Bitcoin thought it had found a bottom, only to be knocked from below. The tumultuous recovery of US stock indices extended a lifeline to BTC/USD; however, a series of bad news caused the token's prices to plummet. It wasn't alone. Ethereum dropped by 7%, and altcoins also faced a wave of sell-offs amid the downgrade of the largest stablecoin, USDT, to junk status.

S&P Global Ratings believes that the falling value of Bitcoin will lead to insufficient backing for the token. Positive news on stablecoins, including Congress's approval of legislation on their use, had previously been one of the catalysts for the BTC/USD rally. By the same token, negative developments lead to price crashes. Moreover, bad news for cryptocurrencies does not stop here.

The People's Bank of China issued a warning about heightened risks associated with digital assets, including stablecoins. The regulator added that government institutions must enhance coordination to curb illegal operations with tokens. In a market with few buyers, fears of punitive measures exacerbate the price decline.

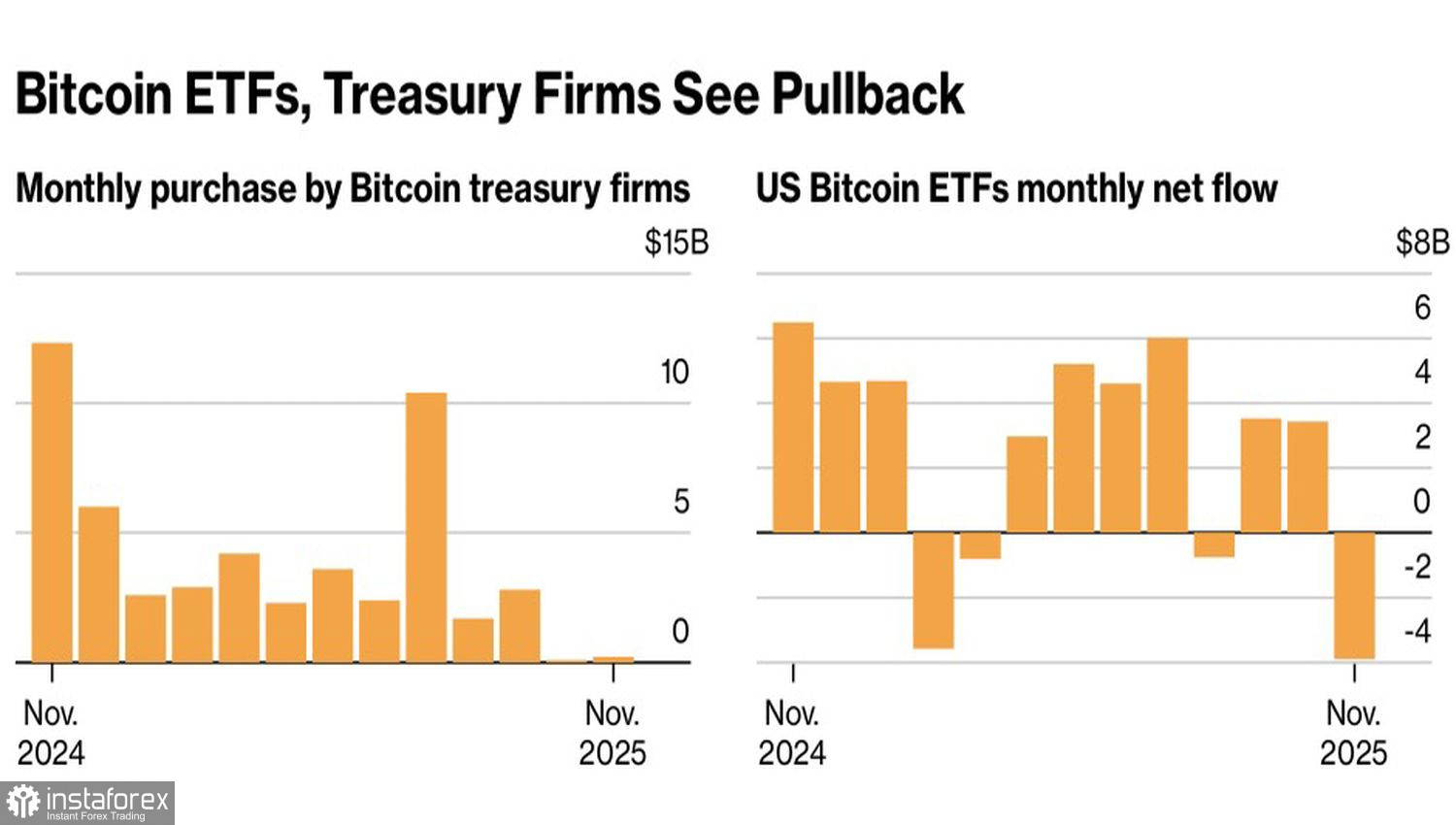

The dynamics of crypto treasury purchases and ETFs

Indeed, crypto treasuries have stopped purchasing tokens, with capital outflows from Bitcoin-focused ETFs totaling $3.6 billion in November, marking the worst monthly performance since the launch of specialized exchange-traded funds. In such a situation, when the leader in crypto treasuries, Strategy, begins to discuss selling, it signals trouble.

