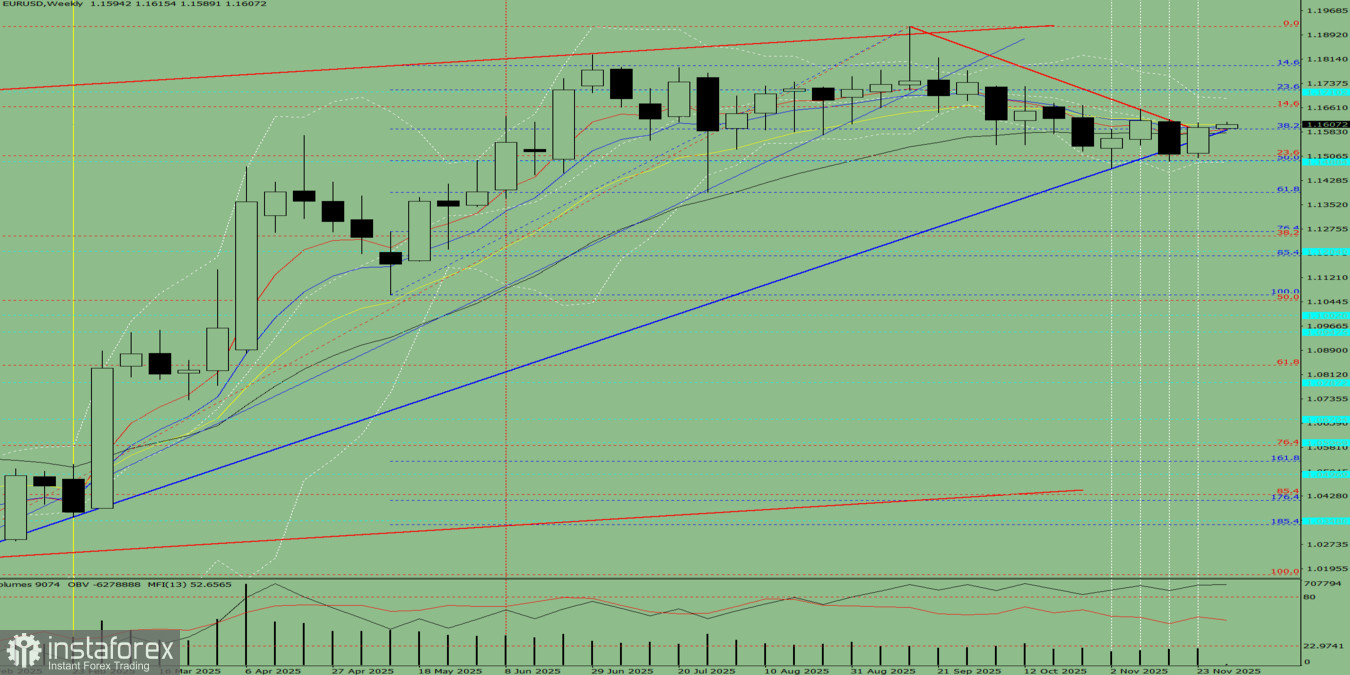

Trend Analysis (Fig. 1)

This week, from the level of 1.1598 (the close of the last weekly candle), the market may begin moving downward toward 1.1391 — the 61.8% retracement level (blue dashed line). When testing this level, the price may rebound upward toward 1.1488 — the historical resistance level (blue dashed line).

Fig. 1 (Weekly Chart).

Comprehensive Analysis:

- Indicator analysis — downward

- Fibonacci levels — downward

- Volume — downward

- Candlestick analysis — downward

- Trend analysis — downward

- Bollinger Bands — downward

- Monthly chart — downward

Conclusion from comprehensive analysis: downward movement.

Overall Summary for the Weekly EUR/USD Candle:

The price will most likely exhibit a downward tendency during the week, with the weekly bearish candle lacking the first upper shadow (Monday — down) and having a lower shadow (Friday — up).

Alternative Scenario:

From the level of 1.1598 (the close of the last weekly candle), the pair may begin moving downward toward 1.1492 — the 50% retracement level (blue dashed line). When testing this level, the price may rebound upward toward 1.1557 — the resistance line (bold blue line).