Bitcoin and Ethereum maintained their positions yesterday, preserving the potential for further recovery following the active sell-off observed on the first day of December this year.

Ethereum received additional support from major market players after the news that the Fusaka update had been activated on the Ethereum mainnet. This new upgrade aims to enhance the scalability, efficiency, and security of the network.

The changes are expected to significantly increase the network's throughput and reduce transaction fees, making Ethereum more attractive to a broad range of users and developers. The implementation of Fusaka has positively impacted investor sentiment and strengthened confidence in Ethereum's long-term potential. Following the update activation, an increase in trading activity and heightened trading volumes for Ethereum on major exchanges were noted. Some experts suggest this could be the beginning of a new upward trend for the cryptocurrency. However, not everyone shares these optimistic forecasts. Some caution against excessive enthusiasm, indicating that the real benefits of the Fusaka implementation will only become apparent over time. Additionally, the entire cryptocurrency market is currently experiencing challenging times.

Despite this, Fusaka represents an important milestone in Ethereum's development and reinforces its position as a leading platform for decentralized applications and smart contracts. The update opens up new opportunities for developers and stimulates further growth in the Ethereum ecosystem.

Overall, the activation of Fusaka is a positive signal for the cryptocurrency market, indicating that projects continue to evolve and enhance their technologies. This inspires confidence in the future of DeFi and other blockchain applications based on Ethereum.

Trading recommendations:

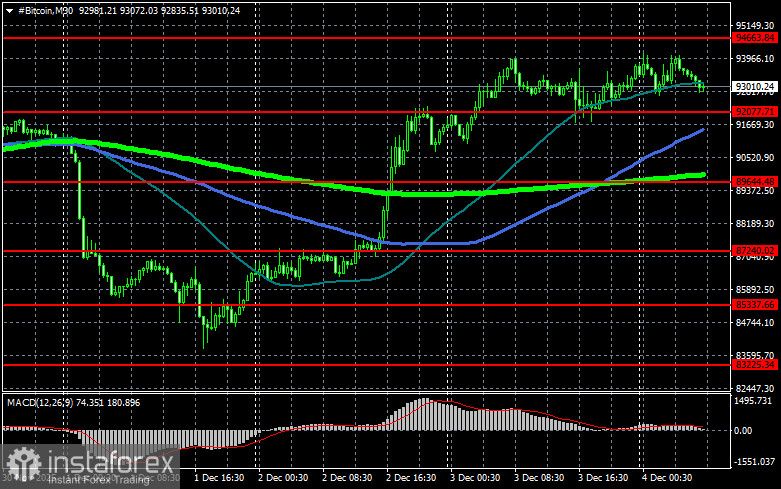

Regarding the technical picture for Bitcoin, buyers are currently focused on reclaiming the $94,600 level, which opens a direct path to $97,300, and it is just a stone's throw away from the $99,400 level. The ultimate target is the peak around $102,300, and surpassing this level would signal an attempt to return to a bull market. Should Bitcoin fall, buyers are expected at the $92,000 level. A return of the trading instrument below this area could swiftly drop BTC to the vicinity of $89,600, with the farthest target being around $87,200.

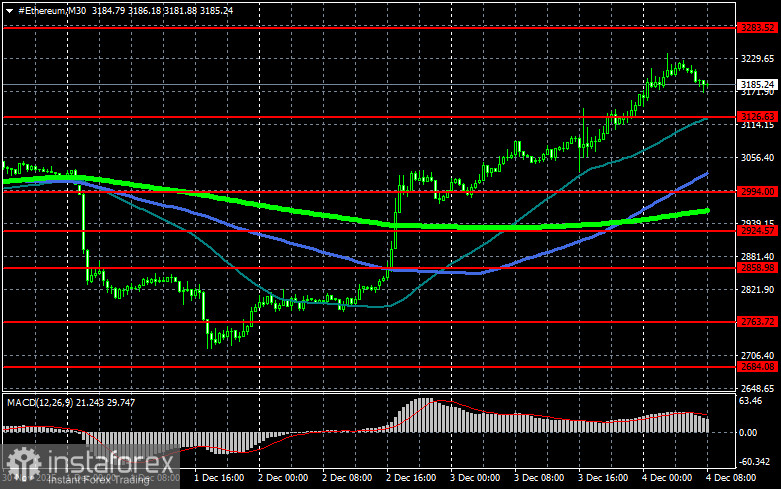

As for Ethereum's technical picture, a clear consolidation above the $3,283 level opens a direct path to $3,474. The ultimate target is the peak around $3,664, and overcoming this would indicate a strengthening of bullish market sentiment and renewed buyer interest. If Ethereum falls, buyers are anticipated at the $3,126 level. A return of the trading instrument below this area could quickly push ETH to the vicinity of $2,994, with the farthest target being around $2,924.

What we see on the chart:

- Red lines indicate support and resistance levels where either a price slowdown or active growth is expected;

- Green lines indicate the 50-day moving average;

- Blue lines indicate the 100-day moving average;

- Light green lines indicate the 200-day moving average.

Typically, a crossover or price test of these moving averages either halts market momentum or sets a new directional impulse.