The NZD/USD pair is confidently holding above the round 0.5800 level, having surpassed the weekly high set the day before. Furthermore, the current fundamental factors create favorable conditions for bullish sentiments, indicating that the path of least resistance for spot prices is upward.

The U.S. dollar plummeted after the Federal Reserve made a moderate decision to lower interest rates and fell further after Thursday's release of negative news in the country. This step is seen as a key factor supporting the NZD/USD pair. The Fed lowered rates as expected, noting that the easing cycle will likely conclude in January. Additionally, it is projected that rates will decrease by only a quarter percentage point in 2026 — the same forecast was made in September.

However, investors remain cautious, anticipating further rate cuts following comments made by Fed Chairman Jerome Powell during the post-meeting press conference. Powell emphasized that the U.S. labor market faces significant downside risks, and the Fed does not want its restrictive policy to hinder job creation. As a result, traders began actively pricing in two additional rate cuts in 2026. This, combined with positive market sentiment, continues to weaken the dollar as a safe-haven asset, thereby boosting the New Zealand dollar, which is perceived as riskier.

Additional support for the New Zealand dollar comes from the Reserve Bank of New Zealand's strong stance regarding its future monetary policy. In fact, after the November 25-basis-point rate cut to the lowest level in more than three years, the RBNZ hinted that its easing cycle was ending. This approach is notably different from the Fed's dovish stance, strengthening the short-term positive outlook for the NZD/USD pair.

From a technical perspective, surpassing the 100-day SMA is favorable for bulls. Oscillators on the daily chart are positive; however, the relative strength index is close to the overbought zone, suggesting a potential consolidation. The nearest resistance for the pair is at 0.5850, near the 200-day SMA. Breaking through this level would allow the NZD/USD pair to reach the round 0.5900 level.

Immediate support for the pair is provided by the 100-day SMA, which the pair recently surpassed, as well as the round level of 0.5800 and the level of 0.5790. If these levels do not hold, the prices may drop back into the previous range.

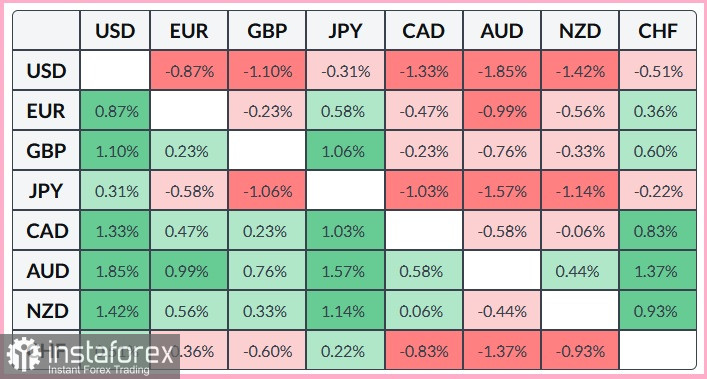

The table below shows the changes in the U.S. dollar exchange rate against major currencies for the current month. The dollar has been strongest against the Japanese yen.