The GBP/USD currency pair slightly corrected on Friday but retained its local upward trend. Currently, the pair may be at the very beginning of a new upward trend that will be part of the trend for 2025. From our perspective, the fundamental backdrop for the dollar has not changed in the second half of this year, and the dollar itself has extracted the maximum from local fundamentals and macroeconomic factors. It is also worth noting that the euro and the pound generally trade in the same direction and quite similarly. If the upward trend in the euro were to be reversed, we would have expected further declines in the British pound. However, as the euro remains in a flat range, it is impractical to talk about a downward trend for the pound until this flat is concluded.

Recently, the pound has indeed faced significant pressure from UK macroeconomic data and events related to the approval of next year's UK budget. However, the budget has already been approved, and the macroeconomic data now are subpar both in the UK and the U.S. Therefore, if the global correction is complete, the pound will rise on almost any grounds, and the market will simultaneously remember both the "shutdown" and the "dovish" policy of the Federal Reserve, as well as the trade war.

This week, there will be no important reports from the UK, and in the U.S., only a few reports that cannot be considered significant by any means. Traders are accustomed to the first week of each month being when unemployment data and Non-Farm Payrolls are released, which currently have a considerable influence on the Fed's decisions. However, this week, the mentioned reports are not scheduled in the economic calendars. On December 10 (next week), the Fed is set to meet. It appears that the Fed may once again have to act blindly.

Of course, the event calendar can be adjusted, and the Bureau of Statistics could release reports before the Fed meeting. But as of now, the calendars are empty. The only significant reports are the ISM business activity indices for the services and manufacturing sectors. According to expert forecasts, both indices are expected to decline in November, and the manufacturing sector is already in recession, below the "waterline" of 50. On Wednesday, the ADP report for November will be published, and in the absence of Non-Farm Payrolls, the market and the Fed will once again have to rely solely on this report to gauge the state of the U.S. labor market. It is worth noting that this report is not the most accurate, as it does not account for certain sectors of the economy, and the market usually focuses on Non-Farm Payrolls. But "in the absence of fish, even a crayfish is a fish."

Other reports include industrial production, the University of Michigan consumer sentiment index, and the core personal consumption expenditures (PCE) price index. However, in our view, these reports will not change market sentiment. If the correction is complete, we will see an increase regardless of the data. If not, we will witness a decline despite any data.

