Analysis of Macroeconomic Reports:

There are relatively few macroeconomic reports scheduled for Thursday, and none of them are considered important. In the UK, the construction sector's business activity index will be published. In the Eurozone, retail sales data will be released. In the U.S., initial jobless claims will be announced. We believe even novice traders understand that these data are unlikely to provoke a strong market reaction. All the most significant reports have already been published this week. The ISM business activity indices for the U.S. manufacturing and services sectors showed mixed dynamics, while the most important ADP report on private-sector employment change fell short of expectations for November. Thus, it is likely that the Federal Reserve will lower the key rate for the third time in 2025 next week, which represents another factor contributing to the dollar's decline.

Analysis of Fundamental Events:

General Conclusions:

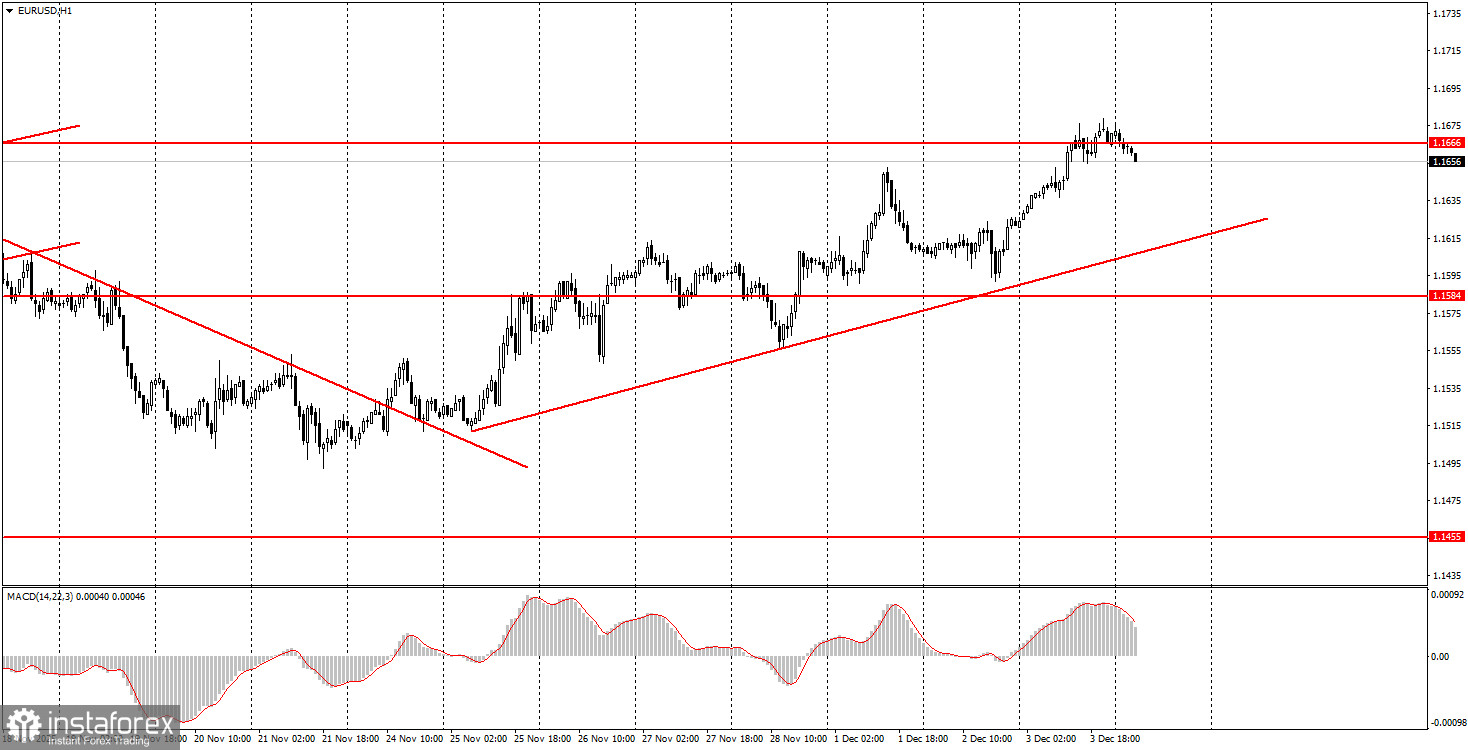

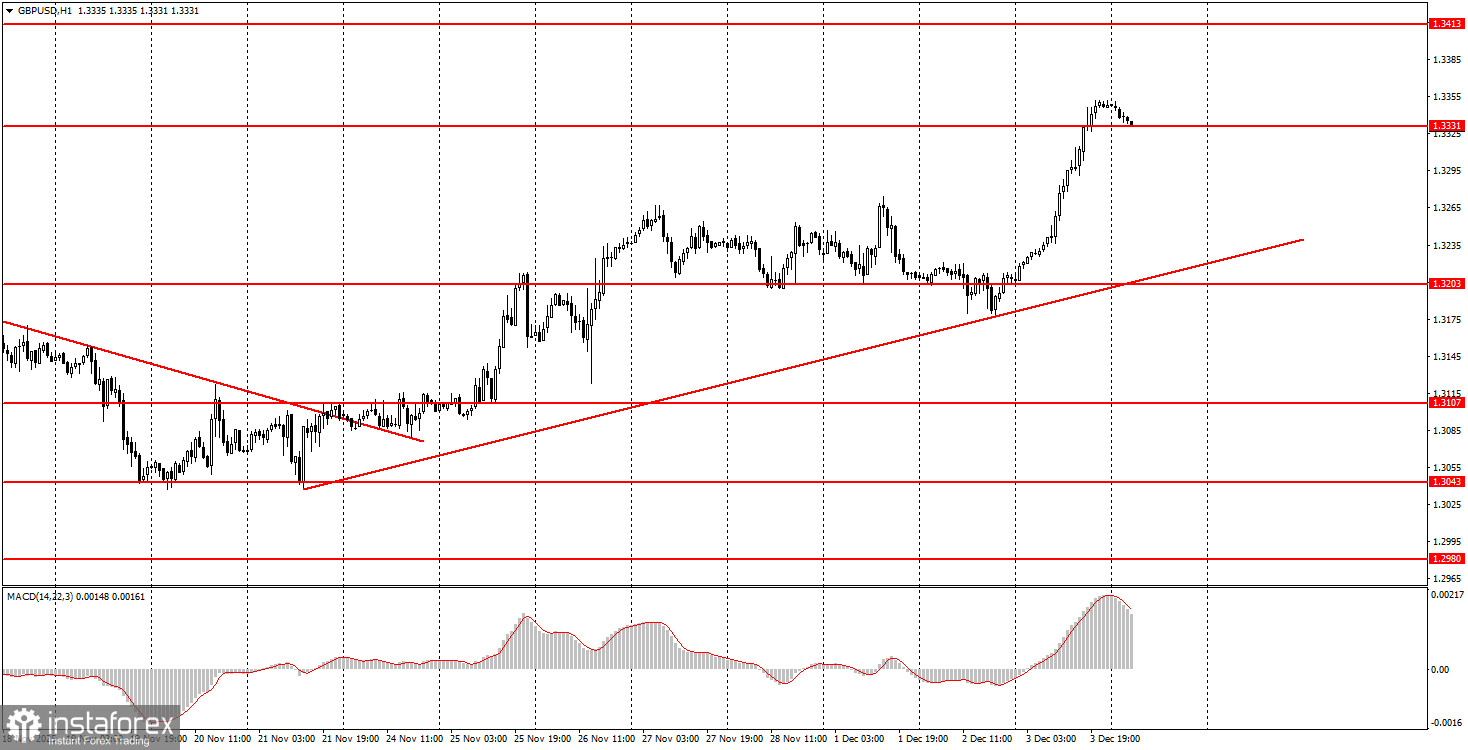

During the penultimate trading day of the week, both currency pairs are likely to trend upwards, as upward trends continue to form in both cases. The euro has a good trading area at 1.1655-1.1666, while the British pound has a zone at 1.3329-1.3331. Volatility on Thursday may be low, as no significant events are scheduled for today.

Key Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can form a multitude of false signals or none at all. At the first signs of a flat, it is better to stop trading.

- Trades are opened during the time between the start of the European session and mid-American session, after which all trades should be closed manually.

- On the hourly timeframe, using signals from the MACD indicator, it is preferable to trade only when good volatility exists, and a trend is confirmed by a trend line or channel.

- If two levels are too close to each other (5 to 20 pips), they should be viewed as an area of support or resistance.

- After moving 15-20 pips in the right direction, a Stop Loss should be set to breakeven.

Chart Explanations:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction to trade.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.