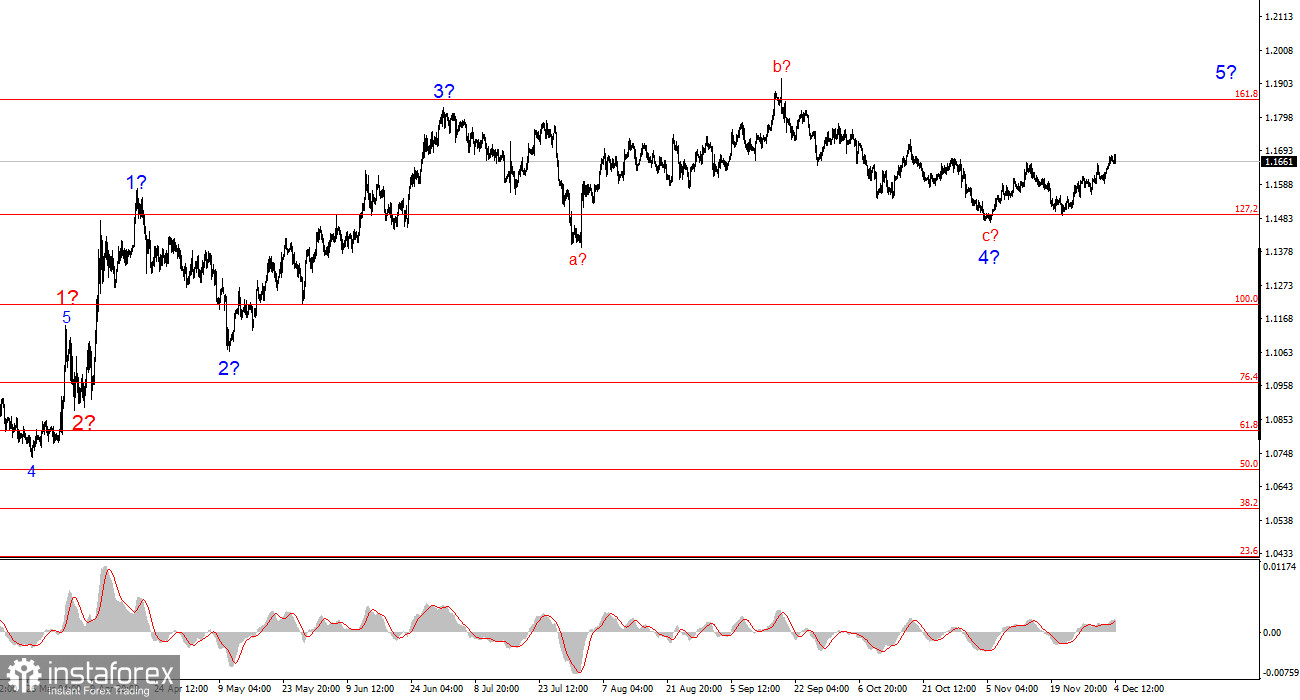

The wave structure on the 4-hour EUR/USD chart has shifted but remains quite understandable overall. There is no talk of canceling the upward trend that began in January 2025, but the wave structure has become significantly more complex and extended since July 1. In my view, the instrument has completed the formation of corrective wave 4, which took on a very unconventional form. Within this wave we observe exclusively corrective patterns, so there is no doubt about the corrective nature of the decline.

