On Wednesday, the ADP report was released in the U.S., which I consider critically important for the American currency. At the beginning of the week, there was significant uncertainty about U.S. economic data. Even on Monday, market participants did not know exactly when the next Nonfarm Payrolls report, crucial to the Federal Reserve, would be released. There were also contradictions in the inflation report, which has the second-strongest impact on the FOMC. Initially, the inflation report was scheduled for December 10—the day of the last Fed meeting of the year. However, closer to mid-week, a new date appeared in the calendars: December 18. At the same time, the next Nonfarm Payrolls report was set for December 16. Given all of the above, it's easy to guess that the FOMC will again be operating in the dark next week.

Only the ADP report could alleviate the U.S. central bank's suffering. It's worth recalling that this report typically attracts little attention among market participants when regular, timely unemployment and Nonfarm Payrolls figures are released. However, it has become increasingly significant now, as there are no other sources of labor market information available. So, what numbers did the ADP report present?

For November, private employers cut their workforce by 32,000 jobs. This figure includes not only layoffs by employers but also employee resignations. The new immigration policy of Donald Trump is leading to mass deportations, cancellations of work visas, and any other documents permitting individuals to live and work in the U.S. Consequently, many are losing their jobs due to the problems associated with the White House's immigration policy.

At the same time, economists had anticipated an increase in the ADP figures by 5,000 to 10,000—far too little to prevent the unemployment rate from rising. Frankly, even an increase of 10,000 jobs is so minimal that it can be considered "negative." The hardest hit were small businesses, those with fewer than 50 employees, which lost 120,000 workers. In contrast, medium and large businesses showed weak but positive growth: up by 51,000 and 39,000, respectively. As we can see, small businesses suffer the most, unable to cope with both the new trade and immigration policies.

While the ADP report is less relevant than the Nonfarm Payrolls, it still allows for certain conclusions to be made. Specifically, the U.S. labor market continues to "cool" despite two rounds of FOMC monetary policy easing. Deterioration in the U.S. labor market threatens to reduce consumer demand, investments, and economic growth rates. Donald Trump, who promised economic revival and significant growth for America, cannot be satisfied with the current situation. This is why he has been calling for a reduction in the Fed's interest rate for almost a year, to levels that would stimulate economic growth. The current situation leaves only one option—to continue lowering the interest rate. However, no one has yet seen the inflation data for October and November. If the consumer price index is rising alongside a declining labor market, it is difficult to predict what the Fed will do.

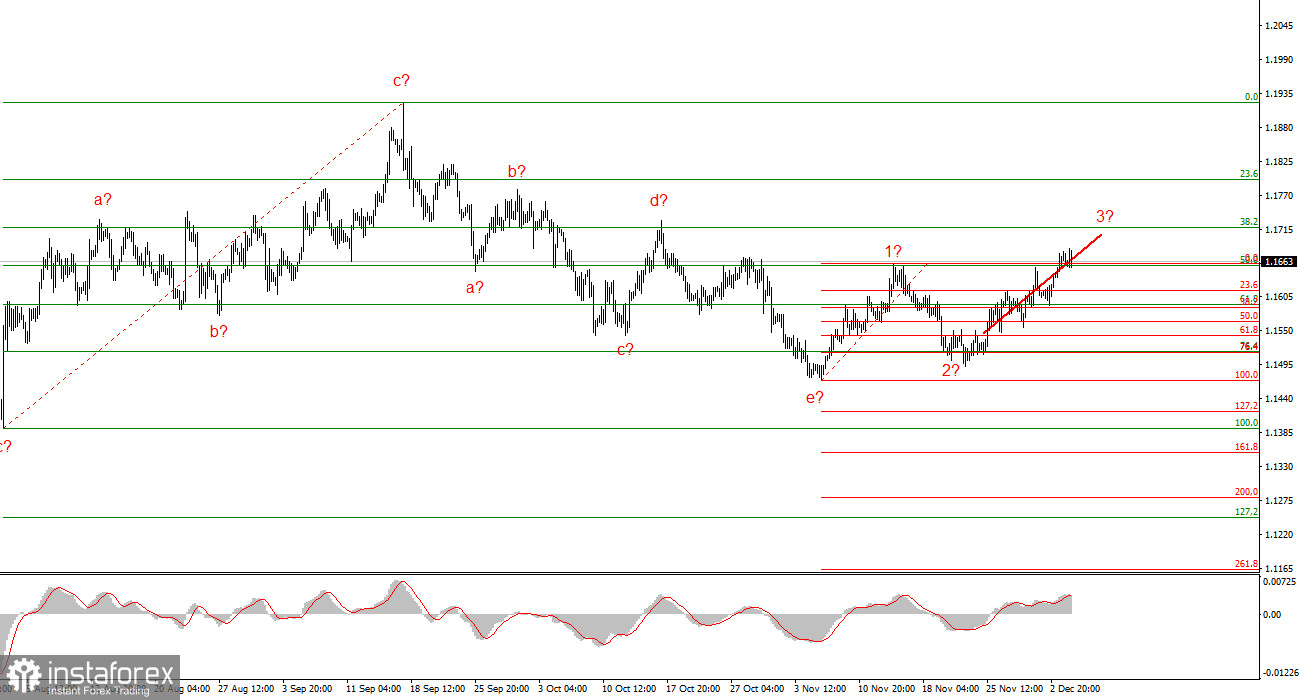

Wave Analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward wave segment. The market has paused in recent months, but the policies of Donald Trump and the Fed remain significant factors in the decline of the American currency in the future. The targets for the current wave segment could extend up to the 25 level. Currently, it may continue to build the upward wave set. I expect that, given the current positions, construction of the third wave of this set will continue, which could be either an impulse or a corrective wave. I remain in long positions with targets in the range of 1.1670 – 1.1720.

Wave Analysis for GBP/USD:

The wave structure of GBP/USD is complex but understandable. We continue to deal with an upward impulsive wave segment, but its internal wave structure has become complex. The descending corrective structure a-b-c-d-e in wave 4 appears to have completed. If this is indeed the case, I expect the main trend segment to resume its formation with initial targets around the 38 and 40 levels. In the short term, I anticipate the construction of wave 3 or wave C, with targets around 1.3280 and 1.3360, which correspond to 76.4% and 61.8% Fibonacci levels. Both targets have already been achieved. The next targets may be around 1.3448 and 1.3552.

Fundamentals of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in market movements, it's better not to enter.

- There can never be 100% certainty about market directions. Remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.