Analysis of Macroeconomic Reports:

There are relatively few macroeconomic reports scheduled for Monday. In the Eurozone, consumer price indices and unemployment rates will be released. These are important reports, but only unexpected and significant figures can provoke a reaction from traders. The European Central Bank has concluded its easing cycle with a 99% probability, so only a strong increase or decrease in inflation could prompt it to reconsider its rate plans. In the UK and the U.S., the calendars are practically empty.

Fundamental Event Analysis:

Very few fundamental events are planned for Tuesday. Overnight, there was an expected speech from Federal Reserve Chair Jerome Powell, but as of now, there is no information about it, and market movements suggest Powell likely did not convey anything significant. Recall that the Fed meeting is scheduled for December 10, and currently, there is no vital information regarding inflation, the labor market, or unemployment. It is uncertain whether any pertinent information will arrive before December 10. Additionally, a speech from FOMC member Michelle Bowman, who has recently supported accommodative monetary policy, is expected.

Overall, the market is anticipating a third rate cut in 2025, but whether the Fed will take such a risk in the absence of labor-market and unemployment data is unclear.

General Conclusions:

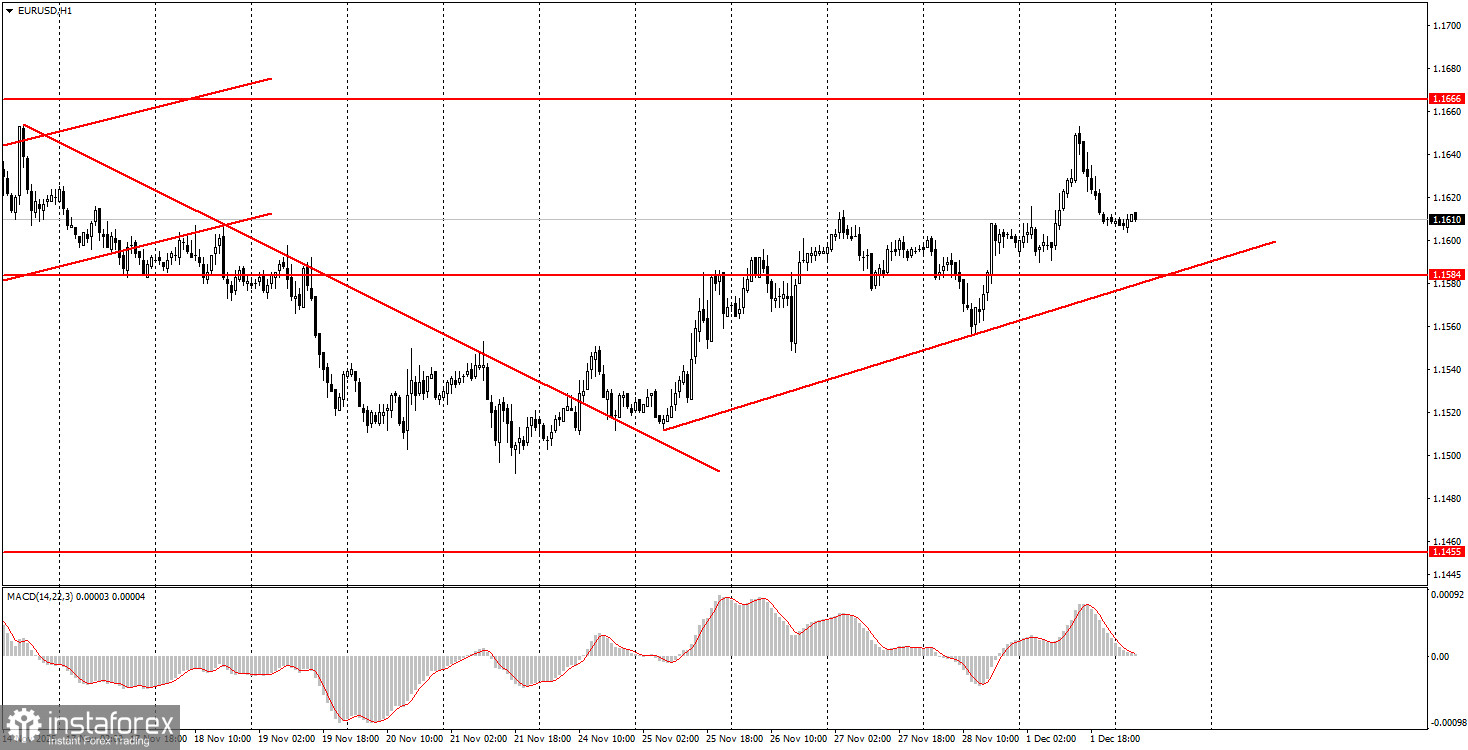

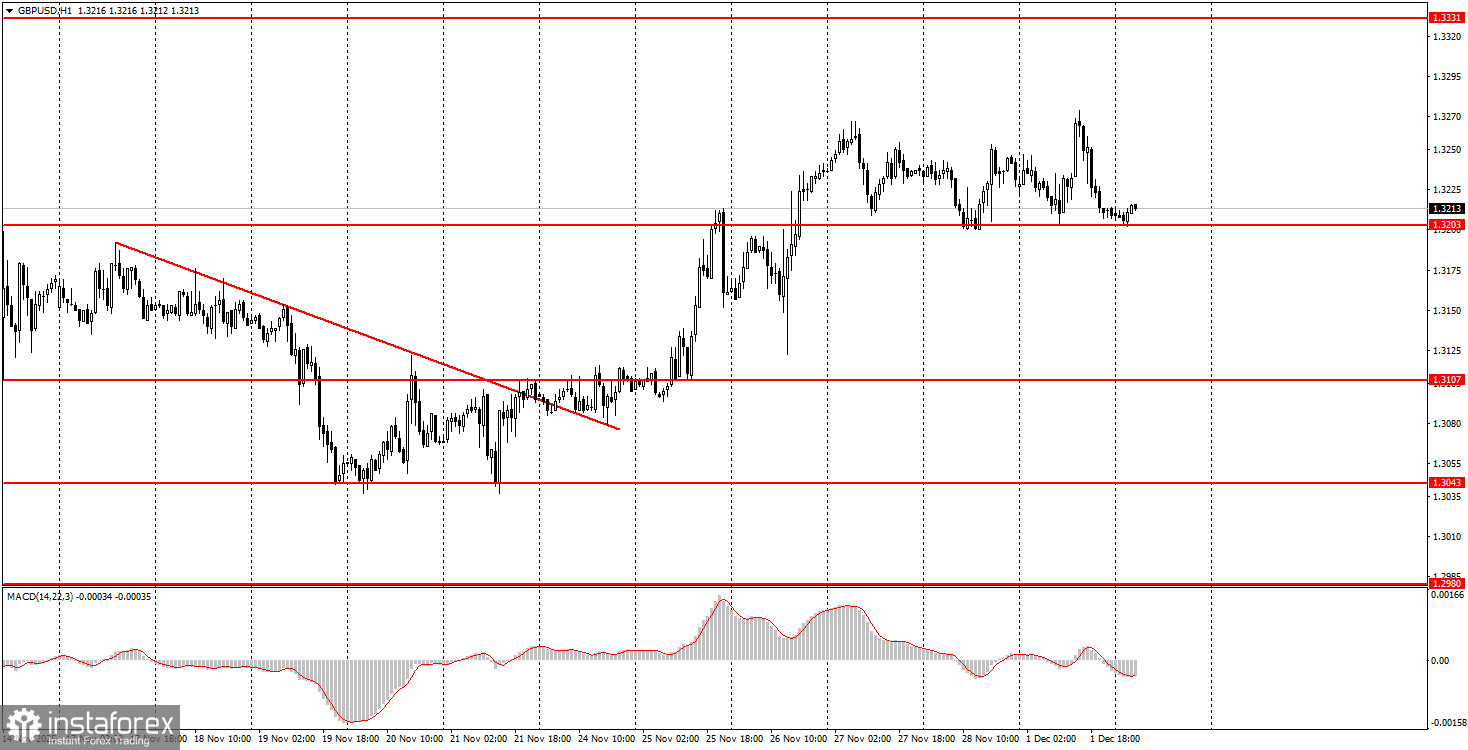

During the second trading day of the week, both currency pairs will trend toward growth, as a rising trend has begun in both cases. The euro has an excellent trading range at 1.1571-1.1584, where several buy signals have formed recently. The British pound has a range of 1.3203-1.3211 and is in a flat pattern. Volatility on Tuesday may remain low.

Key Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can form a multitude of false signals or none at all. At the first signs of a flat, it is better to stop trading.

- Trades are opened during the time between the start of the European session and mid-American session, after which all trades should be closed manually.

- On the hourly timeframe, using signals from the MACD indicator, it is preferable to trade only when good volatility exists, and a trend is confirmed by a trend line or channel.

- If two levels are too close to each other (5 to 20 pips), they should be viewed as an area of support or resistance.

- After moving 15-20 pips in the right direction, a Stop Loss should be set to breakeven.

Chart Explanations:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction to trade.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.