Analysis of Tuesday's Trades:

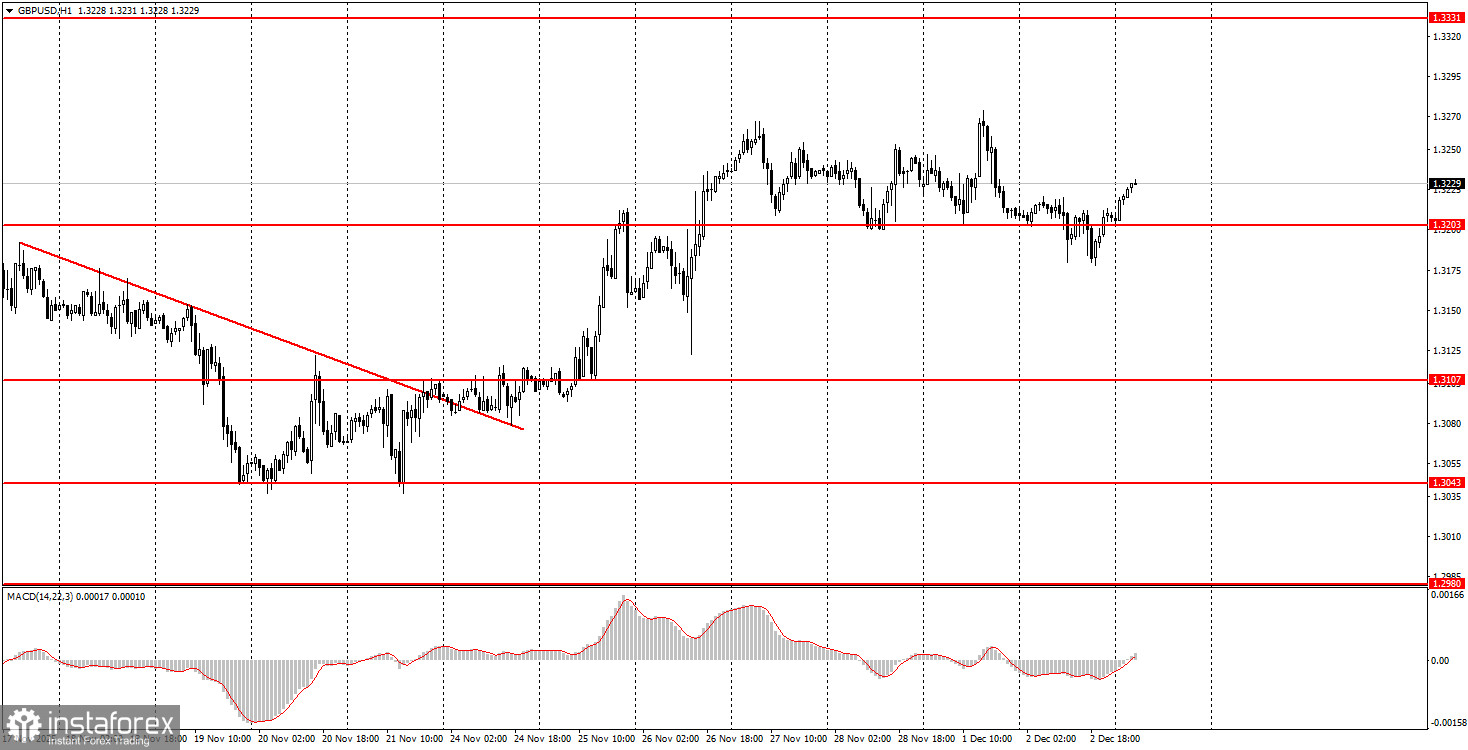

1H Chart for GBP/USD

The GBP/USD pair traded "as if at a wake" on Tuesday. First, we witnessed another decline in the currency pair, with no clear reasons apparent. Secondly, the market effectively ignored the technical level of 1.3203, which had previously provided support twice. Thirdly, there is a possibility of forming a local range. Fourthly, the pair's volatility was 43 pips. Under these conditions, trading could not have been better. Nevertheless, with considerable effort, the British pound is still maintaining an upward trend. Thus, continued growth can be anticipated. However, this is unlikely to be rapid growth that enables easy, profitable trading. Instead, it will likely be a slow, "grinding" movement that ignores the macroeconomic backdrop entirely.

