Buyers of the euro and the pound have made their presence felt after yesterday's good corrections against the U.S. dollar, fueling expectations of continued bullishness in risk assets.

Positive data on the increase in the Economic Optimism Index in the U.S. from RCM/TIPP led to a temporary strengthening of the dollar, but the market subsequently reversed. The initial surge, fueled by hopes of sustainable economic growth in the U.S., proved short-lived. Traders quickly reassessed the situation, focusing on the increased odds of a Federal Reserve rate cut next week, which again weakened the dollar's position. Given that the short-term upward momentum of the dollar was swiftly countered by broader macroeconomic trends and shifts in investor risk appetite, we can expect the euro, pound, and other risk assets to continue to rise.

Today, in the first half of the day, everything will depend on the data regarding the Services PMI, the composite PMI, and the Producer Price Index (PPI) in the Eurozone. Additionally, European Central Bank President Christine Lagarde will be delivering a speech today. Similar reports on the services sector will also be published for the UK.

A close examination of macroeconomic indicators will allow traders to assess the resilience of economies' recoveries after recent shocks. The Services PMI, in particular, will provide information about the state of a key sector that constitutes a significant part of both the European and British GDP. The composite PMI, on the other hand, will aggregate data across all sectors of the economy, offering a more comprehensive picture of the economic climate.

The Eurozone's PPI also deserves focused attention, as it may signal inflationary pressures in the manufacturing sector. An increase in PPI could foreshadow further increases in consumer prices, which would affect the ECB's monetary policy decisions.

Christine Lagarde's speech is anticipated to be the key event of the day. Traders will closely monitor her comments regarding the current economic situation, growth prospects, inflation, and signals about the ECB's future actions.

Equally important will be the speech by Bank of England Monetary Policy Committee member Catherine L. Mann. Given the current economic situation, characterized by high inflation and risks to the UK economy, traders will carefully analyze her comments on the prospects for monetary policy. Any hints at potential interest rate cuts could have a significant impact on the British pound.

If the data aligns with economists' expectations, it is advisable to employ a Mean Reversion strategy. If the data is significantly above or below economists' expectations, a Momentum strategy should be used.

Momentum Strategy (Breakout):

For EUR/USD

- Buy on a breakout of the level 1.1651, which could lead to the euro rising to around 1.1678 and 1.1703.

- Sell on a breakout of the level 1.1623, which could lead to the euro falling to around 1.1591 and 1.1558.

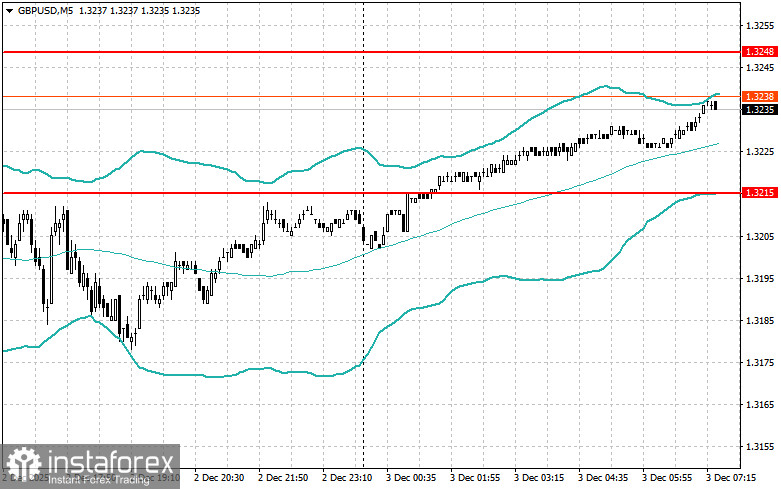

For GBP/USD

- Buy on a breakout of the level 1.3250, which could lead to the pound rising to around 1.3272 and 1.3300.

- Sell on a breakout of the level 1.3226, which could lead to the pound falling to around 1.3203 and 1.3177.

For USD/JPY

- Buy on a breakout of the level 155.75, which could lead to the dollar rising to around 156.12 and 156.55.

- Sell on a breakout of the level 155.40, which could lead to the dollar declining to around 155.08 and 154.77.

Mean Reversion Strategy (Return):

For EUR/USD

- Look for sales after a failed breakout above 1.1654 on a return below this level.

- Look for buys after a failed breakout above 1.1628 on a return to this level.

For GBP/USD

- Look for sales after a failed breakout above 1.3248 on a return below this level.

- Look for buys after a failed breakout above 1.3215 on a return to this level.

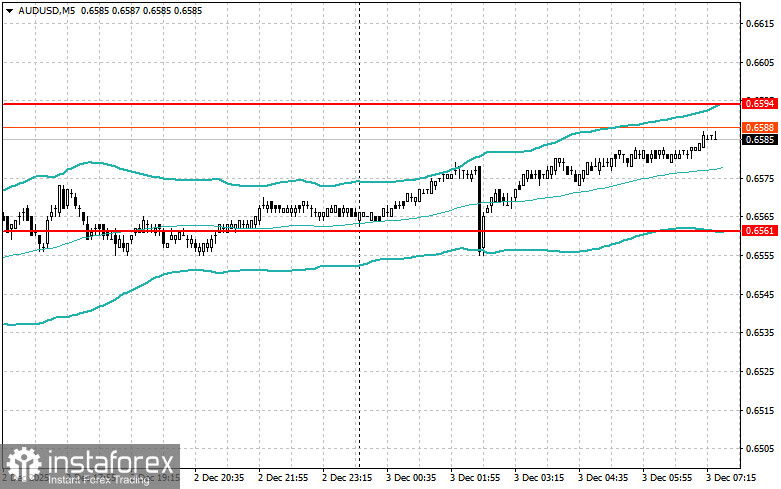

For AUD/USD

- Look for sales after a failed breakout above 0.6594 on a return below this level.

- Look for buys after a failed breakout above 0.6561 on a return to this level.

For USD/CAD

- Look for sales after a failed breakout above 1.3983 on a return below this level.

- Look for buys after a failed breakout above 1.3961 on a return to this level.