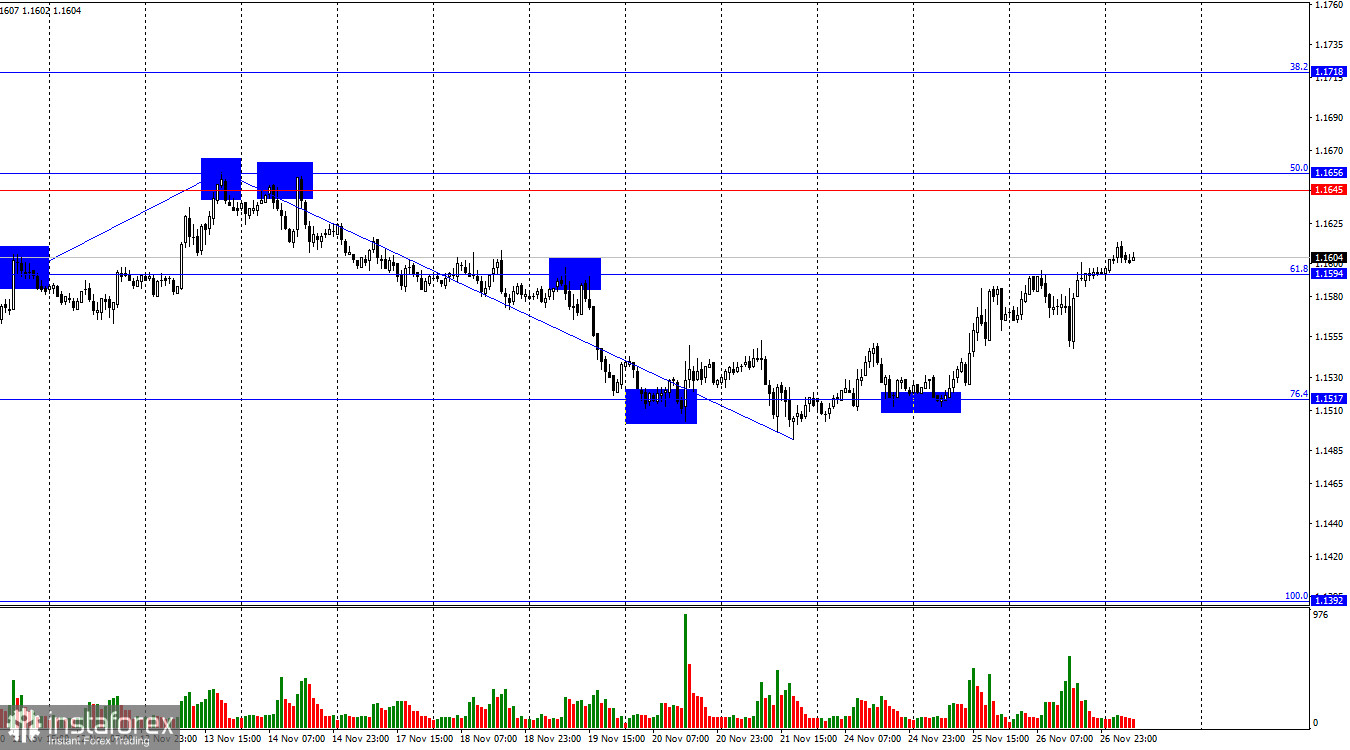

On Wednesday, the EUR/USD pair first bounced from the 61.8% corrective level at 1.1594, and then consolidated above this level. Thus, the upward movement may continue today toward the resistance level of 1.1645–1.1656. A consolidation of the pair below 1.1594 will work in favor of the US currency and a slight decline toward the 76.4% Fibonacci level at 1.1517.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave did not break the previous peak, and the last completed downward wave did not break the previous low. Thus, the trend remains "bearish" for now. The bullish traders have moved into attack mode, but their efforts are still insufficient for establishing a trend. For the "bearish" trend to be considered fully completed, the pair needs to rise above 1.1656.

