Trade review for Tuesday:

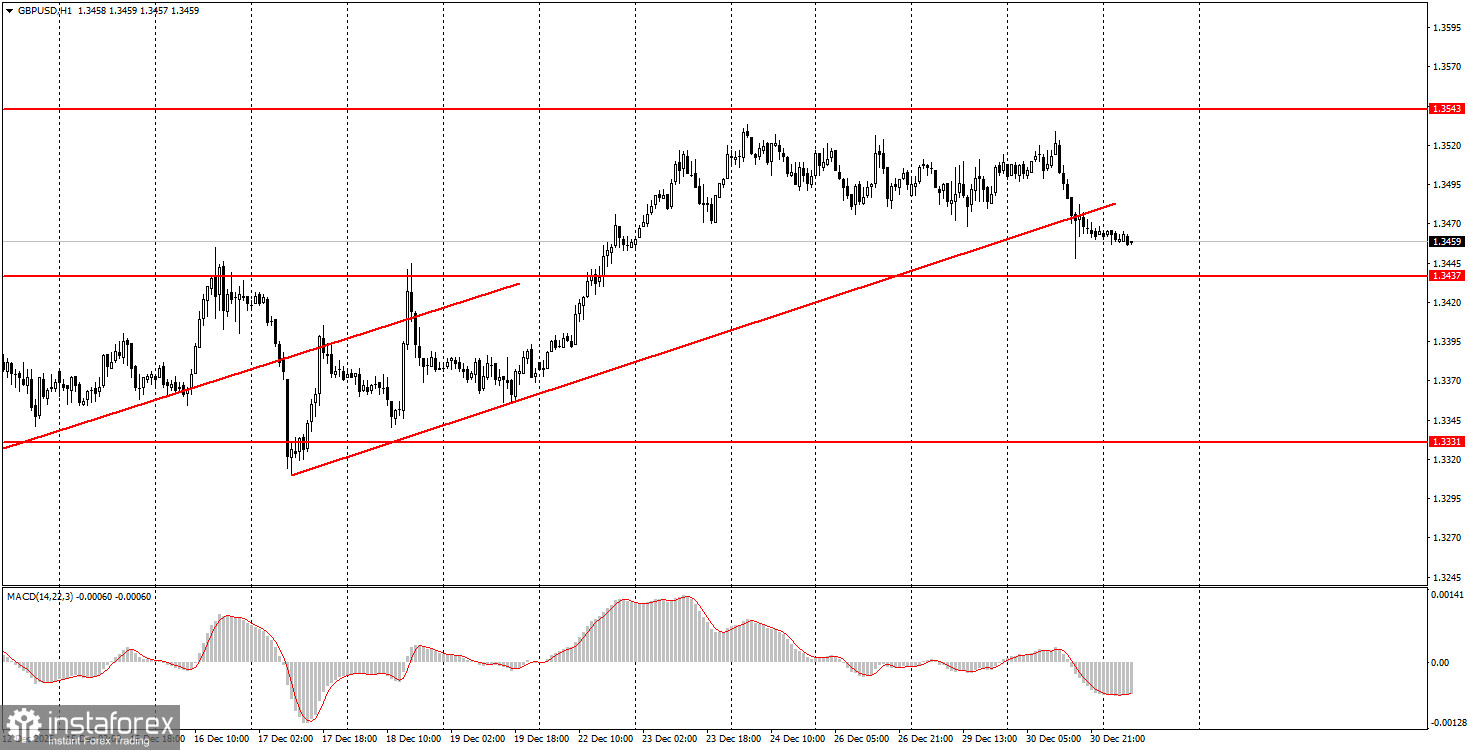

1H chart of GBP/USD

The GBP/USD pair showed a relatively strong downward move on Tuesday by holiday-period standards and settled below the ascending trend line. It is hard to call Tuesday's volatility high, but it was still higher than over the several days prior. The macroeconomic and fundamental backdrop remained absent. Thus, on December 31, one could say the uptrend has shifted to a downtrend; we would prefer to wait until the holidays end before drawing such conclusions. Yesterday, there were no particular reasons for the dollar to rise. But it can also not fall constantly. We treat such moves as random.

