Given the very small spike in volatility in the first half of the day, no valid entry points were formed for the Mean Reversion strategy. Using the Momentum strategy, I traded only the Japanese yen.

The euro and the pound rose in the first half of the day, continuing yesterday's bullish market following the Fed's decision to cut interest rates. However, after the initial spike caused by news from Washington, momentum weakened, and the single currency stabilized near 1.1700 against the U.S. dollar. Since the market had already largely priced in the expected rate cut, new catalysts are needed for further euro appreciation. Nonetheless, despite some consolidation, the overall tone in the currency markets remains positive for risk assets.

Next, the focus will shift to U.S. data on weekly initial jobless claims, the trade balance, and changes in wholesale inventories. Close monitoring of initial jobless claims will help assess the current state of the U.S. labor market. A rise in claims may signal slower hiring and a potential increase in unemployment, which in turn could negatively affect consumer spending, economic growth, and the U.S. dollar, which would continue to fall against risk assets.

The trade balance, reflecting the difference between exports and imports, is an important indicator of the competitiveness of U.S. goods and services on the global market. An expanding U.S. trade deficit would point to reliance on imports and may put pressure on the national currency. The session will conclude with the wholesale inventories report. An increase in inventories may indicate weakening demand and potential production cuts in the future—negative for the economy and for the dollar.

If the statistics are strong, I will rely on the Momentum strategy. If the market shows no reaction to the data, I will continue using the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day

For EURUSD:

- Buying on a breakout of 1.1720 may lead to euro growth toward 1.1750 and 1.1777

- Selling on a breakout of 1.1690 may lead to a decline toward 1.1670 and 1.1650

For GBPUSD:

- Buying on a breakout of 1.3389 may lead to pound growth toward 1.3416 and 1.3440

- Selling on a breakout of 1.3375 may lead to a decline toward 1.3350 and 1.3320

For USDJPY:

- Buying on a breakout of 156.10 may lead to dollar growth toward 156.55 and 156.94

- Selling on a breakout of 155.75 may lead to dollar sell-offs toward 155.40 and 155.05

Mean Reversion Strategy (Reversal) for the Second Half of the Day

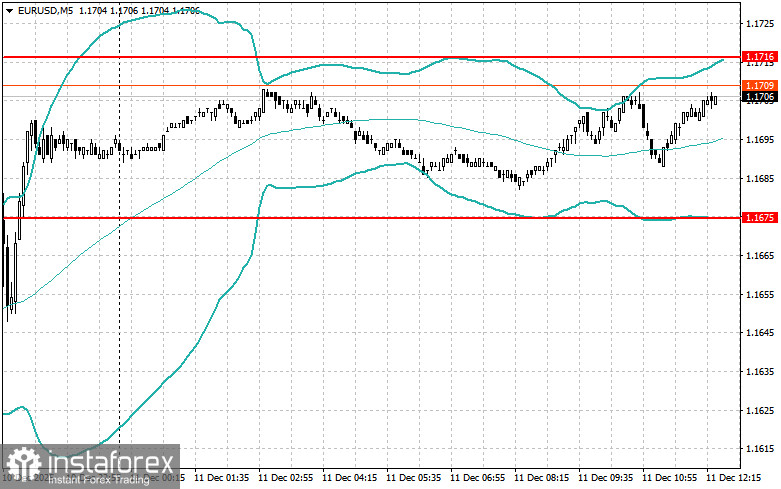

For EURUSD:

- Look for selling opportunities after a failed breakout above 1.1716 with a return below this level

- Look for buying opportunities after a failed breakout below 1.1675 with a return to this level

