Trade Review and Tips for Trading the Japanese Yen

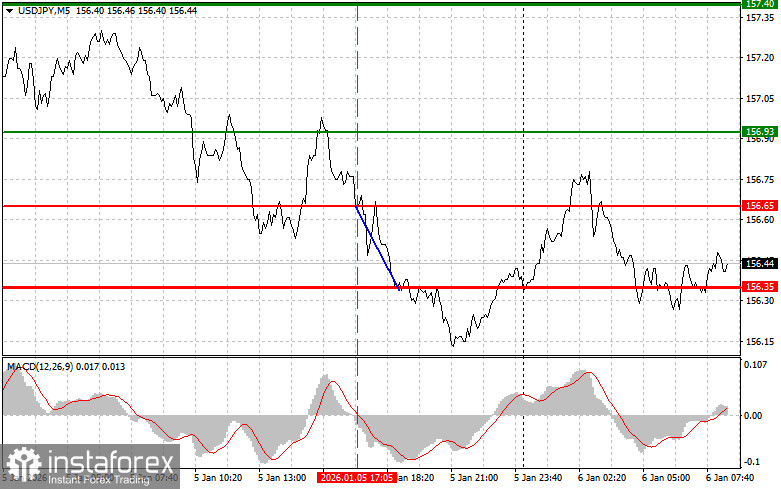

The test of the 156.65 price level coincided with the moment when the MACD indicator was just starting to move downward from the zero line, which confirmed a correct entry point for selling the dollar. As a result, the pair declined toward the target level of 156.35.

The Japanese yen strengthened against the dollar following news that in the last month of 2025, the US manufacturing PMI fell to 47.9. This figure was below analysts' forecasts. The drop in the PMI indicates continued contraction in US industrial activity, which heightens concerns about a slowdown in economic growth in the US. Yen strength is also related to expectations regarding the Bank of Japan's future policy. Many traders believe that further interest rate hikes by the regulator may occur as early as this summer, making the yen more attractive to investors. In the near term, the yen-dollar exchange rate will depend on further US economic data, statements from the Federal Reserve and the Bank of Japan, as well as overall market sentiment in global financial markets.

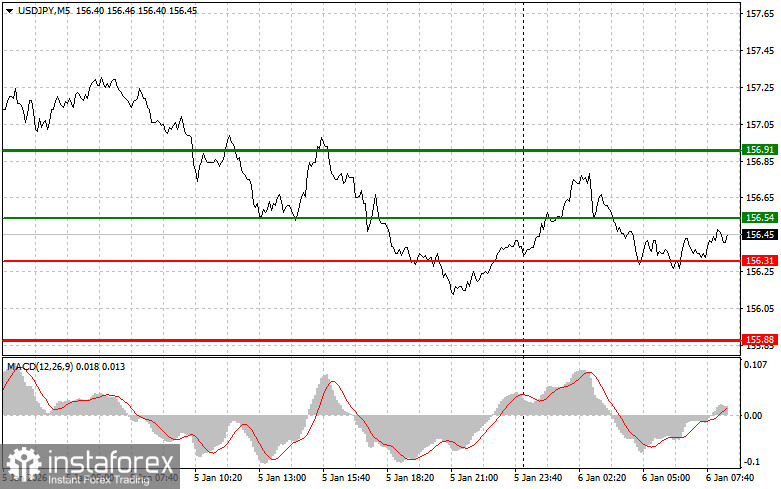

Regarding intraday strategy, I will primarily rely on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

Scenario No. 1: Today, I plan to buy USD/JPY if the entry point is reached around 156.54 (thin green line on the chart), with a target toward 156.91 (thicker green line on the chart). Around 156.91, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 point move in the opposite direction from this level. It's best to return to buying the pair during corrections or significant pullbacks in USD/JPY.Important! Before buying, make sure the MACD indicator is above zero and just starting its upward move.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of 156.31 when the MACD indicator is in the oversold area. This would limit the downward potential of the pair and trigger a reversal upward. Growth toward the opposite levels of 156.54 and 156.91 can be expected.

Sell Scenarios

Scenario No. 1: Today, I plan to sell USD/JPY only after a break below 156.31 (red line on the chart), which would likely lead to a rapid decline in the pair. The key target for sellers is 155.88, where I plan to exit short positions and simultaneously open long positions in the opposite direction, aiming for a 20–25 point move in the opposite direction from this level. Selling is best done from higher prices.Important! Before selling, make sure the MACD indicator is below zero and just starting its downward move.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of 156.54 when the MACD indicator is in the overbought area. This would limit the upward potential of the pair and trigger a reversal downward. A decline toward the opposite levels of 156.31 and 155.88 can be expected.

What's on the Chart

- Thin green line – entry price for buying the trading instrument.

- Thick green line – estimated price where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – estimated price where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it's important to follow overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when making market entries. Before major fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not follow proper money management and trade large volumes.

Remember, successful trading requires a clear trading plan, such as the one outlined above. Making spontaneous decisions based on the current market situation is inherently a losing strategy for an intraday trader.