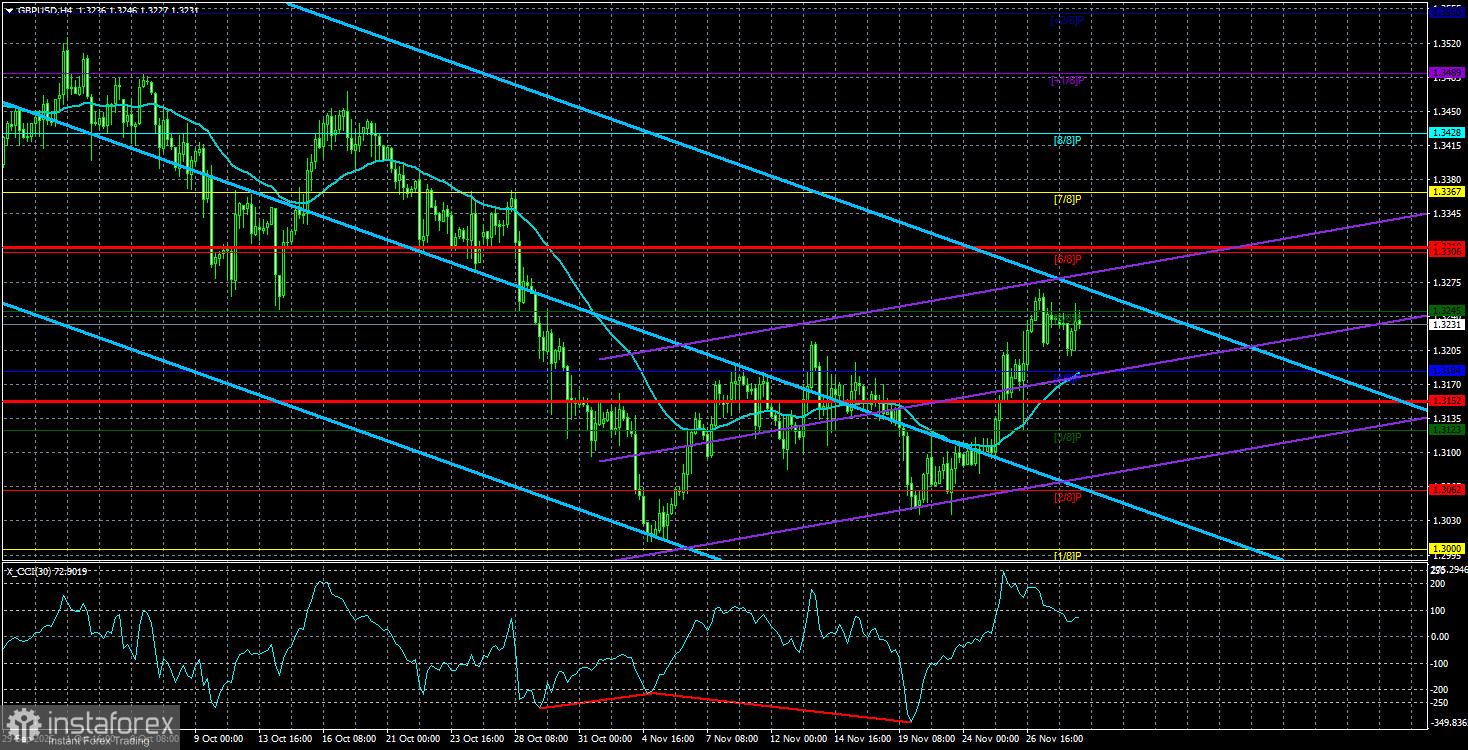

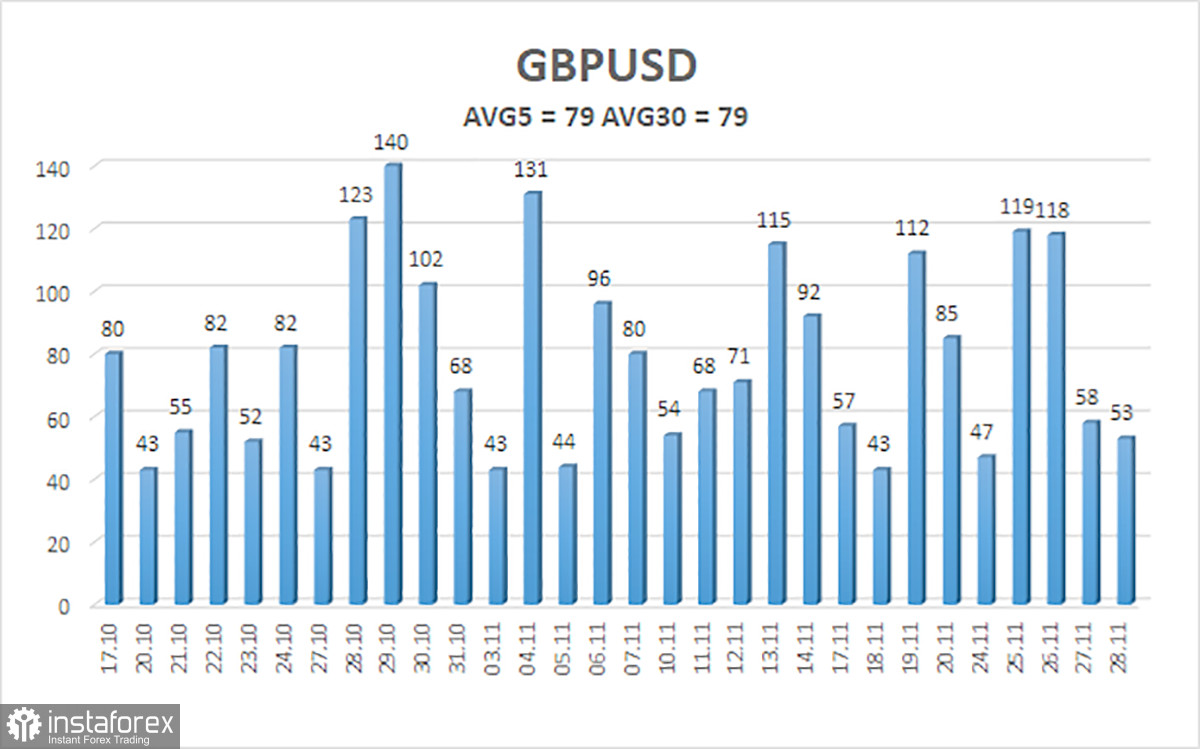

The average volatility of the GBP/USD pair over the last five trading days is 79 pips. For this pair, this value is considered "average." On Monday, December 1, we thus expect movement within the range bounded by levels 1.3152 and 1.3310. The upper channel of the linear regression is directed downward, but this is just due to the technical correction on higher timeframes. The CCI indicator has entered the oversold area six times in recent months and has formed yet another bullish divergence.

Nearest Support Levels:

- S1 – 1.3184

- S2 – 1.3123

- S3 – 1.3062

Nearest Resistance Levels:

- R1 – 1.3245

- R2 – 1.3306

- R3 – 1.3367

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its upward trend for 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Therefore, long positions with targets of 1.3306 and 1.3428 remain relevant for the near future while the price is above the moving average. If the price is below the moving average line, small short positions may be considered with a target of 1.3062 based on technical grounds. Occasionally, the American currency shows corrections (in a global sense), but for it to trend stronger, it needs signs that the trade war is ending or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates a strong trend;

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels – target levels for movements and corrections;

- Volatility levels (red lines) – the probable price channel in which the pair will spend the next twenty-four hours, based on current volatility metrics;

- The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.