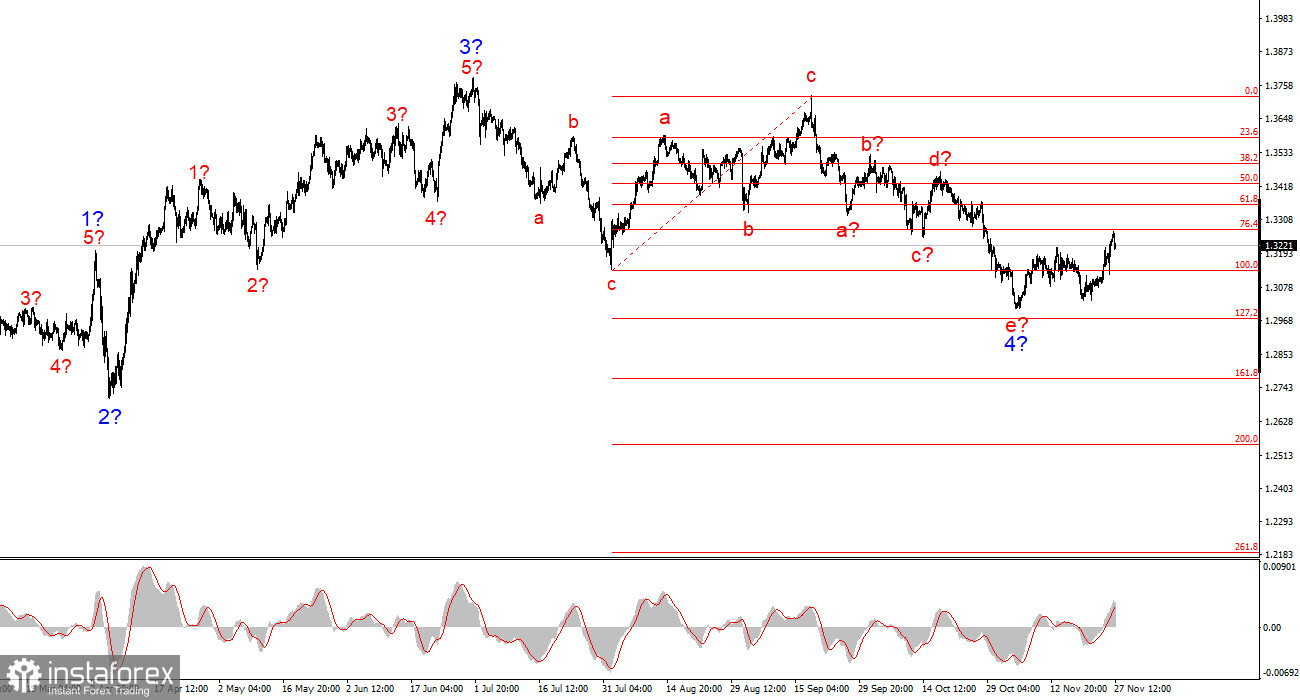

The wave pattern for GBP/USD continues to indicate the formation of an upward trend segment (bottom illustration), but in recent weeks it has taken on a complex and extended form (top illustration). The trend segment that began on July 1 can be considered wave 4, or any major corrective wave, since it has a corrective rather than an impulsive internal wave structure. The same applies to its internal sub-waves. Therefore, despite the prolonged decline of the pound, I believe that the upward trend remains intact.

The downward wave structure that began on September 17 has taken on a five-wave form a-b-c-d-e and may be complete. If this is indeed the case, then the instrument is currently in the process of forming a new upward wave sequence.

Of course, any wave structure can become more complex and extended at any moment. Even the presumed wave 4, which has been forming for almost 5 months, can take on a five-wave pattern, and in that case we would observe a correction for several more months. However, at this time the market has grounds for buying. If this assumption is correct, then the first two waves of the new wave sequence have already been formed, and we are now observing the formation of wave 3 or c.

The GBP/USD rate declined by 10 basis points on Thursday, which even sounds amusing. The pullback occurred after a rather strong rise yesterday, so its reasons are most likely technical. The current wave broke above the peak of the previous wave, so the formation of an upward wave sequence is confirmed. Accordingly, just as before, I expect the British currency to rise.

Yesterday, the full UK budget for 2026 was released, and it was well received by the market. Market participants appreciated the British government's intention to reduce expenses, increase revenue, and avoid excessive borrowing. Unfortunately, the increase in revenue will be achieved through a substantial rise in various taxes (and we will discuss this in a separate review). Recall that during the election campaign, Labour promised not to raise taxes — but in practice, it turned out they promised not to raise only income tax. All other taxes, however, were fair game. Yesterday it became known that the income tax rate will remain unchanged, but Britons will still pay more of this tax because prices and wages in the UK are rising while tax thresholds remain unchanged.

In practice, it works like this: for example, consider the income threshold of £50,000 per year. Below that, the tax rate is 20%; above it, 30%. Since wages and inflation in the UK are rising, British taxpayers are effectively earning more each year — but in real terms, they are not (due to inflation). Therefore, a certain portion of citizens will move from the first tax bracket to the second because of wage increases and will thus pay more tax. Checkmate from Rachel Reeves.

General Conclusions

The wave pattern of GBP/USD has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in c of 4 appears fully completed. If this is truly the case, I expect the main upward trend segment to resume with initial targets around the 1.38 and 1.40 levels. In the short term, we may expect the formation of wave 3 or c with targets near 1.3280 and 1.3360, corresponding to the Fibonacci levels of 76.4% and 61.8%.

The higher-degree wave pattern looks nearly perfect, even though wave 4 went beyond the peak of wave 1. However, let me remind you that perfect wave patterns exist only in textbooks. In practice, everything is much more complicated. At the moment, I see no grounds to consider alternative scenarios to the bullish trend segment.

The Main Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- Absolute certainty about the direction of movement never exists and never will. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.