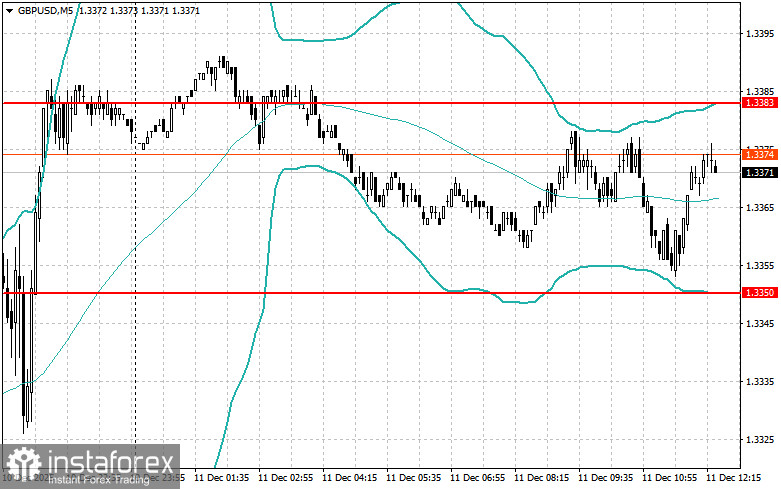

For GBPUSD:

- Look for selling opportunities after a failed breakout above 1.3383 with a return below this level

- Look for buying opportunities after a failed breakout below 1.3350 with a return to this level

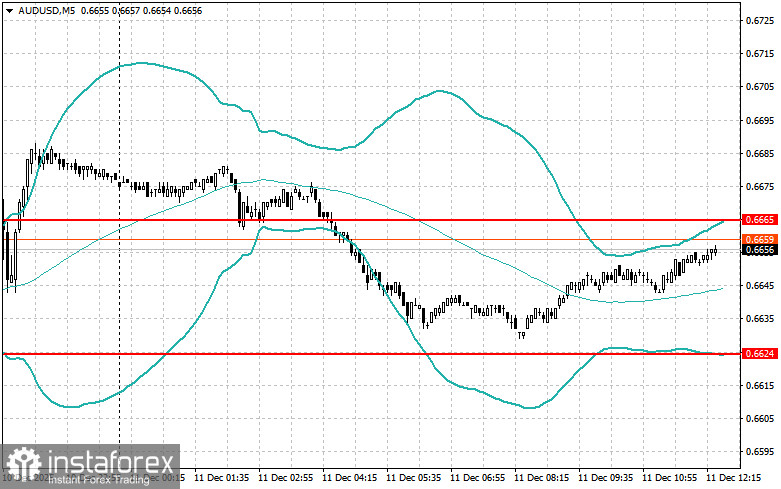

For AUDUSD:

- Look for selling opportunities after a failed breakout above 0.6665 with a return below this level

- Look for buying opportunities after a failed breakout below 0.6624 with a return to this level

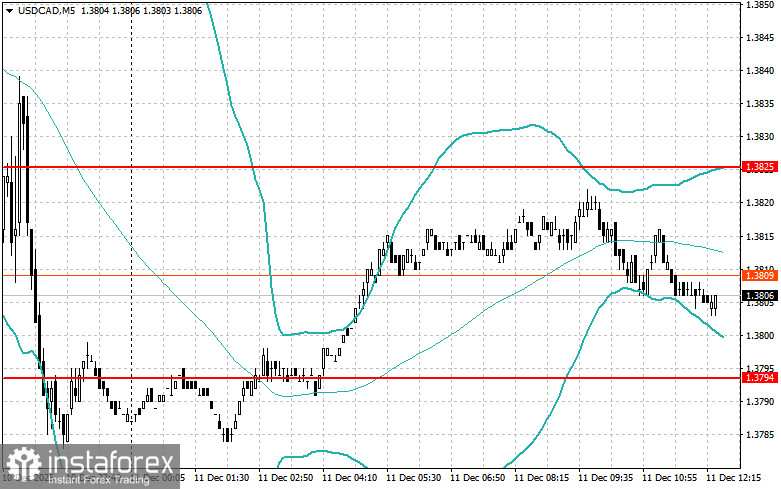

For USDCAD:

- Look for selling opportunities after a failed breakout above 1.3825 with a return below this level

- Look for buying opportunities after a failed breakout below 1.3794 with a return to this level