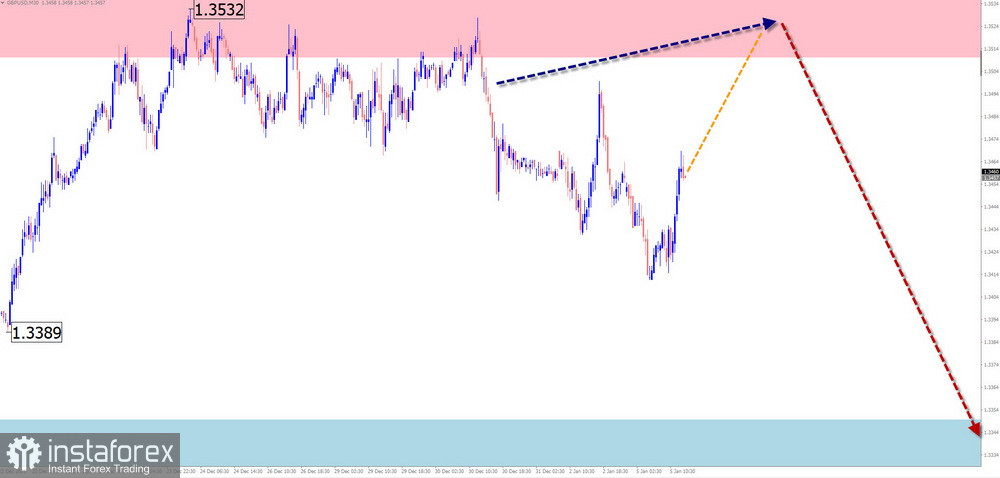

GBP/USD

Brief Analysis:

On the British pound chart, the dominant upward wave that has been in place since January of last year continues, with its final segment (C) having begun two months ago. The structure of this wave segment does not yet appear complete. At the time of analysis, price is located near the upper boundary of a large-scale potential reversal zone.

Weekly Forecast:

Throughout the coming week, a continuation of the overall sideways movement of the British currency is expected, within a price corridor between opposing zones. After an attempt to pressure the resistance zone, a change in direction and a decline toward the projected support zone can be anticipated. The greatest activity is likely toward the end of the week.

Potential Reversal Zones

Resistance:

- 1.3510 / 1.3560

Support:

- 1.3350 / 1.3300

Recommendations:

- Buying: Limited potential and may be risky.

- Selling: Possible with reduced position size after confirmed reversal signals appear near the resistance zone.

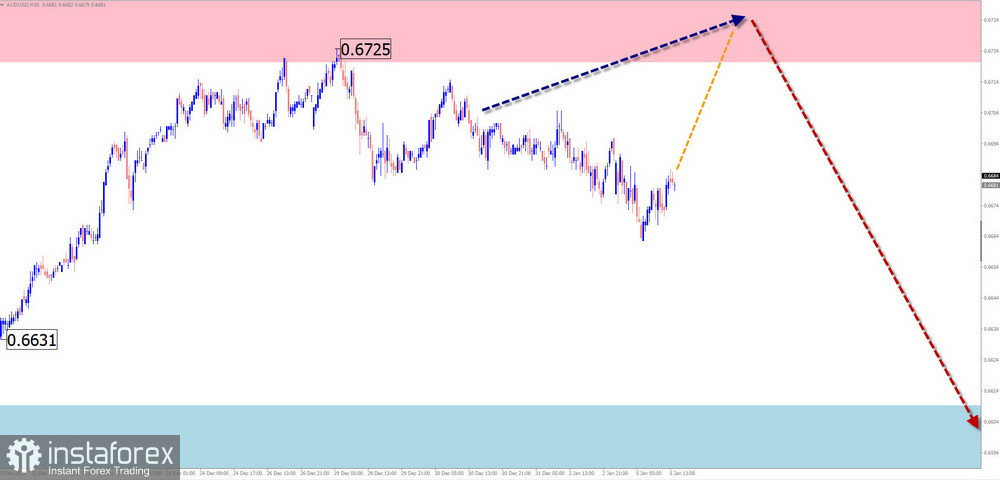

AUD/USD

Brief Analysis:

On the main Australian dollar pair, a bullish wave has been developing since April of last year, defining the general direction of short-term price fluctuations. Within the upward segment that began on November 21, the middle part (B) has been forming over the past three weeks as a shifting flat. Its structure still lacks the final segment.

Weekly Forecast:

In the coming days, a continuation of the overall sideways tone can be expected. At the beginning of the week, an upward move is likely, with price rising toward the projected resistance area. Closer to the weekend, the probability of a reversal and the start of a downward move toward the support zone increases.

Potential Reversal Zones

Resistance:

- 0.6720 / 0.6770

Support:

- 0.6610 / 0.6560

Recommendations:

- Buying: Limited potential and risky.

- Selling: May be used with small position sizes after confirmed reversal signals appear during individual sessions.