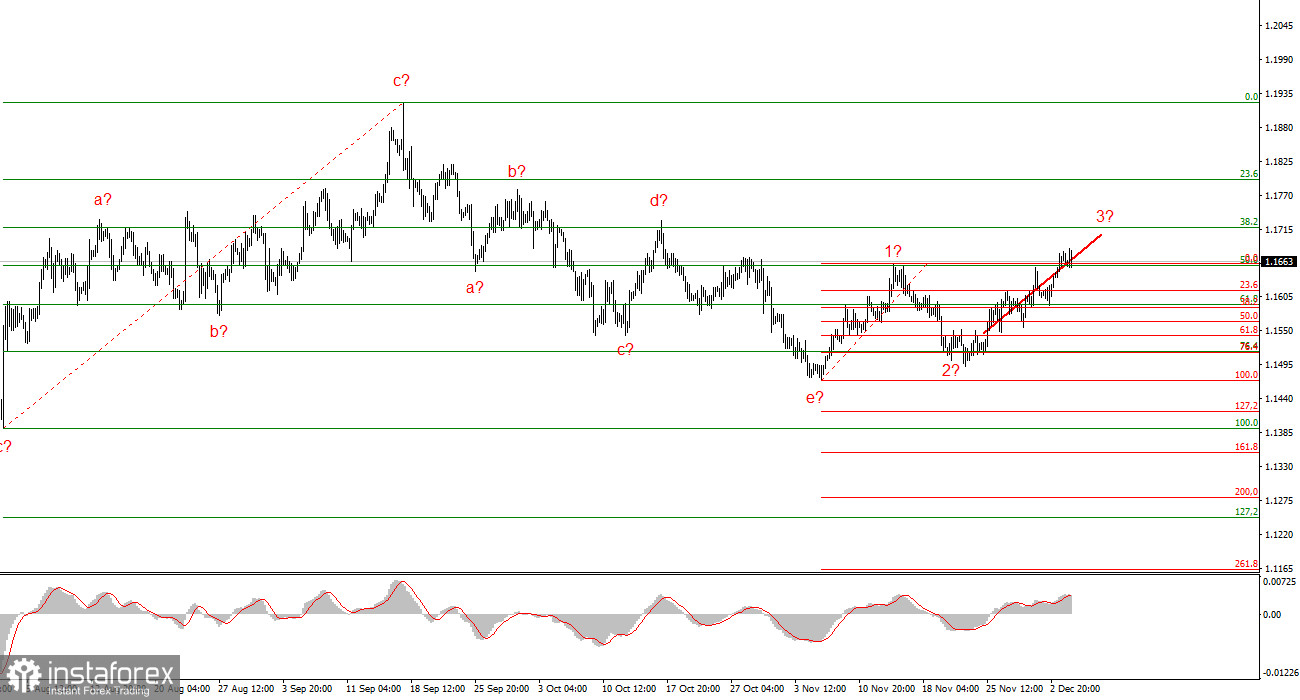

In my opinion, the formation of the upward trend segment is not yet complete, and its targets extend all the way up to the 1.25 level. The a-b-c-d-e series appears complete; therefore, in the coming weeks I expect the formation of a new upward wave sequence. We have seen the presumed waves 1 and 2, and the instrument is now forming wave 3 or c. I expect that within this wave the instrument will rise at least to 1.1717, which corresponds to the 38.2% Fibonacci level. I also do not rule out a scenario in which the upward wave sequence takes on a five-wave structure.

The EUR/USD exchange rate barely changed on Thursday but maintained a bullish mood. Let me remind you that this week saw at least four important economic indicators released for the U.S. and the Eurozone. In Europe, November inflation came out slightly above market expectations. However, the 2.2% annual reading places no pressure on the ECB's monetary policy stance. More important reports came from the U.S., including ISM Manufacturing and Services PMIs. Manufacturing came in below expectations, while services came in above them—overall a neutral outcome.

But the ADP report cannot be called "neutral" under any circumstances. Despite minimal market expectations (only +5–10 thousand new jobs), even those were not met. The U.S. labor market lost 32,000 jobs. While this figure may not be entirely precise—ADP does not account for some sectors—the private sector did lose that number of employees. Moreover, this reflects the sum of hiring, firing, and layoffs. In other words, businesses may have been actively hiring but experienced even more layoffs. Businesses may not have implemented targeted reductions, but workers could have quit on their own.

This report indicates that the labor market continues to cool, and the Federal Reserve will have to cut interest rates next week for the third time in a row, without waiting for the release of Nonfarm Payrolls and the unemployment rate. Demand for the currency is falling this week, which fully aligns with the current wave picture and my expectations. However, I note that the nature of the current rise is clearly not impulsive. Therefore, what we are seeing now is the formation of another corrective structure.

General conclusions

Based on my analysis of EUR/USD, I conclude that the instrument continues to form an upward trend segment. Over the last few months, the market has taken a pause, but the policies of Donald Trump and the Federal Reserve remain significant factors that could weaken the U.S. dollar in the future. The targets of the current trend segment may extend up to the 1.25 level. For now, the upward wave sequence may continue to form. I expect that from current levels, the formation of the third wave of this sequence will continue, which may be either wave c or wave 3. At the moment, I remain in long positions, with targets in the 1.1670–1.1720 level.

On the smaller scale, the entire upward trend segment is visible. The wave structure is not the most standard, as the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this can happen. Let me remind you that it is best to identify clear structures on charts rather than trying to label every single wave. Right now, the bullish structure raises no doubts.

Key principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to revisions.

- If you are not confident about what is happening in the market, it is better not to enter it.

- Absolute certainty about market direction does not exist and never will. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.