Holy ground cannot remain empty. With the US markets closed for Thanksgiving, investors are shifting their focus to other regions, Asia and Europe. At the same time, traders have an opportunity to ponder the future of the S&P 500. According to the consensus forecast by Reuters experts, the broad stock index is expected to rise by 12% in 2026 due to the easing of the Federal Reserve's monetary policy, the resilience of the US economy, and the ongoing strength of the technology sector.

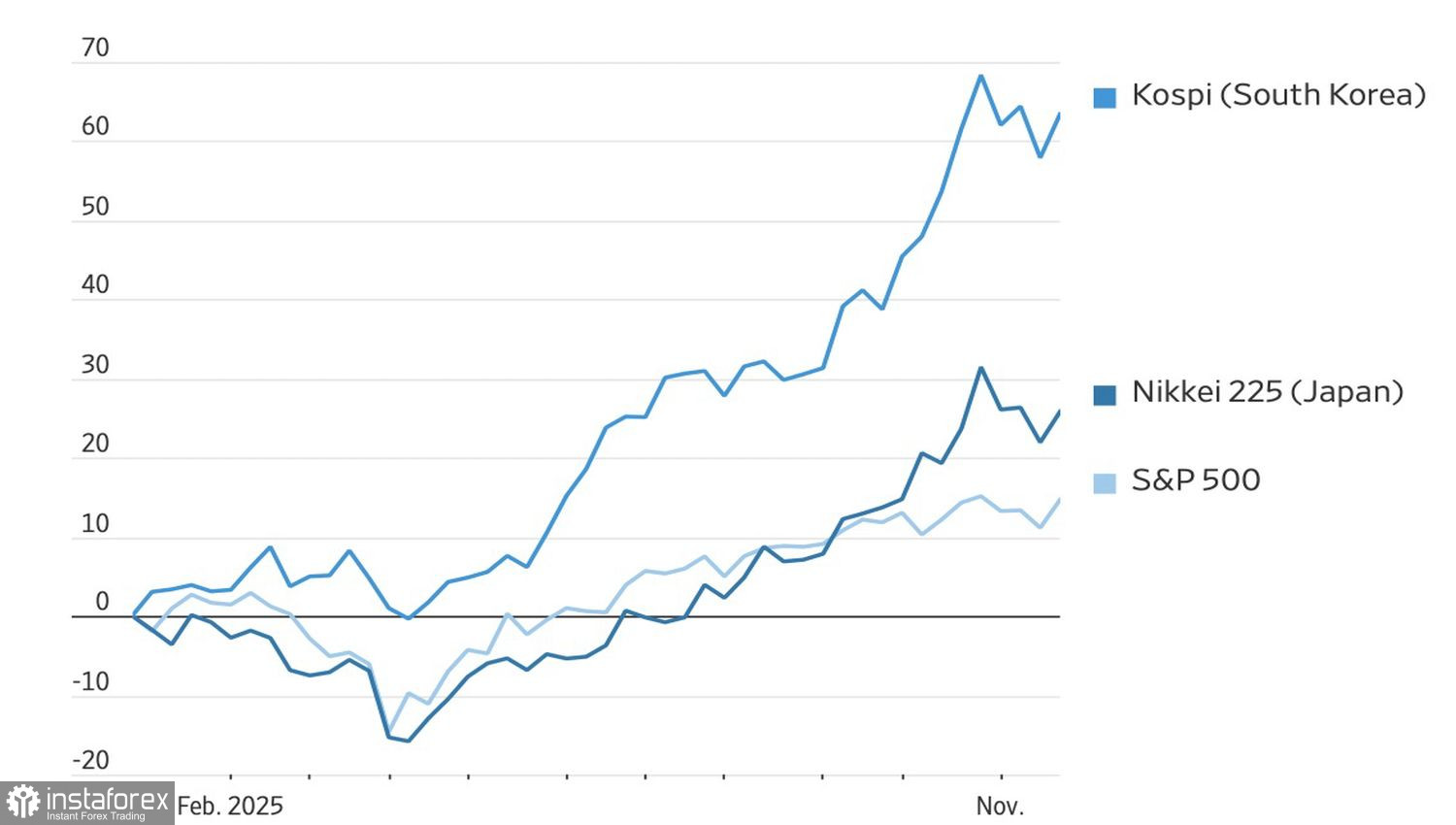

Interestingly, in light of the closed US markets, investors prefer to buy shares of technology companies in other regions. Asian stock indices outperformed their American counterparts in 2025 due to more accommodative monetary policies. For instance, the Bank of Japan is keeping the overnight rate low and is in no hurry to raise it, despite inflation exceeding the 2% target for 43 consecutive months. The Bank of Korea has only recently begun signaling the end of its monetary expansion cycle.

Dynamics of US and Asian Stock Indices

In 2026, everything risks being turned upside down. The Fed has taken its time, but it is now prepared to lower the federal funds rate at an accelerated pace amid a cooling labor market. According to FOMC member Stephen Miran, the sharp slowdown in employment is linked to overly tight monetary policy. He voted for a 50 basis point cut in borrowing costs at the previous two FOMC meetings. Investors believe that another person from the White House, Kevin Hassett, will be a pronounced "dove." The increased chances of his appointment by Donald Trump as the chair of the Fed have weakened the US dollar.

