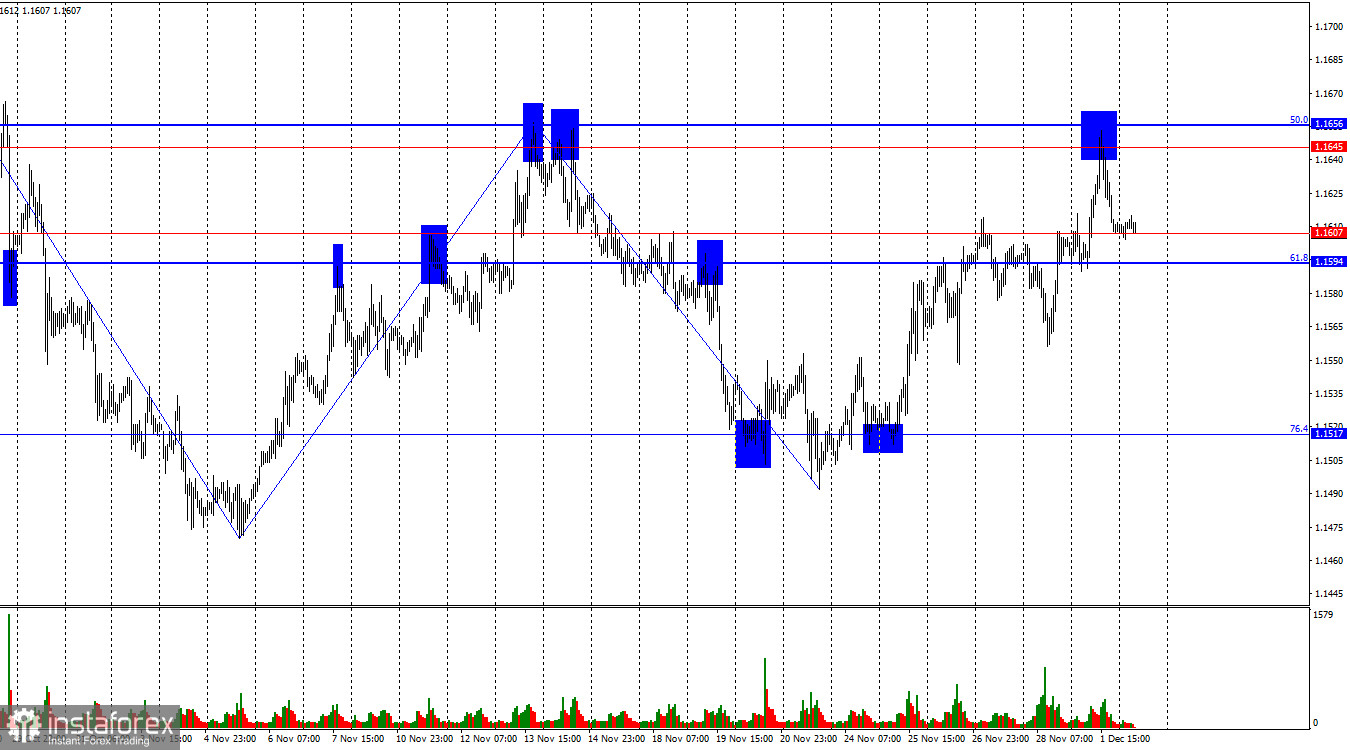

On Monday, the EUR/USD pair continued its upward movement, reached the resistance level of 1.1645–1.1656, bounced off it, and returned to the support level of 1.1594–1.1607. Thus, today a rebound from the 1.1594–1.1607 level will again work in favor of the European currency and some growth toward the resistance level. A consolidation of the pair below 1.1594–1.1607 will allow for the expectation of continued decline toward the 76.4% Fibonacci level at 1.1517.

The wave structure on the hourly chart remains simple and clear. The last completed downward wave did not break the previous wave's low, and the latest upward wave did not break the previous peak. Thus, the trend still remains "bearish" at the moment. Bullish traders have gone on the offensive, but their momentum is still insufficient to form a trend. For the bearish trend to be considered over, the pair must rise above 1.1656.

