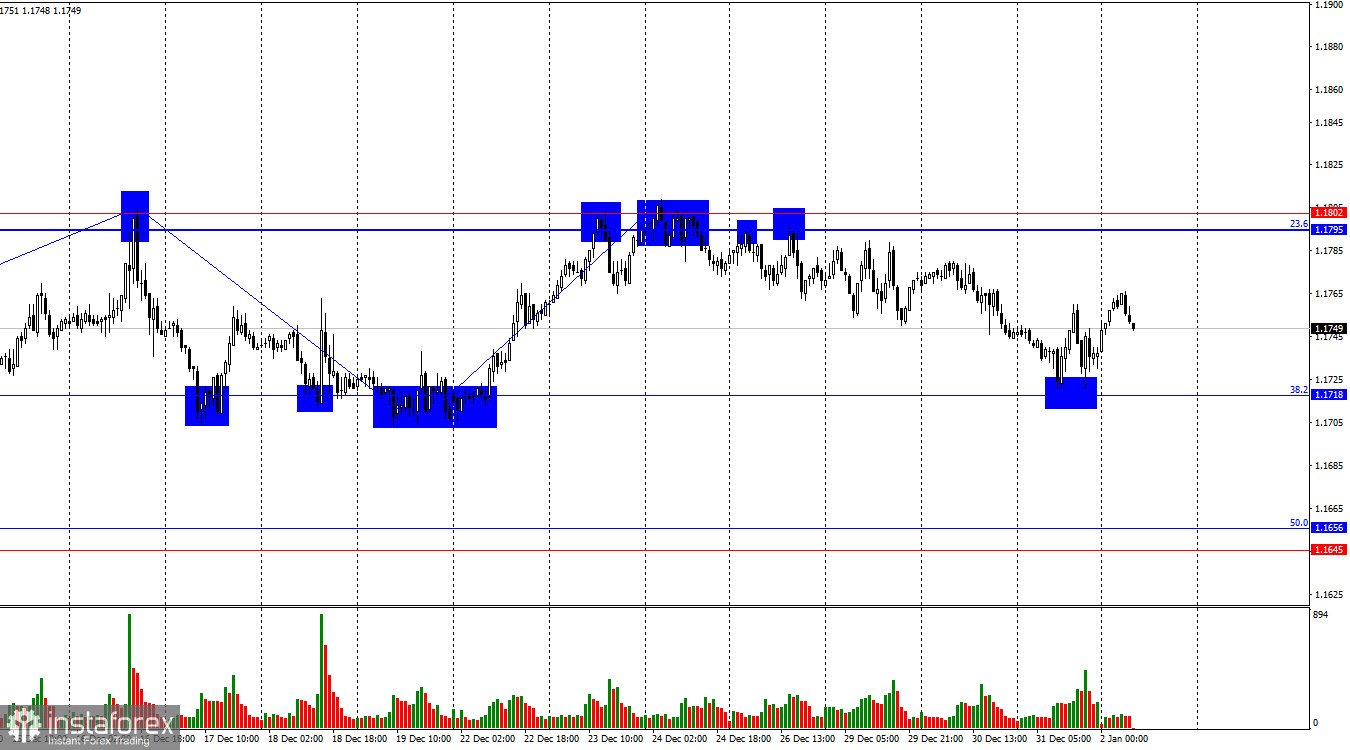

The wave situation on the hourly chart remains simple. The last completed upward wave failed to break the peak of the previous wave, while the new downward wave has not yet broken the previous low. Thus, the trend officially remains "bullish." It would be hard to call it strong, but in recent weeks the bulls regained confidence, and then the holidays began. Easing of Fed monetary policy will put pressure on the dollar in 2026, while the ECB will not create any problems for the euro. The "bullish" trend will end if the pair consolidates below the 1.1718 level and the last three lows.

On Wednesday, the news background in the U.S. and the European Union was still absent, and the entire past week and the current week have been more festive than working weeks. Ahead of the New Year, bullish traders stopped attacking and gave bears the opportunity to take the initiative. However, the bears are also in no hurry to attack, preferring to wait until next week, when economic data will start coming in from the U.S. and the EU. I remind you that the key issues for traders remain the U.S. labor market, unemployment, and inflation. For bullish traders to continue their next offensive, these reports must continue to show weak readings. The FOMC has cut interest rates three times, but whether this will be enough to restore the labor market is still unclear. The U.S. dollar still cannot count on strong growth against the European currency, but the bulls also need new reasons to attack. Thus, in my view, it is necessary to wait for the next batch of statistics.