Michael Saylor's company intends to dispose of its crypto holdings if their value exceeds its market capitalization. Currently, the ratio stands at 1.19, and its further decline amid falling BTC/USD prices could introduce a new seller into the market and accelerate the downward movement.

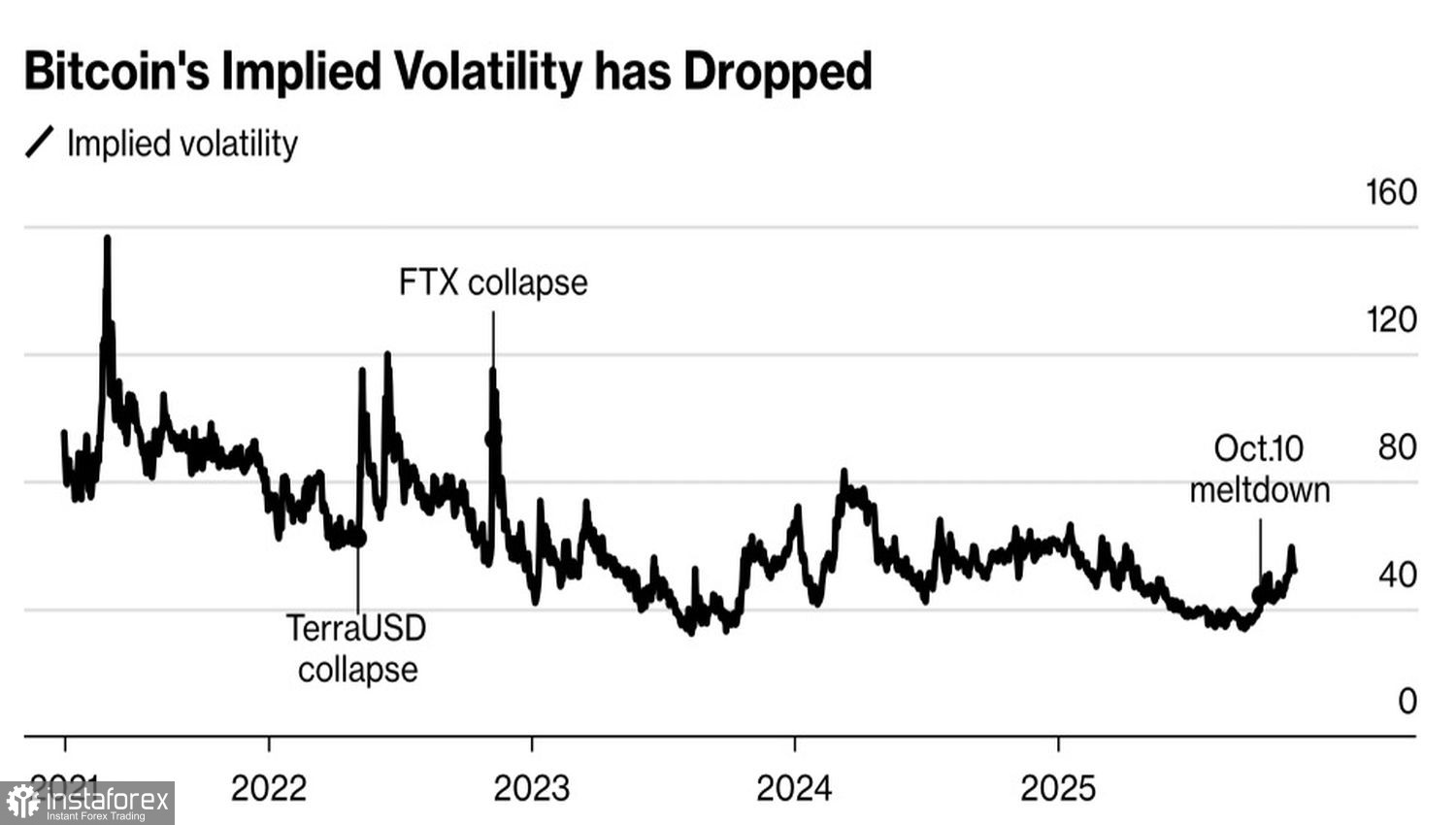

The dynamics of Bitcoin volatility

Meanwhile, a fundamental shift is occurring in the cryptocurrency space. During previous price crashes of digital assets, volatility spiked. Now, there is none in sight. There are grounds to believe the market is becoming more mature, with the emergence of various groups of investors—not just crypto whales, but also institutional players. Furthermore, strong demand for risk hedging supports the argument for the market transitioning from being fully speculative to a more traditional investment landscape.

