Analysis of Trades and Trading Tips for the British Pound

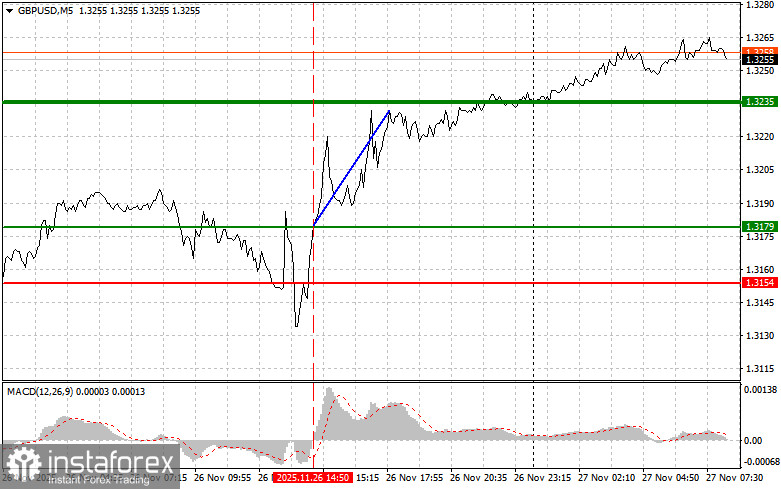

The price test at 1.3179 coincided with the MACD indicator just starting to move upward from the zero mark, confirming the correct entry point for buying the pound and driving a rise towards the target level of 1.3235.

The publication of the UK budget sparked volatility, with the pound emerging as the winner. Investors seemingly perceived the budget initiatives as evidence of the government's commitment to stabilizing the economic situation. Specifically, the tax increases and spending cuts, while painful for the population and businesses, are viewed as necessary steps to restore confidence in the British economy. However, the key factor driving the pound's rise was the realization that the government's fiscal measures would inevitably put additional pressure on inflation.

Today's trading day is characterized by relative calm regarding the publication of important macroeconomic indicators. The only event worth noting will be the speech by Bank of England Monetary Policy Committee member Megan Green. Her speech is particularly important—especially in light of the new budget. Investors will focus their attention on her statements, aiming to understand how the BoE plans to respond to potential inflationary pressures. If her comments are more moderate and she emphasizes risks to economic growth, this could undermine investor optimism and weaken the pound.

Regarding the intraday strategy, I will continue to rely on the implementation of scenarios №1 and №2.

Buy Scenarios

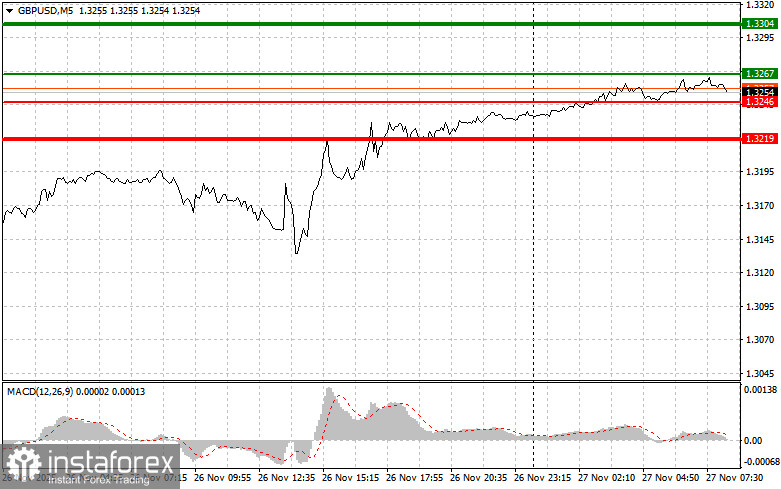

Scenario #1: I plan to buy the pound today when it reaches the entry point around 1.3267 (green line on the chart), targeting a move to 1.3304 (thicker green line on the chart). At around 1.3304, I intend to exit the long positions and open shorts in the opposite direction, aiming for a movement of 30-35 pips in the reverse direction. Expecting a rise in the pound can be based on the continuation of the new upward trend. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of 1.3246 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. An increase can be expected towards the opposite levels of 1.3267 and 1.3304.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3246 level is updated (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the level of 1.3219, where I intend to exit the shorts and open immediate longs in the opposite direction, aiming for a movement of 20-25 pips in the reverse direction from the level. It is unlikely that sellers of the pound will make a strong appearance today. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3267 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline can be expected towards the opposite levels of 1.3246 and 1.3219.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.