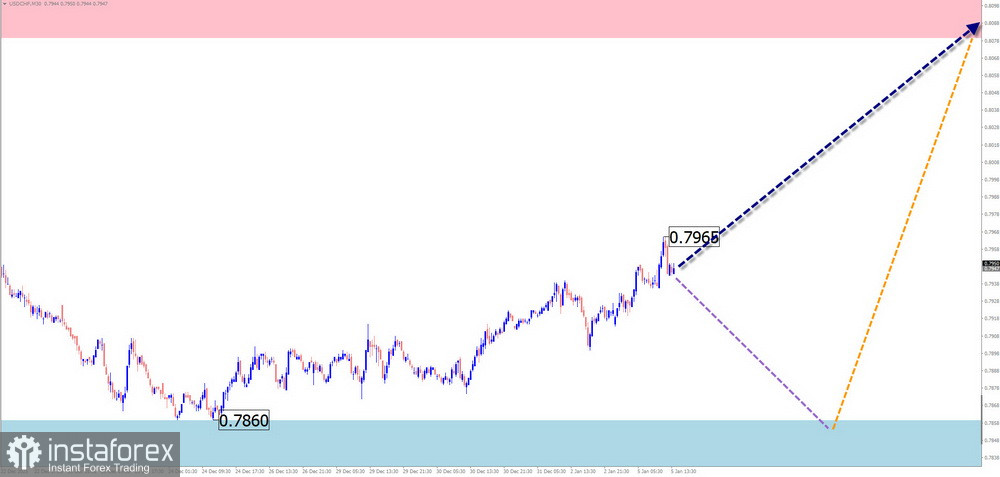

USD/CHF

Brief Analysis:

On the Swiss franc chart, the main direction of movement is set by an upward wave that began in April of last year. The wave structure forms an extended/shifting flat and does not yet appear complete. Price is located near the upper boundary of a potential reversal zone. No clear signals of an imminent reversal are currently observed.

Weekly Forecast:

Over the coming week, predominantly sideways price action is expected. In the first half of the week, sideways movement near the support zone is more likely. Closer to the weekend, a reversal and resumption of upward movement can be anticipated.

Potential Reversal Zones

Resistance:

- 0.8080 / 0.8130

Support:

- 0.7860 / 0.7810

Recommendations:

- Selling: Limited potential and may lead to losses.

- Buying: Can be considered after confirmed reversal signals appear near the support zone.

EUR/JPY

Brief Analysis:

On the EUR/JPY pair, an upward wave has been developing since February of last year, nearing the end of a bullish trend on a higher timeframe. At present, the wave structure does not look complete. Over the past two weeks, price has been correcting mainly sideways, forming an extended flat that remains unfinished at the time of analysis.

Weekly Forecast:

During the current week, price is expected to move within a sideways channel between opposing zones. In the first days, a decline toward the projected support is more likely. After that, a reversal and upward movement can be expected. During the change in direction, a brief break below the lower boundary of the price corridor cannot be ruled out.

Potential Reversal Zones

Resistance:

- 185.00 / 185.50

Support:

- 182.10 / 181.60

Recommendations:

- Selling: Quite risky with limited potential.

- Buying: After confirmed reversal signals appear near the support zone, suitable for short-term trades.

AUD/JPY

Brief Analysis:

The direction of short-term price movements in the AUD/JPY pair since April of last year has been defined by an upward wave. Its currently unfinished segment began in mid-October. Price is trading within a potential reversal zone on the daily timeframe, approaching its upper boundary. No clear signals of an imminent trend change are observed.

Weekly Forecast:

At the beginning of the coming week, a continuation of sideways movement can be expected. Further growth and pressure on the resistance zone are likely. A brief break above its upper boundary cannot be ruled out. After that, a change in direction and a decline in the cross rate can be expected.

Potential Reversal Zones

Resistance:

- 105.80 / 106.30

Support:

- 102.80 / 102.30

Recommendations:

- Buying: Possible during individual sessions with limited position size.

- Selling: Can be used after confirmed reversal signals appear near the resistance zone.

EUR/CHF

Brief Analysis:

On the EUR/CHF pair, the direction of price movement since March of last year has been defined by a bearish wave. Within the wave structure, the final part of the corrective phase (B) has been developing since mid-November. During the pullback, price has approached a large-scale support level on the chart.

Weekly Forecast:

In the first days of the coming week, a continuation of the downward movement of the pair can be expected, potentially completing near the projected support area. After contact with the reversal zone, a change in direction and the start of price growth can be anticipated. The boundaries of weekly volatility are defined by the projected opposing zones.

Potential Reversal Zones

Resistance:

- 0.9400 / 0.9450

Support:

- 0.9260 / 0.9210

Recommendations:

- Buying: Will become relevant after confirmed reversal signals appear near the support zone.

- Selling: Limited potential and risky.

Notes:

In simplified wave analysis (SWA), all waves consist of three parts (A–B–C). On each timeframe, the last unfinished wave is analyzed. Dotted lines indicate expected movements.

Attention:

The wave algorithm does not take into account the duration of price movements over time.