Trade Analysis and Advice for Trading the Euro

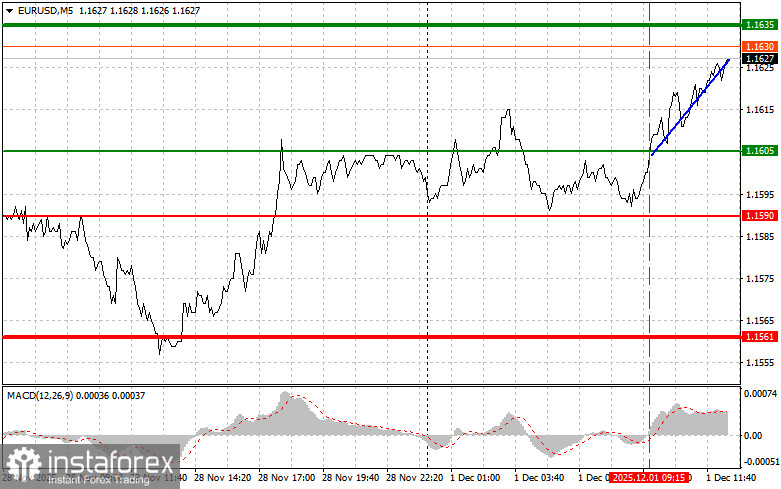

The price test at 1.1605 coincided with the MACD indicator just starting to move upward from the zero line, confirming the correct entry point for buying euros. As a result, the pair rose by more than 20 points, stopping just short of the target level at 1.1635.

The euro seemed to completely ignore economic realities, showing resilience despite negative signals. Despite fairly weak data on the contraction in Eurozone manufacturing activity, the euro continued to rise. This behavior could be driven by speculative interest in the currency. Investors may be expecting the European Central Bank to maintain a wait-and-see approach to combat inflation, even if it negatively affects economic growth.

Later today, market attention will focus on the release of the U.S. ISM Manufacturing PMI. This key indicator reflects the state of American industry. If the actual ISM value exceeds the forecast, it is likely to support the U.S. dollar, signaling economic resilience and potentially dissuading traders expecting a softer Federal Reserve policy. Conversely, if the index falls below expectations, it could weaken the dollar, raising concerns about slowing economic growth.

For intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

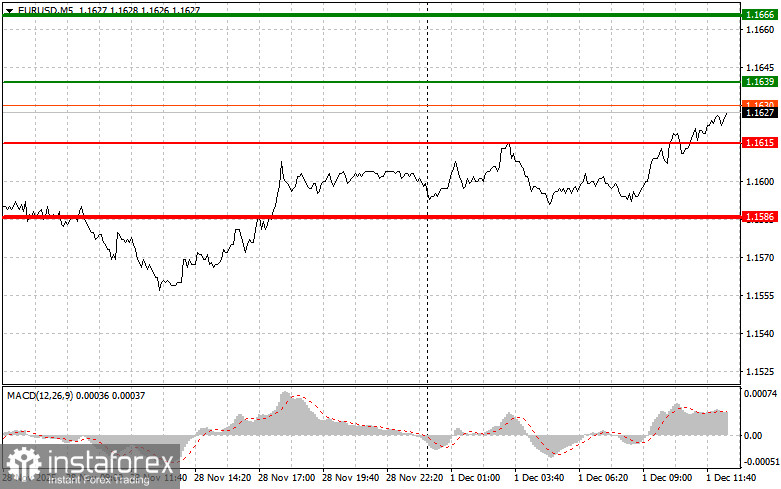

Scenario #1: Today, buy euros around 1.1639 (green line on the chart) targeting a rise to 1.1666. At 1.1666, plan to exit the market and sell euros in the opposite direction, expecting a 30–35 point move from the entry point. Strong euro growth can be expected following weak U.S. data. Important: Before buying, ensure the MACD indicator is above zero and just starting to rise.

Scenario #2: Buy euros if the price tests 1.1615 twice while the MACD is in the oversold zone. This limits the pair's downward potential and may trigger a market reversal upward, with expected growth toward 1.1639 and 1.1666.

Sell Signal

Scenario #1: Sell euros after reaching 1.1615 (red line on the chart). Target 1.1586, where you plan to exit and immediately buy in the opposite direction (expecting a 20–25 point move back). Pressure on the pair today will increase if manufacturing activity rises sharply. Important: Before selling, ensure the MACD is below zero and just starting to fall.

Scenario #2: Sell euros if the price tests 1.1639 twice while the MACD is in the overbought zone. This limits the pair's upward potential and may trigger a downward reversal, with expected decline toward 1.1615 and 1.1586.

Chart Notes

- Thin green line – entry price for buying the instrument.

- Thick green line – expected level for Take Profit or manual profit-taking; further growth above this level is unlikely.

- Thin red line – entry price for selling the instrument.

- Thick red line – expected level for Take Profit or manual profit-taking; further decline below this level is unlikely.

- MACD indicator – use overbought and oversold zones for entry guidance.

Important Notes for Beginners:

Forex beginners should be very cautious when entering the market. It's best to stay out before major fundamental reports to avoid sudden price swings. If trading during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you trade large volumes without proper money management.

Remember: successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on current market conditions is a losing strategy for intraday traders.