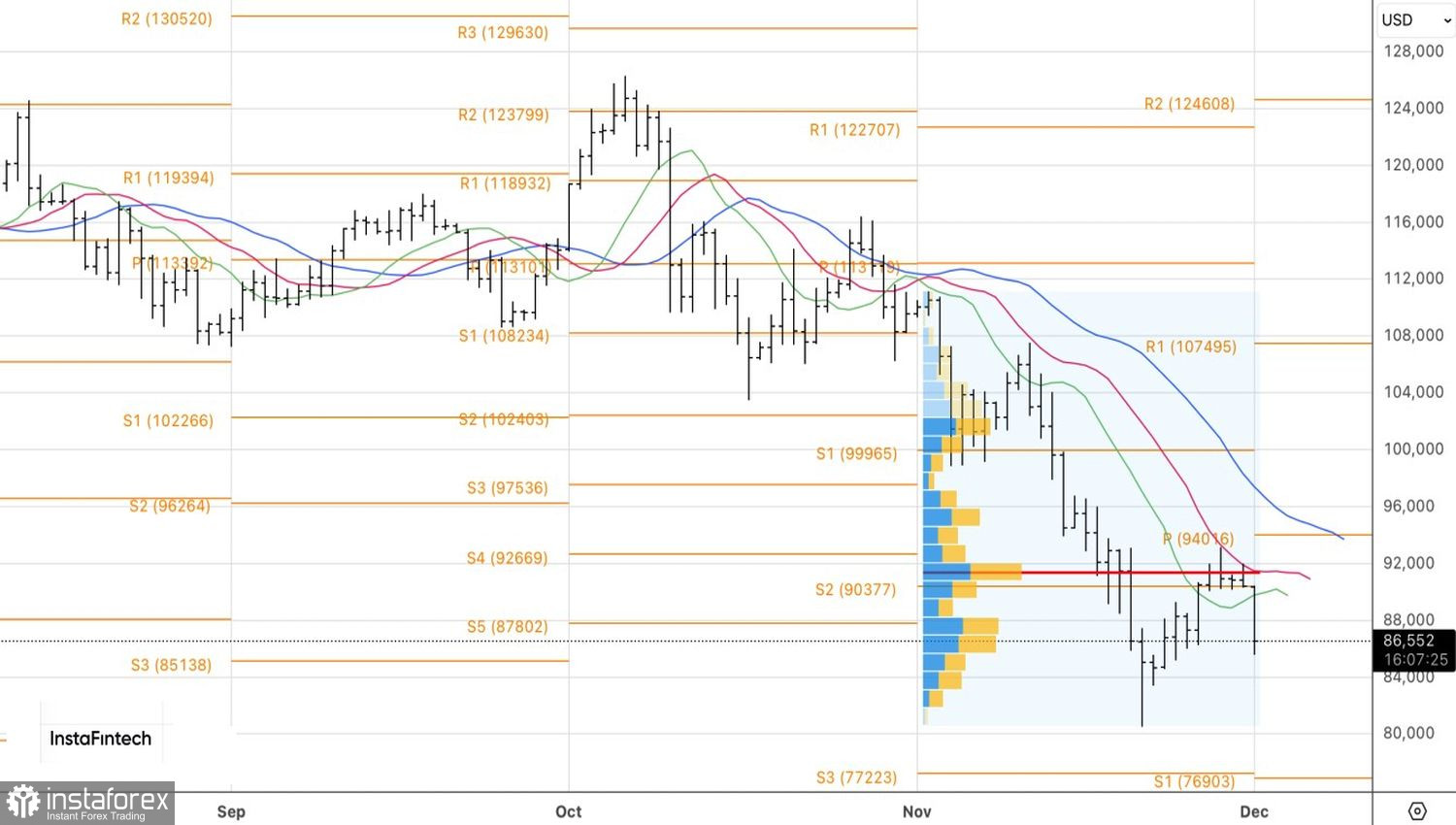

Therefore, the series of bad news, including the downgrade of USDT, warnings from the People's Bank of China about precarious positions of cryptocurrencies in the country, and Strategy's discussions about potential Bitcoin sell-offs, have allowed the "bears" in BTC/USD to renew their attack. In a climate of insufficient buyers, prices may continue to crash—especially if new sellers in the form of crypto treasuries emerge.

Technically, much depends on the bears' ability to establish a new local bottom at 80,500 on the daily BTC/USD chart. If they succeed, it may be possible to increase short positions with targets at 77,170 and 74,000.