On Wednesday, the fundamental background was not on the side of the bulls. The most important report—the US durable goods orders for September—showed an increase of 0.5% versus the forecast of +0.3%. The previous month's figure was also revised upward by 0.1%. Less significant initial jobless claims were better than expected as well. Only the Chicago PMI disappointed the bears. Thus, the dollar had every chance yesterday to recover Tuesday's losses. However, the bearish attack was short-lived. The bulls launched a new offensive and, in my view, it is a genuine advance that cannot be overturned by local reports. I believe the bears had been pressuring the market for too long and had fully priced in all available reports, factors, and news. Now it is the bulls' turn. And the weak fundamental background for the euro will only trigger corrective pullbacks. In my opinion, the "bearish" trend will soon come to an end, and the euro will continue its upward movement.

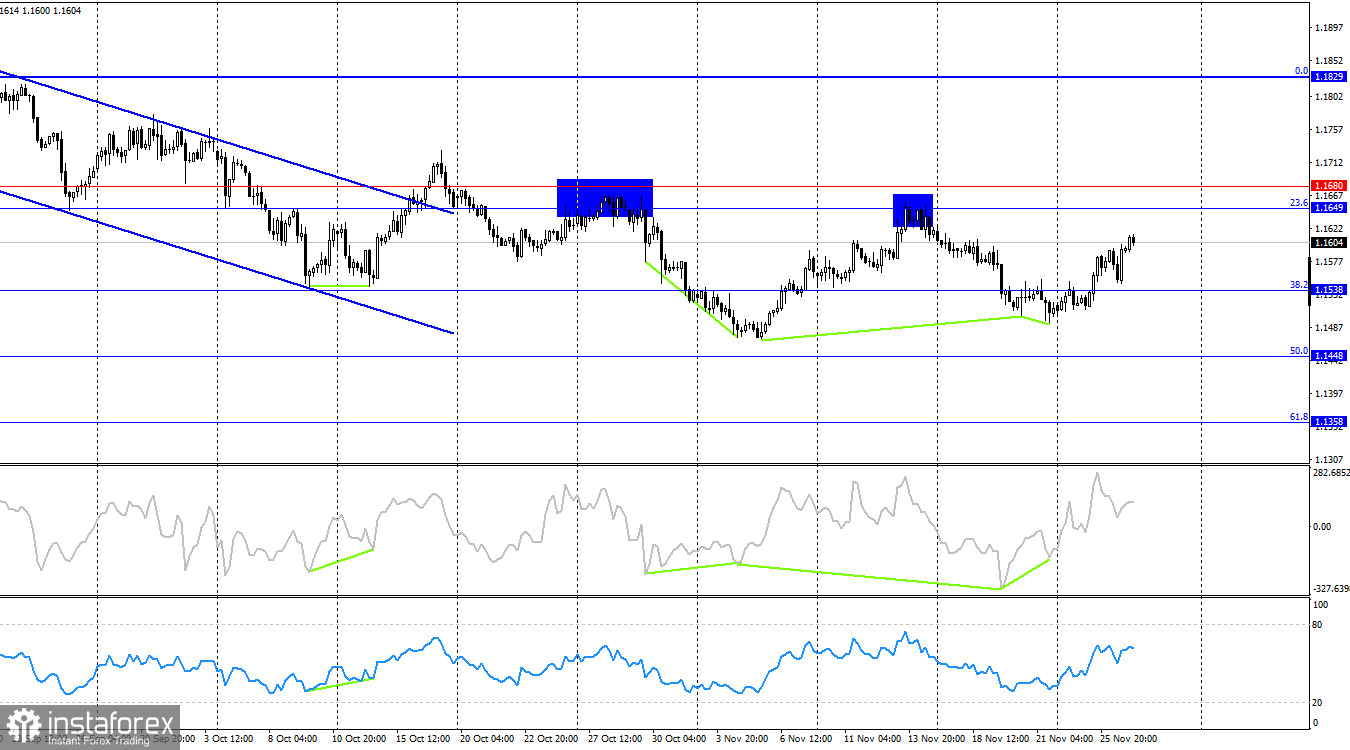

On the 4-hour chart, the pair reversed in favor of the euro after forming two "bullish" divergences on the CCI indicator. The pair consolidated above the 38.2% corrective level at 1.1538, which allows traders to expect continued growth toward the resistance level 1.1649–1.1680. No emerging divergences are seen today in any indicator. A rebound of the quotes from the 1.1649–1.1680 level will work in favor of the dollar and a slight decline.

