The euro and British pound have maintained their strength and continued to rise against the US dollar. The USD/JPY pair has also recovered all its losses, setting a new weekly low.

The US dollar temporarily strengthened yesterday after news that the US economy grew at the fastest pace in two years in the third quarter. However, despite the positive economic news, traders remain cautious about long-term growth prospects. Concerns are arising from challenges in the labor market and inflationary pressures that may resurface amid such strong economic indicators. Growth in consumer spending indicates lingering confidence among American consumers, while the rise in business investments points to optimism among companies about prospects. Despite strong economic indicators in the third quarter, many economists believe growth will likely slow in the coming months.

Today, there are no reports from the Eurozone, so the EUR/USD pair may continue its upward trajectory. However, the absence of macroeconomic data does not imply a lack of market movement. Traders are likely to focus on general market conditions, geopolitical factors, and unexpected news that may emerge throughout the day. Technical analysis can also play a crucial role, allowing traders to identify support and resistance levels as well as form chart patterns. Given the current situation, it is important to stay vigilant and monitor the news to quickly react to any changes in market sentiment.

For the UK, there are also no reports scheduled for today, meaning that the pound has every chance for another push upward before the holidays.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data significantly exceeds or falls short of economists' expectations, the Momentum strategy is most appropriate.

Momentum Strategy (Breakout):

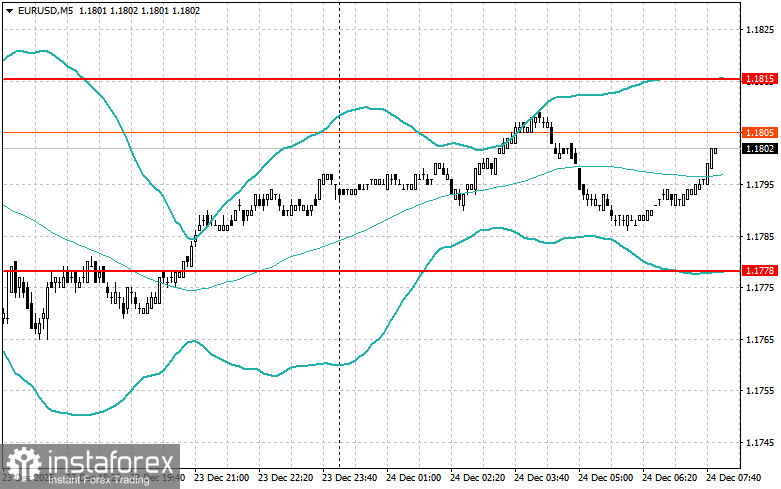

For EUR/USD

- Long positions on a breakout above 1.1807 may lead to the euro rising to around 1.1840 and 1.1882.

- Short positions on a breakout below 1.1785 could send the euro to around 1.1760 and 1.1730.

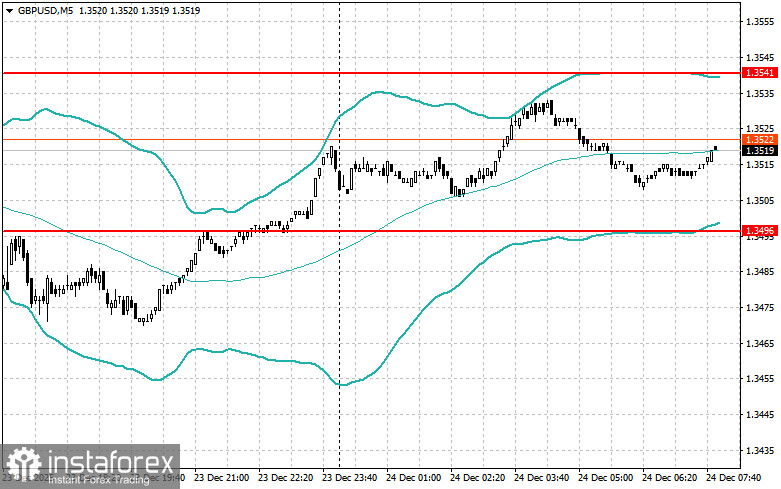

For GBP/USD

- Longs on a breakout above 1.3536 may result in an increase in the pound to around 1.3560 and 1.3590.

- Shorts on a breakout below 1.3508 could send the pound to around 1.3478 and 1.3447.

For USD/JPY

- Longs on a breakout above 155.99 may lead to an increase in the dollar to around 156.30 and 156.68.

- Shorts on a breakout below 155.65 could send the dollar to around 155.32 and 154.95.

Mean Reversion Strategy (Pullback):

For EUR/USD

- I will look for shorts after a failed breakout above 1.1815 and a return below this level.

- I will look for longs after a failed breakout below 1.1778 and a return to this level.

For GBP/USD

- I will look for shorts after a failed breakout above 1.3541 and a return below this level.

- I will look for longs after a failed breakout below 1.3496 and a return to this level.

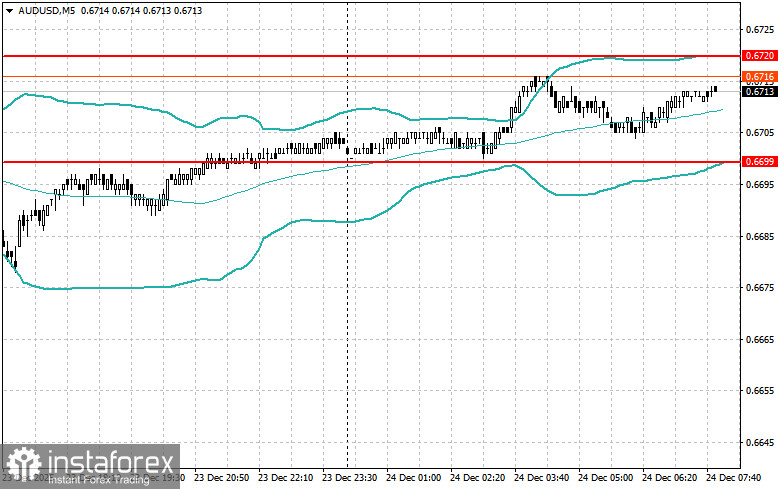

For AUD/USD

- I will look for shorts after a failed breakout above 0.6720 and a return below this level.

- I will look for longs after a failed breakout below 0.6699 and a return to this level.

For USD/CAD

- I will look for shorts after a failed breakout above 1.3694 and a return below this level.

- I will look for longs after a failed breakout below 1.3668 and a return to this level.