On Monday, the news was quite interesting, but traders reacted to it in a very strange way. In the morning, when there were no reasons to sell the dollar, we saw growth; in the evening, when reasons to sell the dollar did appear, the pair declined. Thus, the U.S. ISM Manufacturing PMI had a very odd impact on the market. In November, business activity fell from 48.7 to 48.2 points, although traders expected a decline only to 48.6. However, the weak ISM figure did not stop the bears. Bearish traders still have not lost the trend, although bulls have attacked more frequently in recent weeks. Thus, both the chart picture is ambiguous now, and the market reacted oddly to the first important report of the week, and the bulls failed to break through the important 1.1645–1.1656 level. Now the bulls need to at least hold the 1.1594–1.1607 level. If they lose it, the bears may launch a new full-scale offensive. And in just a week the FOMC meeting will take place, and at this point I am not confident about a "dovish" outcome.

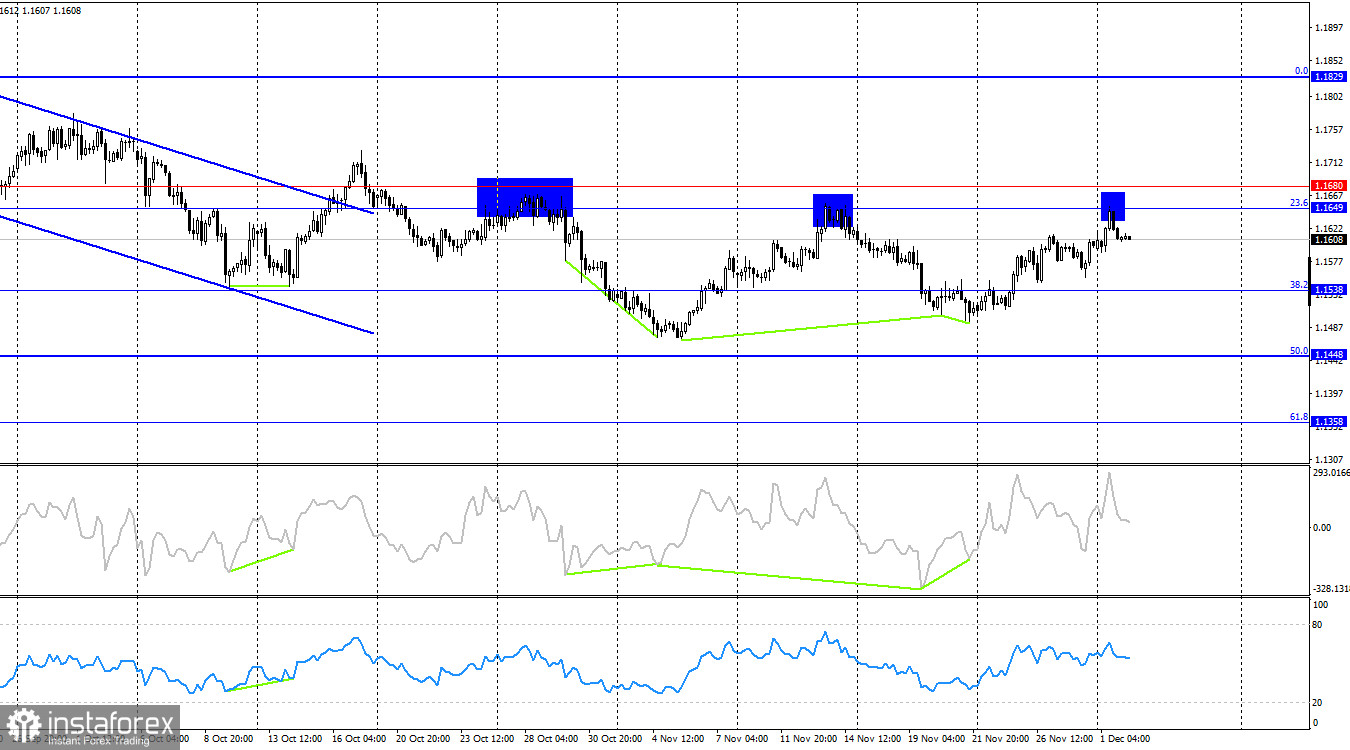

On the 4-hour chart, the pair turned upward toward the 23.6% correction level at 1.1649, bounced off it, and reversed in favor of the U.S. dollar. Thus, in the near term the pair may continue declining toward the 38.2% Fibonacci level at 1.1538. A consolidation above the resistance level of 1.1649–1.1680 will increase the likelihood of continued growth toward the next correction level of 0.0% at 1.1829. No emerging divergences are observed today on any indicator.

