Bitcoin is making every effort to break above the $94,000 level, but each time it encounters some difficulties during its rise. However, considering that each dip is actively bought up, there are chances for further development of a bull market. Ethereum is also trading steadily above $3,100, which allows for further growth projections.

Meanwhile, according to data from Cryptoquant, most on-chain indicators for BTC are bearish. The company believes that without new positive macroeconomic indicators, a gradual entry of the market into a bear cycle can be expected. A similar viewpoint is shared by Glassnode, noting a decline in wallet activity and a decrease in transaction volume on the Bitcoin network. This indicates a waning interest in cryptocurrency from both retail and institutional investors. The drop in trading volumes on popular crypto exchanges also points to reduced market liquidity and increased volatility, which in turn discourages potentially new participants.

Nonetheless, given the high interest in the market, it is unlikely that even bear phases will be as prolonged and deep as they were in the past. They can be seen as an opportunity to enter the market at more attractive prices, but with the condition that you keep an eye on risks and do not over-leverage.

As for the intraday strategy in the cryptocurrency market, I will proceed by relying on any major dips in Bitcoin and Ethereum in anticipation of continued growth in the bull market over the medium term, which is still very much alive.

Bitcoin

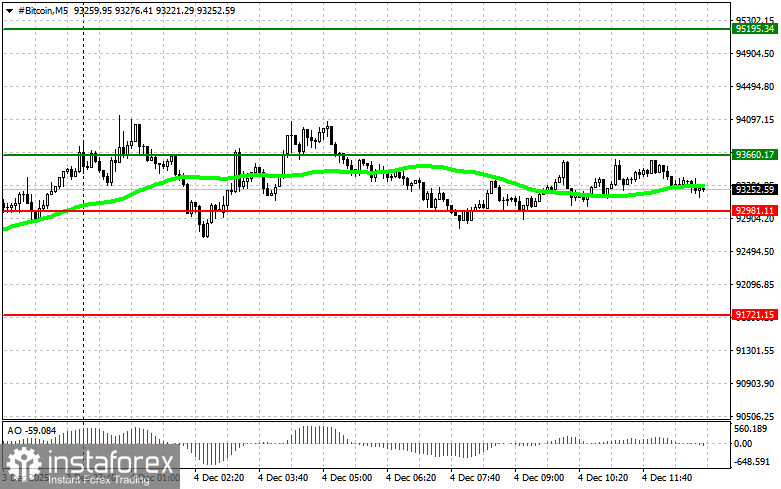

Buy scenario Scenario #1: I will buy Bitcoin today when it reaches an entry point around $93,600 with a target rise to $95,200. Near $95,200, I will exit my buy positions and sell immediately during a rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone. Scenario #2: I can buy Bitcoin from the lower border at $92,800 if there is no market reaction to its breakout downward toward the levels of $93,600 and $95,200.

Sell scenario Scenario #1: I will sell Bitcoin today as soon as it reaches an entry point around $92,900 with a target drop to $91,700. Near $91,700, I will exit my sell positions and buy immediately during a dip. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone. Scenario #2: I can sell Bitcoin from the upper border at $93,600 if there is no market reaction to its breakout downward toward the levels of $92,900 and $91,700.

Ethereum

Buy scenario Scenario #1: I will buy Ethereum today upon reaching an entry point around $3,210 with a target rise to $3,293. Near $3,293, I will exit my buy positions and sell immediately during a rebound. Before buying on a breakout, I need to ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone. Scenario #2: I can buy Ethereum from the lower border at $3,165 if there is no market reaction to its breakout downward toward the levels of $3,210 and $3,293.

Sell scenario Scenario #1: I will sell Ethereum today upon reaching an entry point around $3,165 with a target drop to $3,095. Near $3,095, I will exit my sell positions and buy immediately during a dip. Before selling on a breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome oscillator is in the negative zone. Scenario #2: I can sell Ethereum from the upper border at $3,210 if there is no market reaction to its breakout downward toward the levels of $3,165 and $3,095.