The GBP/USD currency pair continued its upward movement on Wednesday and Thursday, driven by the publication of the UK budget for the 2026 financial year. Traders reacted positively to news of tax increases in the UK, as these measures are likely to help avoid budget deficits and other financial problems. However, we cannot overlook one important question: the alignment between British voters' expectations and reality.

It's important to note that the key disagreements regarding the budget revolved around the Labour Party's promise not to raise taxes during the election campaign. However, the party received such a "legacy" after 14 years of Conservative rule that it became evident that not raising taxes was not an option. This is how the "bad streak" for the British pound began. Both the euro and the pound traded calmly within sideways channels on the daily timeframe, but the pound has fallen significantly more than the euro over the past two months, primarily due to the issues surrounding the British budget. Several statements from Rachel Reeves triggered sell-offs of the sterling, as the Chancellor of the Exchequer struggled to decide whether to raise taxes and risk losing the next election or not raise taxes and accept a "hole" in the budget.

In addition to raising approximately 10 different taxes, the income tax took center stage. In our opinion, this tax is the largest source of revenue for the budget and affects all citizens of the country. Reeves did not wish to raise it, but payments for this tax will increase nonetheless. Reeves made a strategic move. Instead of raising the tax rate, she "froze" the limits for tax brackets. What does this mean?

It is no secret that, based on total income, Brits pay taxes at different rates. The higher the income, the higher the tax rate. Thus, "freezing" the limits that separate tax brackets effectively means that wage growth will forcibly push many Brits from a lower tax rate to a higher one. Wage growth in the UK has been consistently around 5% over the past year. Imagine how many taxpayers in Britain are in the "marginal" zone. All of them will transition into a wealthier category either this year or next and will pay taxes at a higher rate.

However, for traders, the resolution of the budget issue is good news, and as a result, the British pound has experienced two consecutive days of upward movement. We continue to believe that the GBP/USD pair has far more global fundamental factors for growth than concerns about the British budget. Yet, bulls in the market have exhibited relative passivity lately. Consequently, even the growth observed now is cause for celebration.

It should be remembered that the European currency could initiate a new wave of a global upward trend. If so, the British pound could also begin a new upward trajectory. And there are plenty of reasons for the dollar to fall.

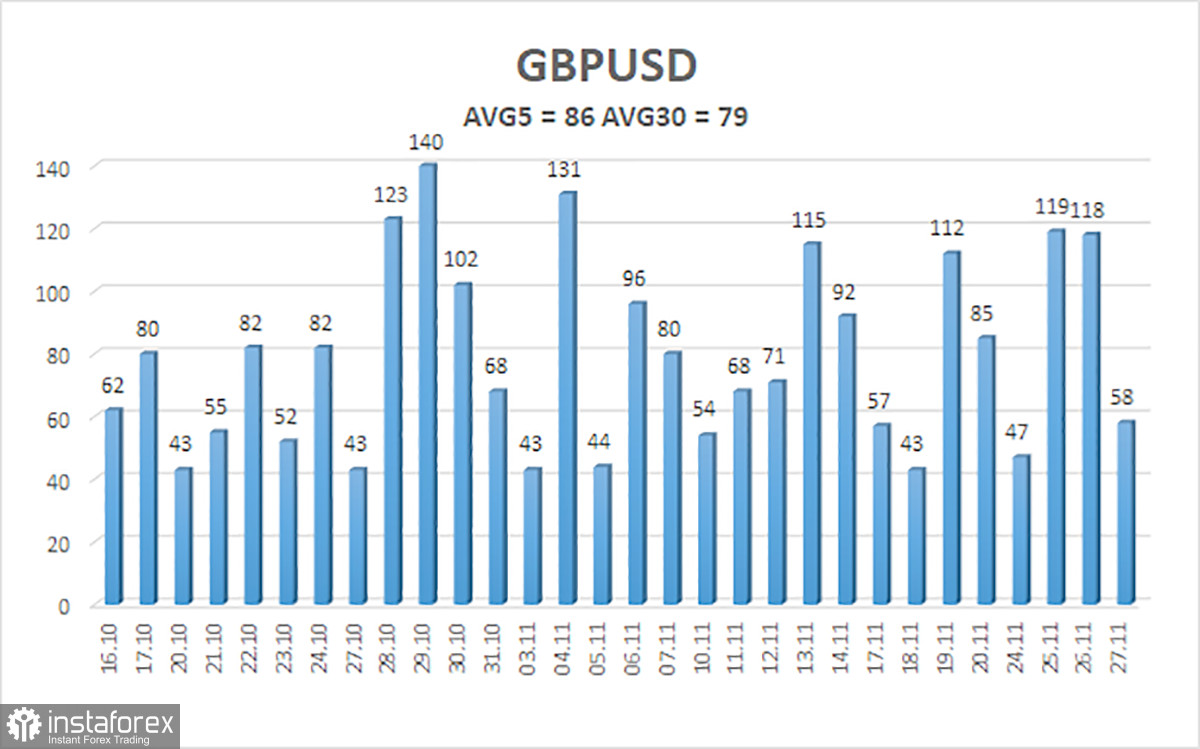

The average volatility of the GBP/USD pair over the past five trading days stands at 86 pips, which is considered "average." Therefore, on Friday, November 28, we expect movement within a range limited by levels 1.3154 and 1.3326. The higher linear regression channel is directed downward, but only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold zone six times in recent months, forming another "bullish" divergence.

Nearest Support Levels:

- S1 – 1.3184

- S2 – 1.3123

- S3 – 1.3062

Nearest Resistance Levels:

- R1 – 1.3245

- R2 – 1.3306

- R3 – 1.3367

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its upward trend for 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Therefore, long positions with targets at 1.3306 and 1.3428 remain relevant for the near term, when the price is above the moving average. If the price is below the moving average line, small short positions can be considered targeting 1.3062 based on technical grounds. Occasionally, the American currency experiences corrections (in a global sense), but for trend-based strengthening, it requires real signs of the end of the trade war or other positive global factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, then the trend is currently strong;

- The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are targeted levels for movements and corrections;

- Volatility levels (red lines) denote the probable price channel within which the pair will trade in the coming day, based on current volatility metrics;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.