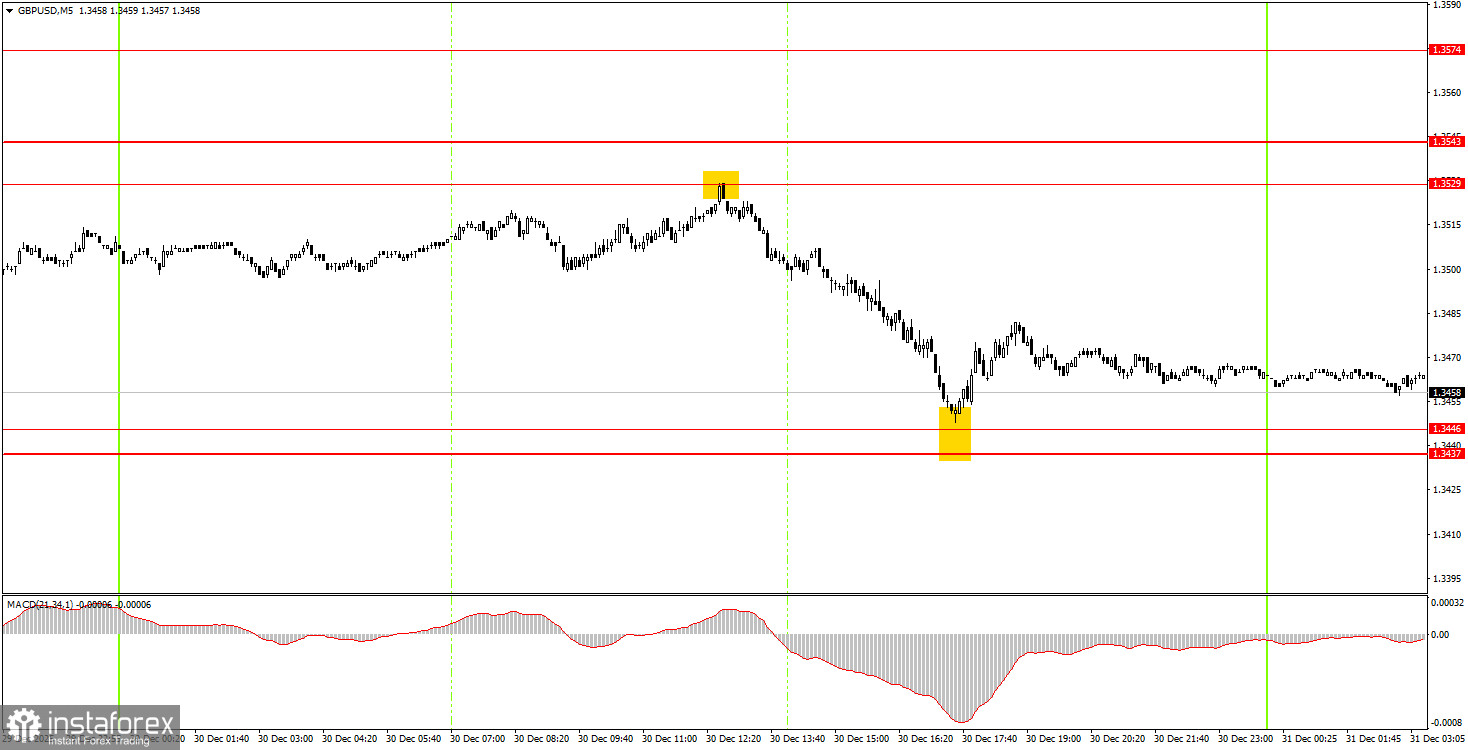

5M chart of GBP/USD

How to trade on Wednesday:

On the hourly timeframe, the GBP/USD pair has settled below the trend line, so formally, technical analysis points to further decline of the British currency at the start of the next year. However, there are no global reasons for medium-term dollar strength, so we expect movement only to the north. Overall, we expect the resumption of the global 2025 uptrend, which could take the pair to 1.4000 within the next couple of months.

On Wednesday, beginner traders may consider new long positions if the price bounces from the 1.3437–1.3446 area, with targets at 1.3529–1.3543. Short positions will become relevant on a settlement below the 1.3437–1.3446 area, with targets at 1.3319–1.3331.

On the 5-minute timeframe, you can trade the following levels now: 1.2913, 1.2980–1.2993, 1.3043, 1.3096–1.3107, 1.3203–1.3212, 1.3259–1.3267, 1.3319–1.3331, 1.3437–1.3446, 1.3529–1.3543, 1.3574–1.3590. No significant events are scheduled in the UK or the US on Wednesday, and market volatility may remain weak. In the US, a report on initial jobless claims will be released today, but it is a secondary indicator. Trade today only using technicals.

Key Rules of the Trading System:

- The strength of a signal is assessed by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near any level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can create numerous false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades are opened during the period between the start of the European session and the middle of the American session, after which all trades must be closed manually.

- On the hourly timeframe, when trading based on signals from the MACD indicator, it is preferable to trade only when good volatility is present, and a trend is confirmed by a trend line or channel.

- If two levels are positioned too closely to each other (5 to 20 points), they should be viewed as a support or resistance area.

- After moving 20 pips in the right direction, set the Stop Loss to breakeven.

Chart Explanation:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction for trading.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.