The US dollar regained some positions against the euro and the British pound yesterday, though it fared poorly against the strengthening Japanese yen ahead of the central bank meeting.

Following the news that jobless claims in the US fell to their lowest level in more than three years last week, the dollar gained some momentum. This positive report lifted trader optimism, suggesting resilience in the US labor market. However, the dollar's growth was limited by cautious rhetoric from White House representatives.

Today, important economic reports are expected in the first half of the day, which could significantly impact the euro's exchange rate and the overall economic health of the Eurozone. Specifically, attention will be paid to the Eurozone's GDP figures for the third quarter of this year. Analysts forecast moderate growth; however, any deviations from expectations could provoke volatility in the currency markets. Traders will closely examine the components of GDP, especially the dynamics of consumer spending and investments, to gain a fuller picture of growth prospects.

Alongside the GDP data, reports on employment changes in the Eurozone will also be released. A stable labor market is a key factor supporting consumer spending and overall economic growth. Additionally, important sector reports providing insight into the state of individual European economies will be published. France will release data on changes in industrial production, where an increase signals stronger manufacturing activity and demand for goods. Conversely, a slowdown could indicate issues in the production sector, putting pressure on the euro. Italy is expected to present retail sales reports reflecting similar trends.

As for the pound, Halifax house price index data is expected today in the first half of the day. This index serves as an authoritative indicator of the state of the real estate market. The Halifax index data not only helps assess overall price changes but also reveals regional differences and the factors that influence them. The current UK real estate market is under pressure from high-interest rates, and weak Halifax index results may negatively impact the pound.

If the data aligns with economists' expectations, it is advisable to employ a Mean Reversion strategy. If the figures are significantly above or below expectations, using a Momentum strategy is preferable.

Momentum Strategy (Breakout Strategy):

For the EUR/USD Pair

- Long positions on a breakout above 1.1670 may lead to an increase to the area of 1.1700 and 1.1726.

- A sell on a breakout below 1.1649 may lead to a decline to the area of 1.1623 and 1.1590.

For the GBP/USD Pair

- Longs on a breakout above 1.3350 may lead to an increase to the area of 1.3372 and 1.3400.

- A sell on a breakout below 1.3323 may lead to a decline to the area of 1.3293 and 1.3266.

For the USD/JPY Pair

- Longs on a breakout above 154.75 may lead to an increase to the area of 155.08 and 155.41.

- Shorts on a breakout below 154.48 may lead to a drop to the area of 154.12 and 153.70.

Mean Reversion Strategy (Return Strategy):

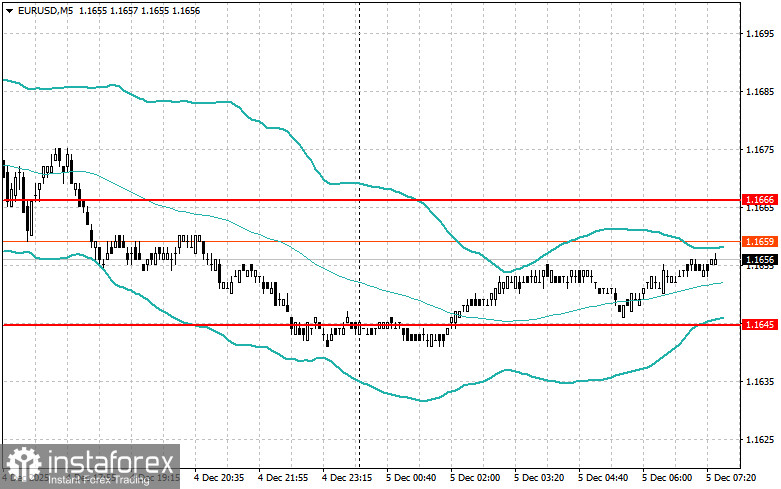

For the EUR/USD Pair

- Look for shorts after a failed breakout above 1.1666 on a return below this level.

- Look for longs after a failed breakout below 1.1645 on a return to this level.