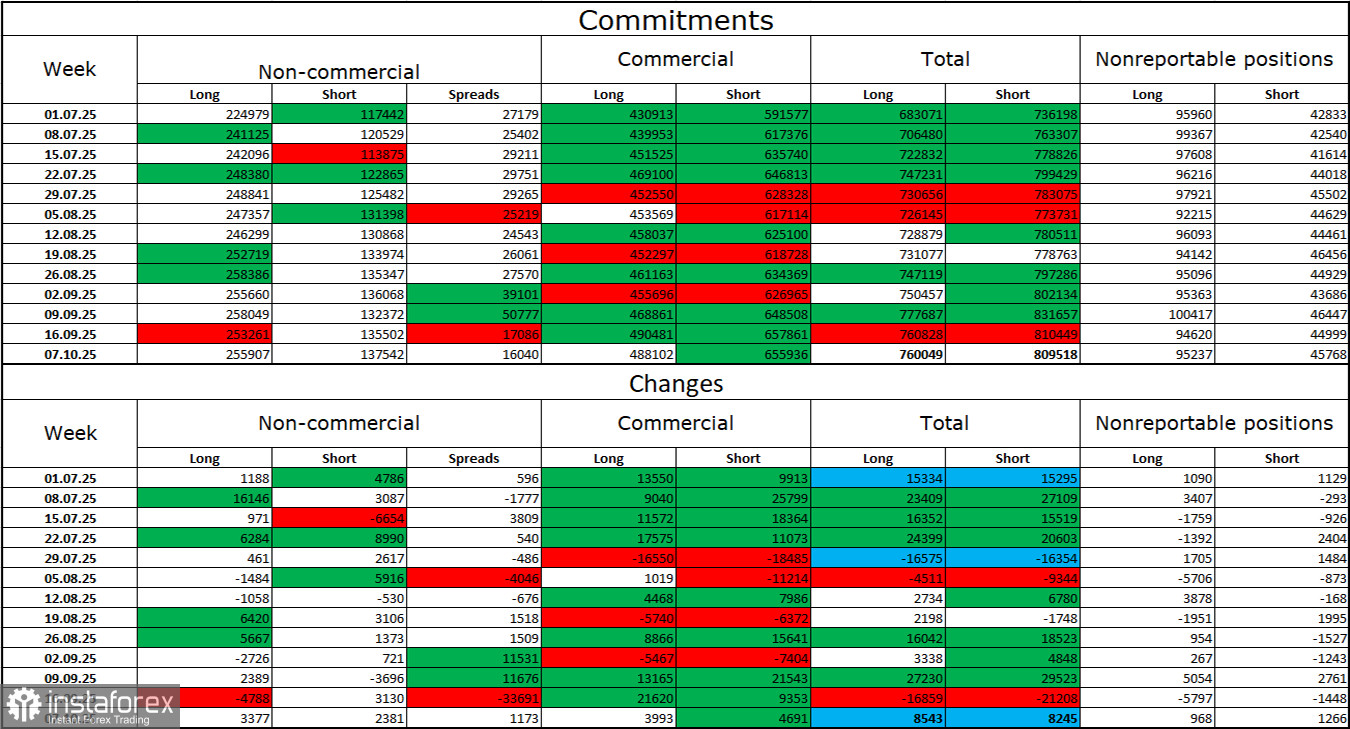

Commitments of Traders (COT) Report:

During the latest reporting week, professional traders opened 3,377 long positions and 2,381 short positions. COT reports have resumed publication after the government shutdown, but the data is still outdated—currently only October figures are being released. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators is now 255,000, while short positions total 137,000.

For thirty-three consecutive weeks, major players have been reducing short positions and increasing long ones. Donald Trump's policies remain the most significant factor for traders, as they may create long-term, structural problems for the United States. Despite several important trade agreements being signed, many key economic indicators are showing decline, and the dollar is losing its status as a "global reserve currency."

News Calendar for the US and the European Union:

European Union – Germany Consumer Confidence Index (07:00 UTC).

On November 27, the economic calendar contains only one low-impact entry. The news background will not influence market sentiment on Thursday.

EUR/USD Forecast and Trading Recommendations:

Selling the pair is possible today if the hourly candle closes below 1.1594, with a target of 1.1517. Sales are also possible after a rebound from the 1.1645–1.1656 level. However, I expect renewed growth. Buy positions could have been opened after a rebound from the 1.1517 level on the hourly chart with a target of 1.1594 — and this target has been reached. New buys were possible after a close above 1.1594, with a target at 1.1645–1.1656.

Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.