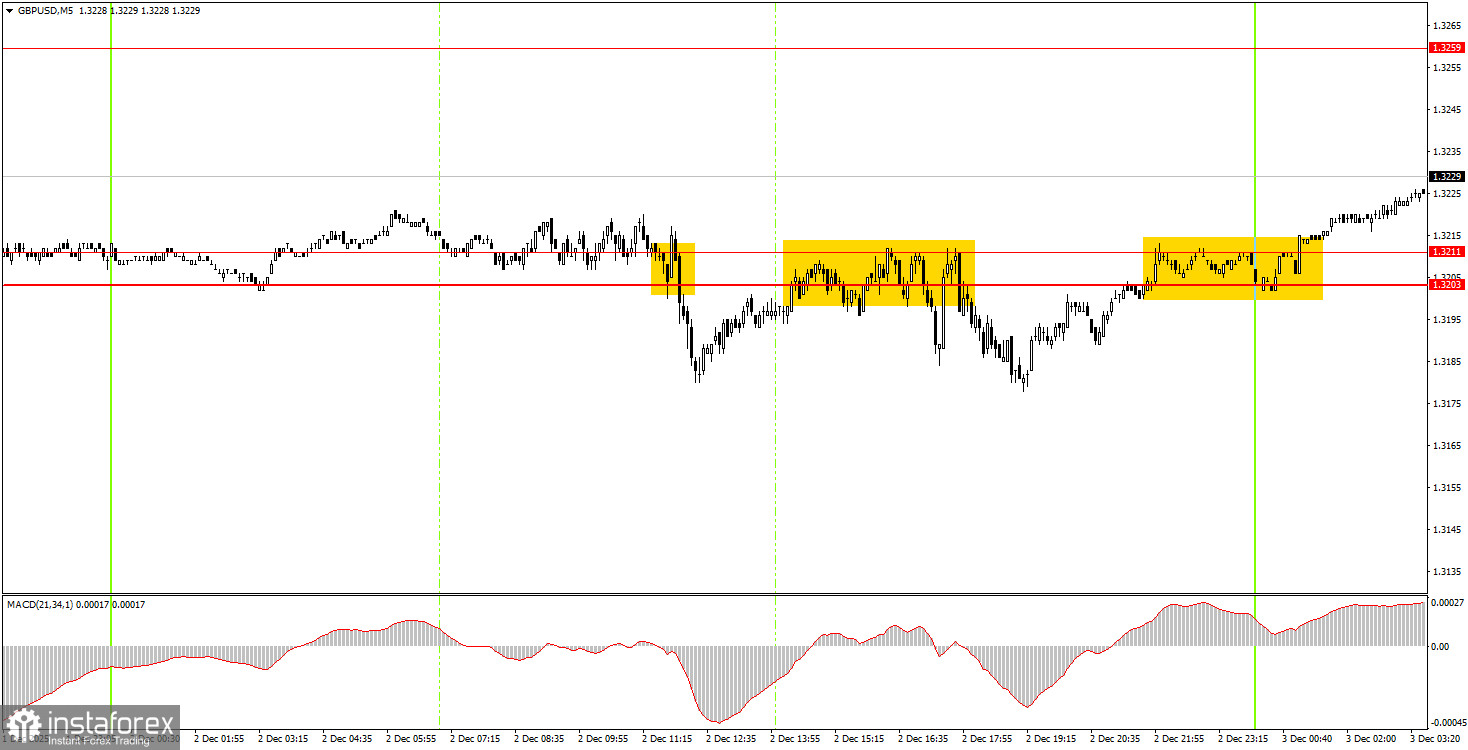

5M Chart for GBP/USD

On the 5-minute timeframe, several trading signals were formed yesterday, but with an overall volatility of 43 pips, it was clear that making a profit from any signal was quite difficult. The price generated two sell signals in the 1.3203-1.3211 area, and a third buy signal emerged late last night. In both instances of sell signals, the price only dropped 15 pips, which was insufficient to set a stop-loss to breakeven. However, there shouldn't have been any losses on the short positions if beginner traders had closed their positions before the evening, as it was clear by then that no significant market movements would occur.

How to Trade on Wednesday:

On the hourly timeframe, the GBP/USD pair continues to form a local upward trend but has become stuck in yet another range. As mentioned, no global factors are driving a sustained rise in the dollar, so in the medium term, we expect movements only to the upside. The correction/range on the daily timeframe may not yet be complete, but any local trend on the hourly timeframe potentially signifies the resumption of the global trend.

On Wednesday, beginner traders can expect new trading signals to form in the 1.3203-1.3211 area, which can now be considered the lower boundary of the range on the hourly timeframe. A bounce from this area will allow for long positions targeting 1.3259. A consolidation below this level will warrant short positions targeting 1.3096-1.3107.

On the 5-minute timeframe, trading can currently focus on the levels: 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Wednesday, there are no significant reports or fundamental events scheduled in the UK, while the U.S. will release several important reports, including the ISM Services Activity Index, the ADP report, and industrial production data.

Key Rules of the Trading System:

- The strength of a signal is assessed by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near any level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can create numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades are opened during the period between the start of the European session and the middle of the American session, after which all trades must be closed manually.

- On the hourly timeframe, when trading based on signals from the MACD indicator, it is preferable to trade only when good volatility is present, and a trend is confirmed by a trend line or channel.

- If two levels are positioned too closely to each other (5 to 20 points), they should be viewed as a support or resistance area.

- After moving 20 pips in the right direction, set the Stop Loss to breakeven.

Chart Explanation:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction for trading.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.