Trade Analysis and Advice on Trading the European Currency

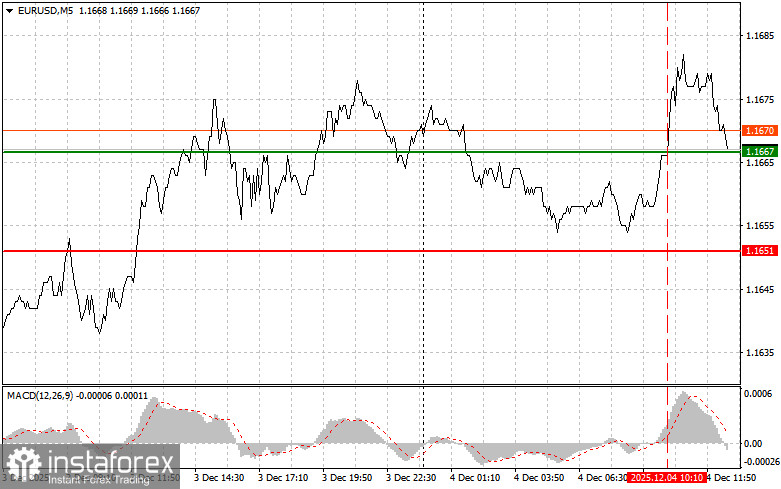

The test of the 1.1667 price level occurred at a moment when the MACD indicator had already moved far above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

Eurozone retail sales data matched economists' forecasts, showing zero growth in October. A more detailed analysis revealed that a decline in non-food and motor fuel sales was offset by increased demand for food, beverages, and tobacco products. This indicates a shift in consumer preferences toward essential goods, likely due to concerns about rising inflation.

Zero growth demonstrates a certain instability in consumer demand. Even under conditions of normal inflation and falling interest rates, consumer spending did not increase significantly, raising certain questions. This fully explains why the euro did not react to the published data.

Next, traders will closely watch U.S. labor market data, as it may shed light on the current condition of the market and, consequently, on potential further steps by the Federal Reserve regarding interest rates. Persistently high jobless claims and an increase in job cuts may indicate that the labor market remains weak, which could push the Fed toward cutting interest rates. Michelle Bowman's speech will also be of interest, as it may shed light on the ongoing discussions within the FOMC regarding inflation and economic growth. However, since the Fed meeting is less than a week away, it is unlikely that Bowman will comment on anything significant.

As for the intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Buy Signal

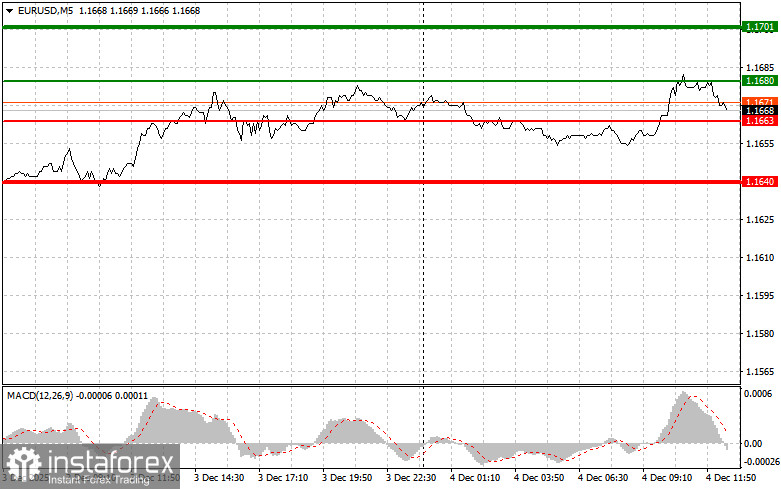

Scenario No. 1: Today, buying the euro is possible when the price reaches the 1.1680 level (green line on the chart) with a target of rising to 1.1701. At 1.1701, I plan to exit the market and also open a sell position in the opposite direction, expecting a 30–35-point move from the entry point. You can count on strong euro growth after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to rise from it.

Scenario No. 2: I also intend to buy the euro today in the case of two consecutive tests of the 1.1663 price level at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth to 1.1680 and 1.1701 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after it reaches the 1.1663 level (red line on the chart). The target will be 1.1640, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25-point move in the opposite direction). Pressure on the pair will return today if the statistics are positive. Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to decline from it.

Scenario No. 2: I also intend to sell the euro today in the case of two consecutive tests of the 1.1680 price level at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline to 1.1663 and 1.1640 can be expected.

What's on the Chart:

- Thin green line – entry price at which the instrument can be bought.

- Thick green line – projected price level for placing Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin red line – entry price at which the instrument can be sold.

- Thick red line – projected price level for placing Take Profit or manually fixing profits, as further decline below this level is unlikely.

- MACD indicator – It is important to rely on overbought and oversold zones when entering the market.

Important. Beginner Forex traders must make entry decisions very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you may quickly lose your entire deposit, especially if you neglect money management and trade large volumes.

And remember, successful trading requires having a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.