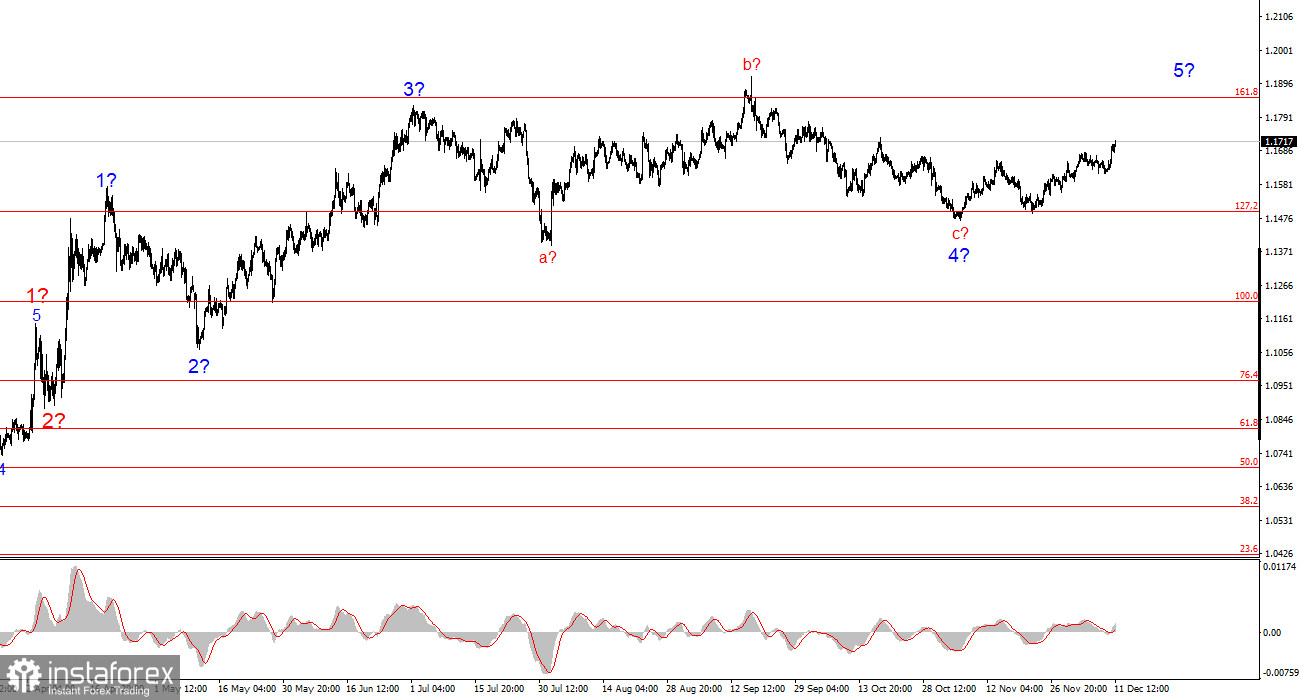

The wave pattern on the 4-hour chart for EUR/USD has changed, but overall it remains quite clear. There is no indication that the upward trend segment, which began in January 2025, has been canceled. However, the wave structure has become significantly more complex since July 1 and has taken a more extended form. In my view, the instrument has completed the formation of corrective wave 4, which took a very unconventional shape. Within this wave, we saw exclusively corrective structures, so there were no doubts about the corrective nature of the decline.

In my opinion, the upward trend segment is not yet completed, and its targets extend up to the 1.25 level. The a-b-c-d-e sequence looks complete, and therefore I expect a new upward wave cycle to form in the coming weeks. We have already seen what appears to be waves 1 and 2, and the instrument is now in the process of forming wave 3 or c. I expected this wave to rise to 1.1717, which corresponds to the 38.2% Fibonacci level, but this wave is taking a more extended form—which is very good, as it means it may turn into an impulse wave. And if so, the entire upward cycle could gain impulse characteristics as well.

The EUR/USD rate rose by 70 basis points on Wednesday and by roughly the same amount again today. Considering that for the previous week the trading range did not exceed 25 points and the movement was almost flat, we can say that yesterday the market finally broke free of its shackles. The euro continues to strengthen, but again only because demand for the U.S. dollar is falling—and that decline has been completely natural throughout all of 2025. I am surprised that market participants waited five whole months before resuming the upward trend. But things do not always unfold the way one wants.

Yesterday, the Federal Reserve announced its decision to cut interest rates by another 25 basis points, which is a dovish move and therefore should have led to reduced demand for the dollar. And that is exactly what we saw. The Fed did not provide any promises for 2026, limiting itself to the standard phrase that "decisions will depend on economic data." However, the dot-plot chart showed that compared with three months ago, Fed officials' expectations have not changed. On average, they still expect one round of easing next year. Thus, in 2026 the Fed's rate cuts may be more symbolic than substantial—unless Donald Trump intervenes.

In my view, the wave pattern remains the most significant factor at the moment. Despite the strong complexity of the presumed wave 4, the entire wave structure remains readable. Therefore, it is still reasonable to expect the formation of the global wave 5. For the dollar, the news background remains weak, which comes as no surprise.

General Conclusions

Based on the EUR/USD analysis, I conclude that the pair continues to build an upward trend segment. In recent months the market paused, but Donald Trump's policies and the Federal Reserve's actions remain significant factors that could weigh on the U.S. currency in the future. The targets of the current trend segment may extend up to the 1.25 level. The latest upward segment is beginning to develop, and I hope that we are now witnessing the formation of an impulse wave cycle within the global wave 5. If so, growth toward the 1.25 level should be expected.

On a smaller scale, the entire upward trend is visible. The wave pattern is not entirely standard, as the corrective waves vary in size. For example, the major wave 2 is smaller than the internal wave 2 within wave 3. But such scenarios do happen. I would remind you that it is best to identify clear structures on the chart rather than forcing interpretation onto every wave. Currently, the upward structure raises no doubts.

Key Principles of My Analysis:

- Wave structures should be simple and easy to read. Complex structures are difficult to trade and often imply changes.

- If you are not confident in what is happening in the market, it is better to stay out.

- There is never 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.