China's self-sufficiency is becoming a problem for many developed countries. The issue is that, with each passing year, Beijing becomes increasingly less reliant on imports. China is developing across all areas of the economy and industry, and it now seems there is no product it does not manufacture. If a country can meet domestic demand with domestic production, why would it need to import anything from abroad?

Export dynamics are different. China exports vast quantities of goods worldwide, which is no secret. I can't say its economy relies solely on exports, but exports are a significant portion of GDP. Thus, China imports little but exports a lot. Consumers from different countries are increasingly ordering goods directly from China, bypassing retail chains. As a result, the treasuries of states lose millions and billions of dollars, and local producers and retail networks simply lose their competitiveness.

One cannot say that China imports absolutely nothing. For example, the country purchases commercial aircraft or manufacturing equipment. However, does anyone doubt that China will eventually learn to produce its own airplanes that match American quality? Remember that just ten years ago, a Chinese car would evoke laughter rather than positive emotions. Now, they are cars that are not significantly inferior to German or Japanese ones.

Consequently, China is earning from the rest of the world, especially from wealthy countries like the U.S. and the European Union. American and European goods are expensive, while Chinese ones are cheap and often comparable in quality. Even if they are inferior, they are not so much to justify paying 5-10 times more for "higher quality" European or American products. As a result, the EU's industry (for example) has not grown for several years, and layoffs are far more common at German automotive plants than production expansions and hiring. Can China be blamed for the current situation? In my opinion, no. China has chosen its path, and consumers around the world fully support it. No one is stopping the U.S. from producing cheap and high-quality goods that could compete with Chinese products.

Wave Analysis for EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument is continuing to build an upward trend segment. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the potential decline of the American currency. The targets for the current segment of the trend may extend to the 25th figure. Currently, the upward wave structure may continue to develop, and I expect that from the current positions, the third wave of this set will progress, which can be either "c" or "3." At this time, I remain in buying positions with targets around the 1.1740 mark.

Wave Analysis for GBP/USD:

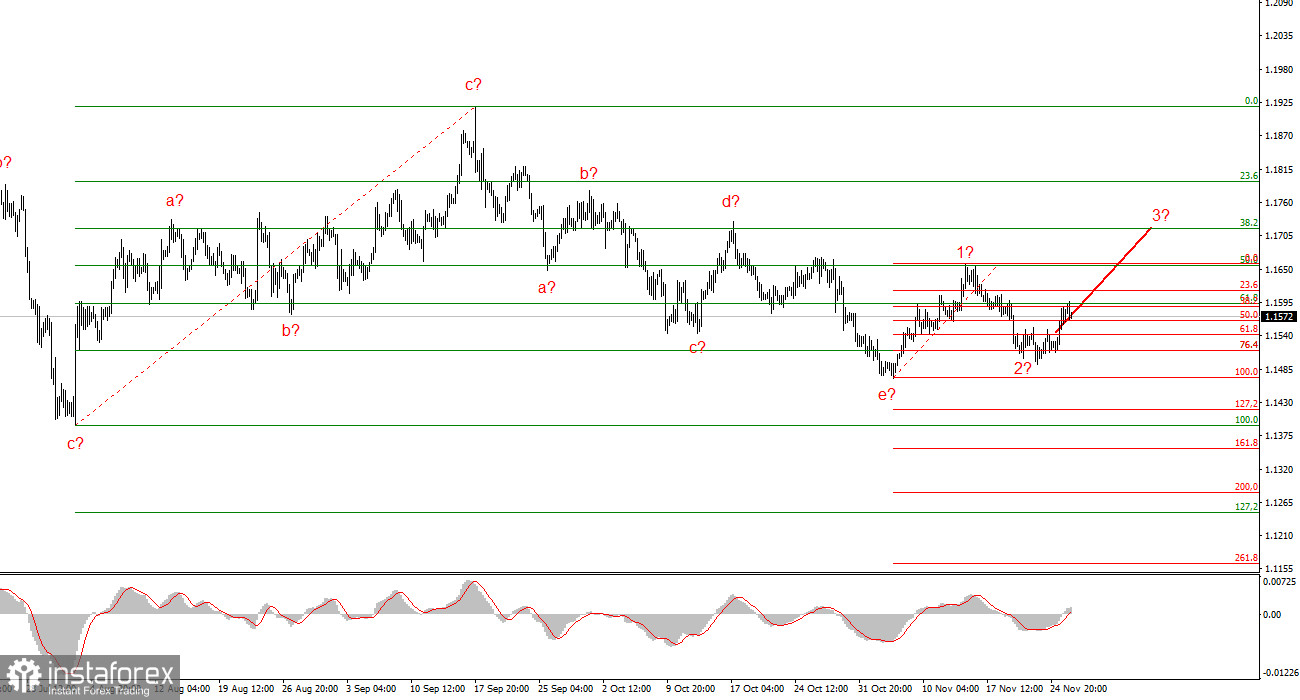

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in "4" appears quite complete. If this is indeed the case, I expect the main trend segment to resume its progression, with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave "3" or "c," with targets around 1.3280 and 1.3360, corresponding to 76.4% and 61.8% on the Fibonacci scale.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade, as they often lead to changes.

- If there is uncertainty about what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget about protective orders like Stop Loss.

- Wave analysis can be combined with other types of analysis and trading strategies.