size. For example, the senior wave 2 is smaller than the inner wave 2 of wave 3. But such situations do occur. Let me remind you that it's better to identify understandable structures on charts rather than trying to label every single wave. At this moment, the upward structure raises no doubts.

Key Principles of My Analysis

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If you are uncertain about market conditions, it is better to stay out.

- Absolute certainty about market direction does not exist. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.