If the US dollar index continues to decline in line with the federal funds rate, it will provide a stronger tailwind for the S&P 500. The weakness of the greenback increases foreign income for companies in the broad stock index. At the same time, the decline in Treasury yields following the Fed's rate cuts reduces their costs. Positive corporate earnings have contributed to the stock market's recovery following the April rout. There are grounds to believe that this advantage will continue to work in favor of bulls.

The Fed's Beige Book indicated that the US economy is experiencing K-shaped expansion. The gap between the wealthiest and poorest segments of the population is widening. The rich are getting richer thanks to investments in growing stock indices, while the poor are barely making ends meet. Nonetheless, massive investments in artificial intelligence technologies are boosting investments, a key component of GDP. Without such investments, the economy would look considerably worse than it does now.

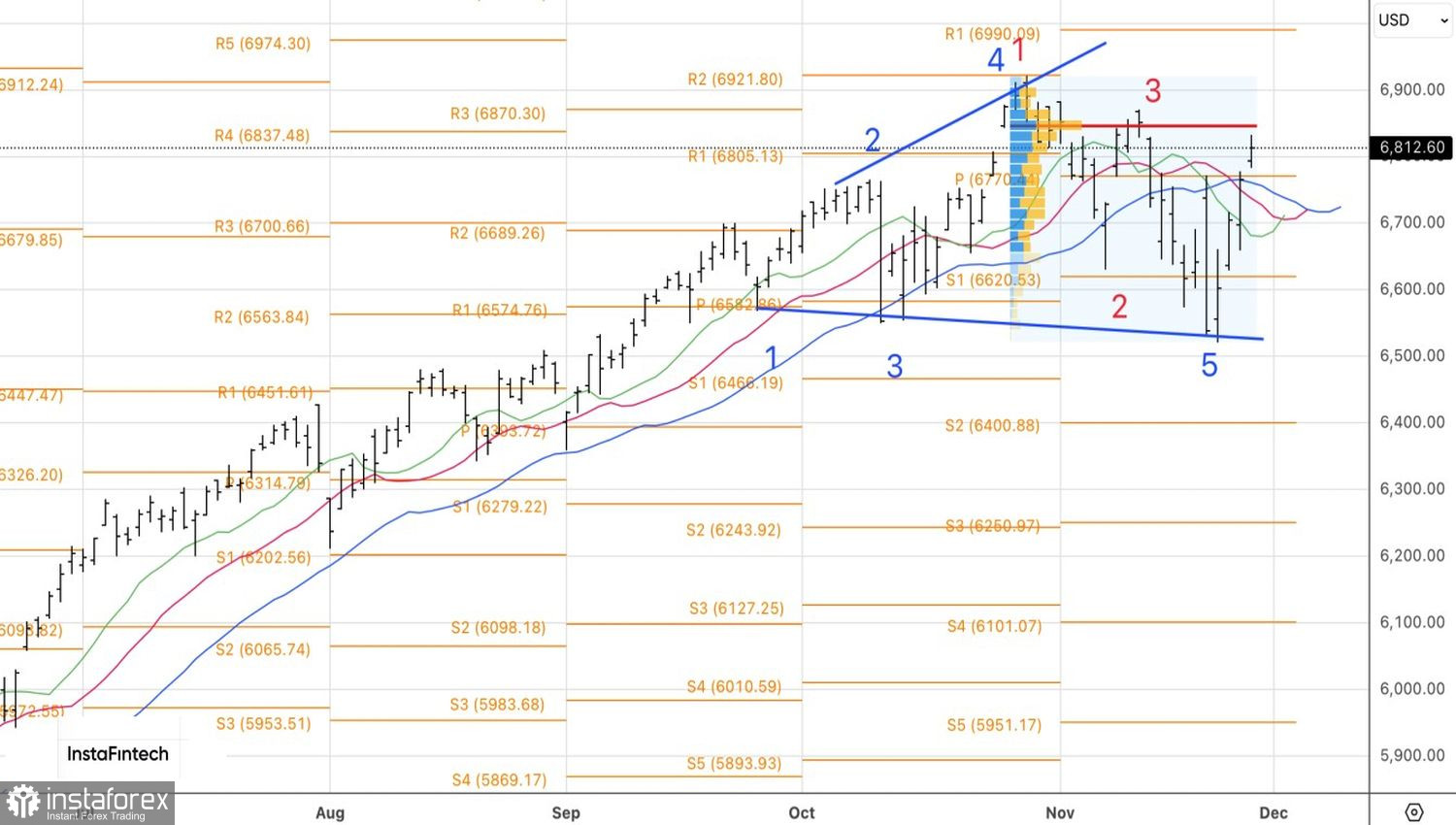

Technically, on the daily chart of the S&P 500, bears have failed to reverse the trend using the Expanding Wedge pattern. However, this pattern operates in both directions. A breakout above the resistance level of 6,845 will allow for increased long positions.