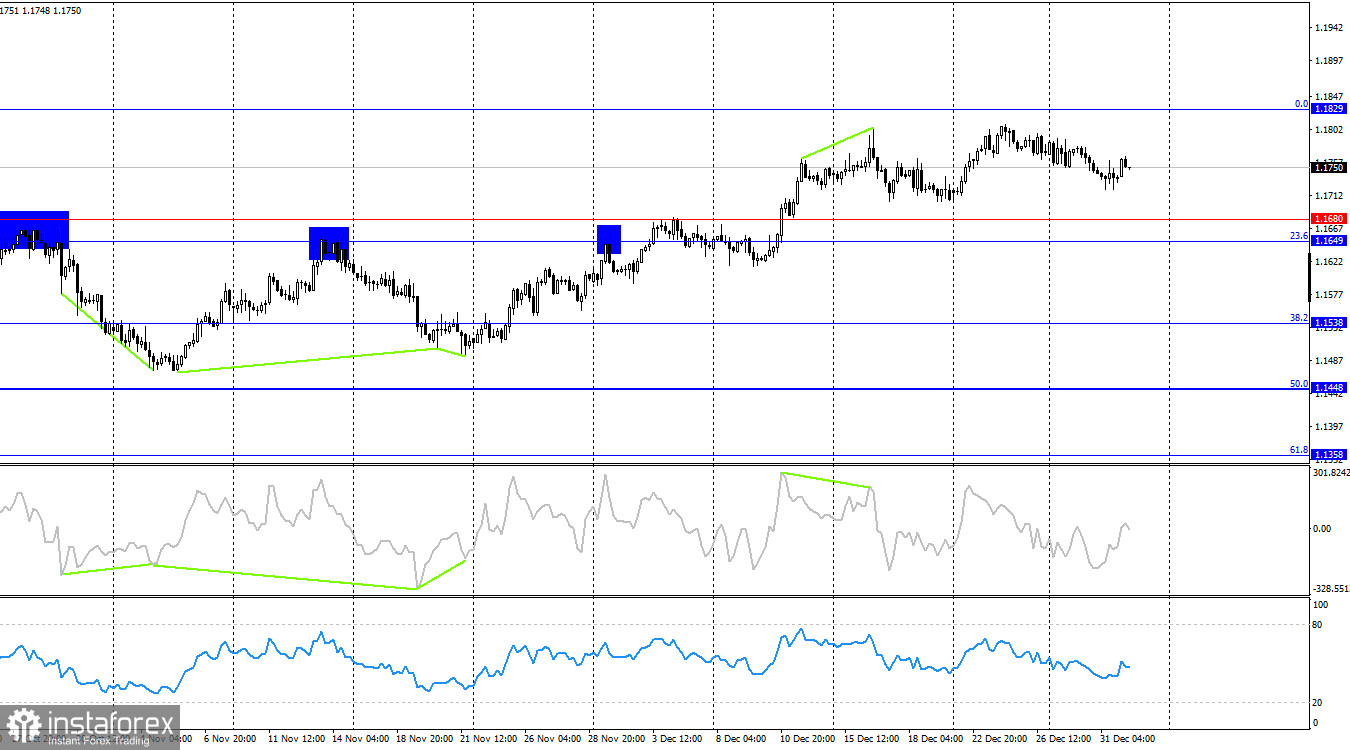

On the 4-hour chart, the pair reversed in favor of the European currency and resumed the growth process toward the 0.0% corrective level at 1.1829. A rebound of quotes from this level would work in favor of the U.S. currency and a moderate decline toward the support level of 1.1649–1.1680. A consolidation above the 1.1829 level would increase the likelihood of further euro growth. No emerging divergences are observed today on any indicator.