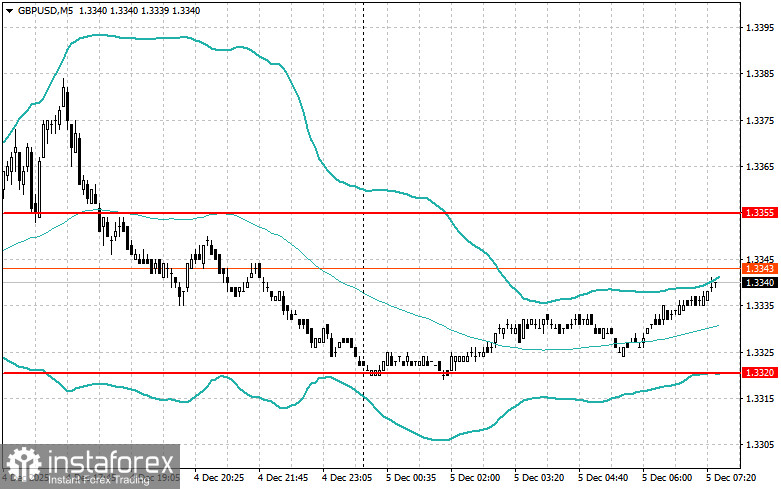

For the GBP/USD Pair

- Look for shorts after a failed breakout above 1.3355 on a return below this level.

- Look for longs after a failed breakout below 1.3320 on a return to this level.

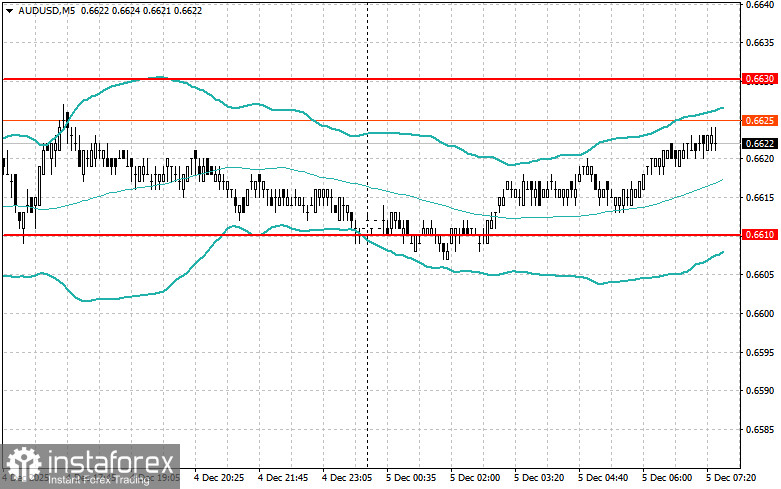

For the AUD/USD Pair

- Look for shorts after a failed breakout above 0.6630 on a return below this level.

- Look for longs after a failed breakout below 0.6610 on a return to this level.

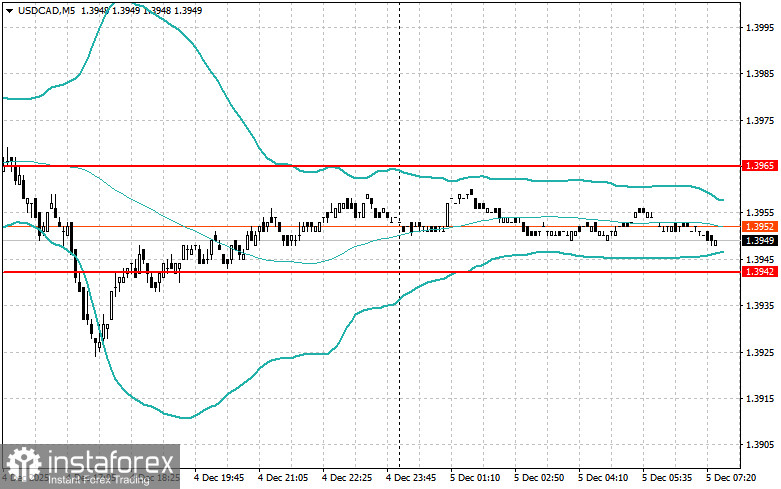

For the USD/CAD Pair

- Look for shorts after a failed breakout above 1.3965 on a return below this level.

- Look for longs after a failed breakout below 1.3942 on a return to this level.