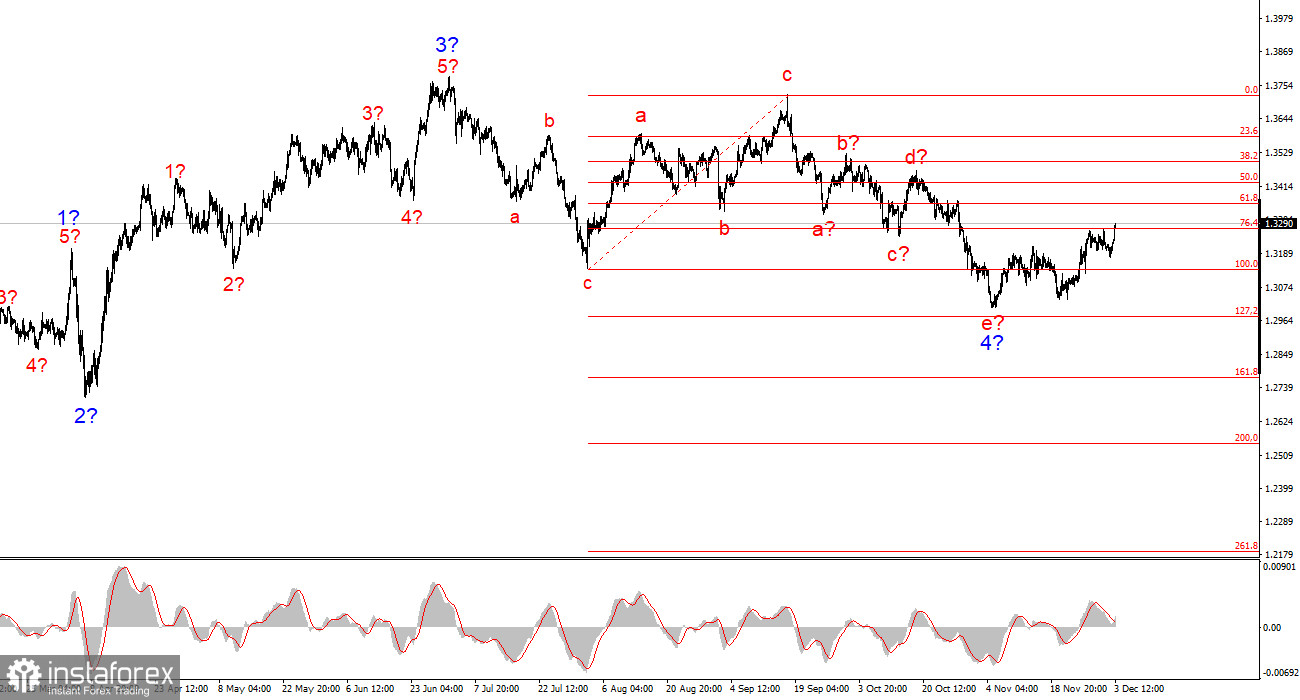

For GBP/USD, the wave pattern continues to indicate the construction of an upward trend segment (bottom chart), but over the past few weeks it has taken on a complex and extended form (top chart). The trend segment that began on July 1 can be considered wave 4—or any global corrective wave—since it has a corrective rather than impulsive internal wave structure. The same applies to its internal subwaves. Therefore, despite the prolonged decline of the pound, I believe that the upward trend remains intact.

The downward wave structure that began on September 17 has formed a five-wave pattern a-b-c-d-e and should now be completed. If this is really the case, then the pair is currently in the stage of building a new upward wave sequence.

Of course, any wave structure can become more complicated at any moment and take on a more extended form. Even the presumed wave 4, which has been forming for almost five months, may turn into a five-wave pattern, in which case we would observe a correction for several more months. However, at the moment, there is every chance that an upward wave sequence is being formed. If this is the case, the first two waves of this segment have already been built, and we are now observing the formation of wave 3 or c.

The GBP/USD pair rose by 90 basis points during the first half of Wednesday, and such movement requires detailed analysis, as nothing similar has been seen in recent weeks or even months. It may seem that demand for the British currency surged due to news flow. But at the moment, only one report has been released—the final November Services PMI for the UK, which differed very little from the preliminary reading. The pound began to rise at night and had already gained about 30 points by the opening of the European trading session. The Services PMI was released at 09:30 UTC, and by that time GBP/USD had already gained about 50 points. Hence, it is clear to me that the British report has nothing to do with this movement.

So what does? Just yesterday Donald Trump announced that he had chosen a new Fed Chair. He did not name the person, but the media are confident that it is Kevin Hassett, Trump's current economic advisor. To be honest, I don't quite understand why the market would have been waiting for this information to resume selling the dollar. Was it not already obvious earlier that the new FOMC chair would, in any case, be Trump's pick? And that he would support aggressive monetary policy easing? However, what exactly triggered the market is not especially important. What matters is that the wave pattern is working, and the pound is rising.

General Conclusions

General Conclusions

The wave pattern of the GBP/USD pair has changed. We are still dealing with an upward impulsive trend segment, but its internal wave structure has become more complex. The downward corrective structure a-b-c-d-e in wave c of 4 appears to be fully completed. If this is indeed the case, I expect the main trend segment to resume with initial targets around the 1.38 and 1.40 levels. In the short term, one can expect the formation of wave 3 or c with targets around 1.3280 and 1.3360, which correspond to the 76.4% and 61.8% Fibonacci levels. These are the minimum targets in case the market decides to make the global wave 4 even more complex.

The larger-scale wave pattern looks nearly perfect, even though wave 4 exceeded the peak of wave 1. However, I remind you that perfect wave patterns exist only in textbooks. In practice, everything is much more complicated. At the moment, I see no reason to consider alternative scenarios to the upward trend segment.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in what is happening in the market, it is better to stay out.

- There can never be 100% certainty in market direction. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.