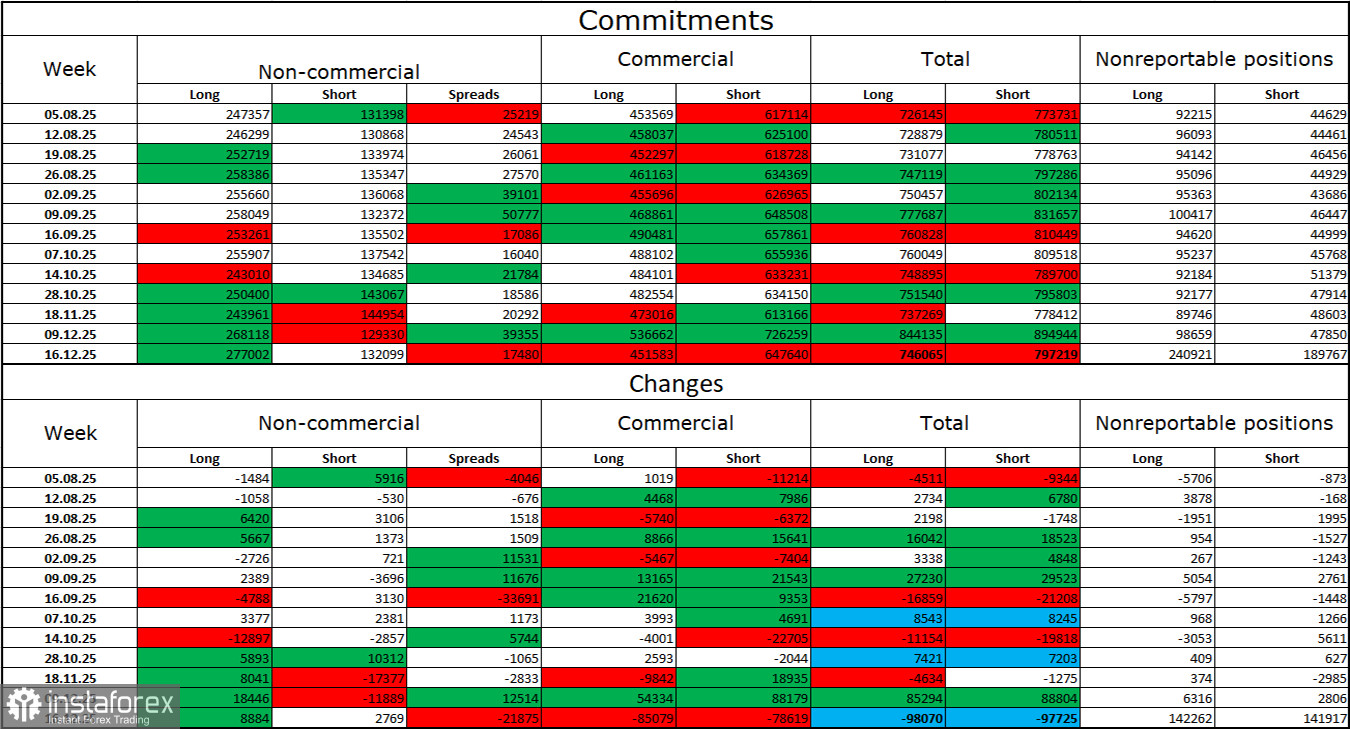

Commitments of Traders (COT) Report:

During the last reporting week, professional players opened 8,884 long positions and 2,769 short positions. Sentiment in the "Non-commercial" group remains "bullish" thanks to Donald Trump and his policies, and it is only strengthening over time. The total number of long positions held by speculators now stands at 277 thousand, while short positions amount to 132 thousand. This represents more than a twofold advantage for the bulls.

For thirty-three consecutive weeks, large players were shedding short positions and increasing longs. Then the "shutdown" began, and now we are seeing the same picture again: bulls continue to build up long positions. Donald Trump's policies remain the most significant factor for traders, as they cause numerous problems that will have long-term and structural consequences for the United States. For example, the deterioration of the labor market. Traders fear a loss of the Fed's independence in 2026 under pressure from Trump and against the backdrop of Jerome Powell's resignation in May.

U.S. and Eurozone Economic Calendar:

On January 2, the economic events calendar contains no entries. The influence of the news background on market sentiment on Friday will be absent.

EUR/USD Forecast and Trading Advice:

Selling the pair was possible on a rebound from the 1.1795–1.1802 level on the hourly chart with a target of 1.1718. The target was reached on Friday. A close below the 1.1718 level will allow new sell trades to be opened with a target of 1.1656. Buy trades could be opened on a rebound from the 1.1718 level with a target of 1.1795. Today, these trades can be kept open.

The Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.