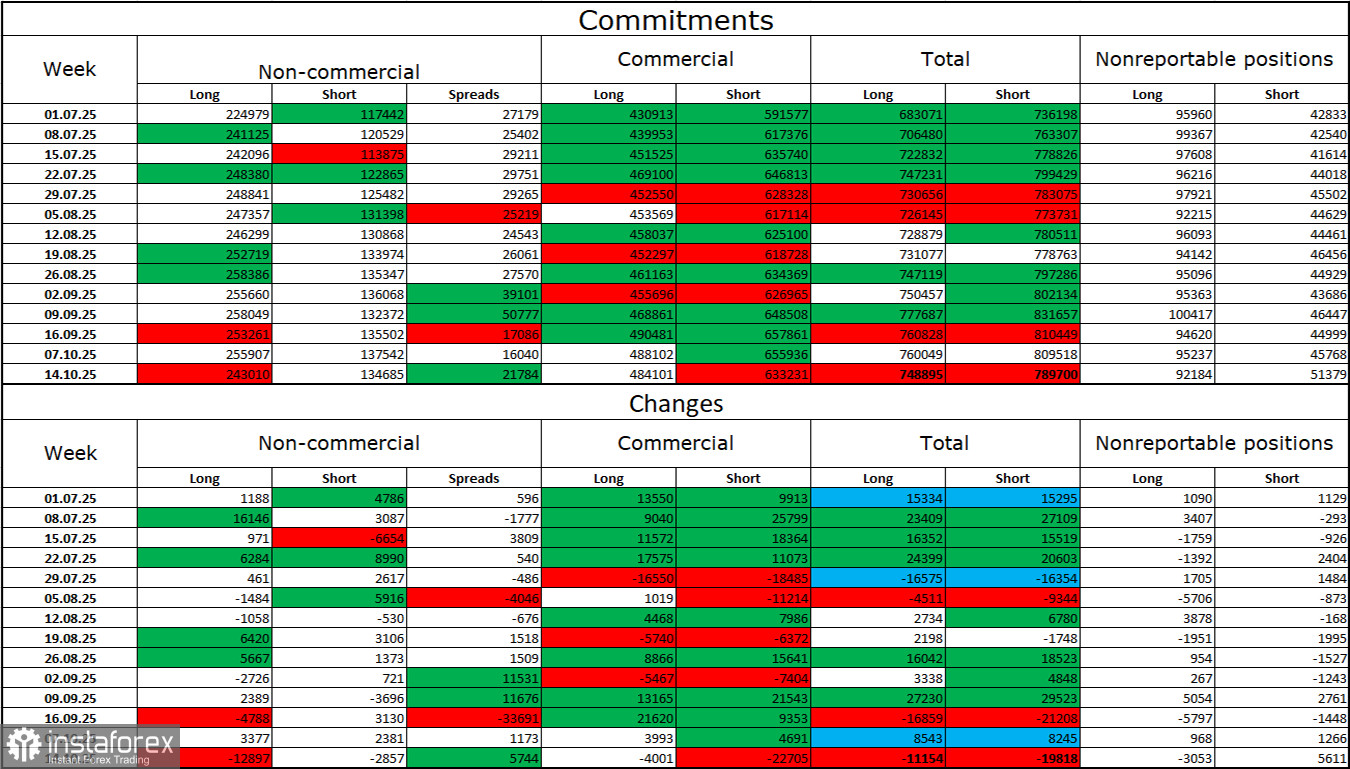

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 12,897 long positions and 2,857 short positions. The COT reports resumed after the shutdown, but for now only outdated data (from October) are being published. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators is now 243,000, while short positions total 135,000.

For thirty-three consecutive weeks, large players have been reducing short positions and increasing long positions. Donald Trump's policies remain the most influential factor for traders, as they may cause numerous long-term structural problems for the U.S. Despite the signing of several important trade agreements, many key economic indicators are falling, and the dollar is losing its status as the "world reserve currency."

News Calendar for the U.S. and the European Union:

European Union – Consumer Price Index (10:00 UTC) European Union – Unemployment Rate (10:00 UTC)

On December 2, the economic calendar contains two noteworthy entries. The influence of the news background on market sentiment on Tuesday will be moderate and mainly in the first half of the day.

EUR/USD Forecast and Trading Recommendations:

Selling the pair was possible on a rebound from the 1.1645–1.1656 level on the hourly chart, targeting 1.1594–1.1607. The target has been reached. New sells — upon a close below 1.1594–1.1607, targeting 1.1517. Buying can be considered today on a rebound from 1.1594–1.1607, targeting 1.1645–1.1656.

The Fibonacci grids are constructed from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.