Trade Breakdown and Tips for Trading the European Currency

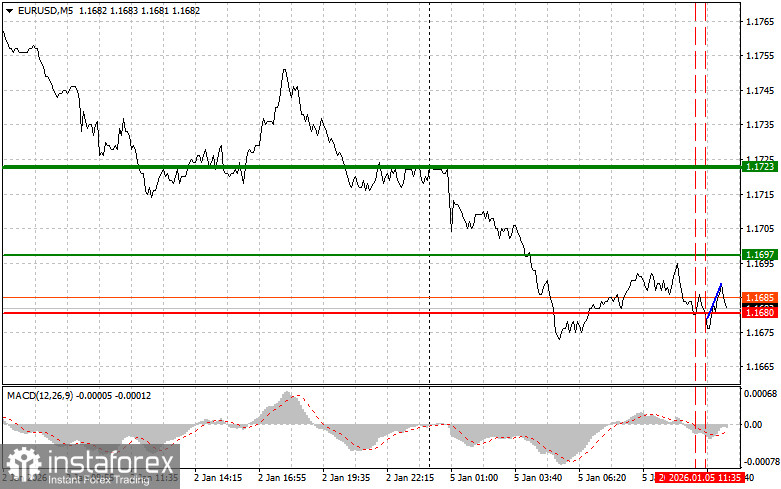

The test of the 1.1680 price level occurred when the MACD indicator had already moved far below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. A second test of 1.1680 shortly afterward took place when the MACD was in oversold territory, which resulted in the implementation of Buy Scenario No. 2 for the euro. However, even in this case, the pair failed to show any significant upward movement.

The euro continues to experience negative pressure from a number of factors: a lack of economic information from the eurozone following the holiday period, as well as heightened geopolitical tensions stemming from the situation in Venezuela. Unpredictable statements by U.S. President Trump also add to global economic uncertainty. Market participants are forced to factor in the risk of new conflicts or changes in U.S. policy, which leads to increased demand for the U.S. dollar.

In the second half of the day, the key event will be the release of the U.S. ISM Manufacturing PMI. Expectations of positive ISM data are putting downward pressure on the European currency, highlighting the relative resilience of the U.S. economy compared with the European one. An improvement in U.S. manufacturing activity could signal further economic growth, increasing the attractiveness of the dollar. This, in turn, may lead to capital outflows from the eurozone and a decline in the EUR/USD exchange rate.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

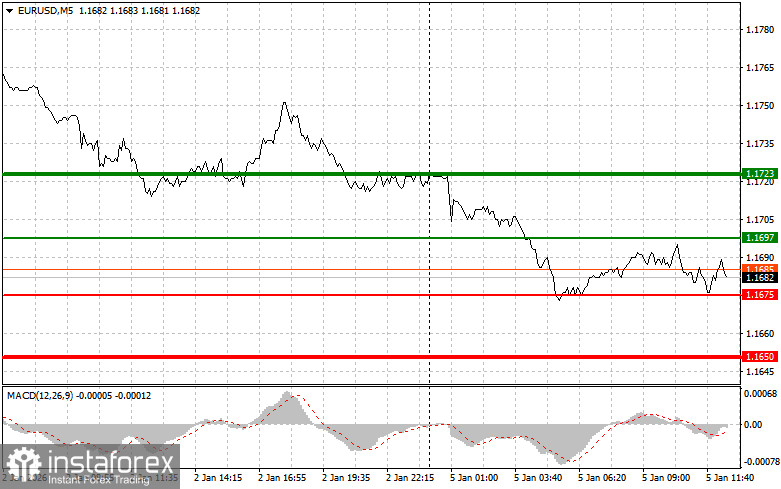

Scenario No. 1: Today, buying the euro is possible if the price reaches the level around 1.1697 (the green line on the chart), with a target of growth toward 1.1723. At 1.1723, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. A strong rise in the euro can only be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1675 price level while the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a bullish market reversal. A rise toward the opposite levels of 1.1697 and 1.1723 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1675 level (the red line on the chart). The target will be 1.1650, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction from that level). Strong pressure on the pair may return at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1697 price level while the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a bearish market reversal. A decline toward the opposite levels of 1.1675 and 1.1650 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price where Take Profit orders can be placed or profits can be manually secured, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price where Take Profit orders can be placed or profits can be manually secured, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly—especially if you do not use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based solely on the current market situation is an inherently losing strategy for an intraday trader.