On Tuesday, the GBP/USD currency pair continued to trade very calmly and near its local highs. GBP/USD traders paid no attention at all to Maduro's arrest. Essentially, they were right, as there is no real geopolitical conflict. And how Trump intends to govern another sovereign state remains unclear to many. As we have already said, it is one thing to carry out a military operation in another country, and quite another to establish full control over it. Venezuela is not an uninhabited wasteland, and virtually every resident there owns a weapon. Thus, from our point of view, Trump can negotiate with Rodriguez as much as he wants. The Venezuelan people will not approve such deals.

Therefore, the British pound against the dollar quite naturally did not react in any way to this event. A bit later on Monday, the ISM Manufacturing PMI was released, which showed what the market currently considers important. Trump may carry out military operations, establish peace, or stop wars, but all of his methods are not welcomed by traders and investors. The U.S. economy showed nearly record growth in the third quarter, but what is it supported by? Government spending? The American economy is not growing because every individual citizen is getting richer. Only wealthy Americans are getting richer in the U.S., while the poor continue to get poorer. The unemployment rate is rising, the labor market is in a knockout, business activity is declining, the Fed is forced to cut the key interest rate, and industrial production is not growing.

Thus, as before, we expect only growth in the GBP/USD pair. Both fundamental and technical factors support this view. Fundamentally, there is still no answer to the question of what could even drive the dollar higher. Only the factor of monetary policy easing by the Bank of England in 2026 could provide some support for the dollar. Previously, the dollar could count on market support amid geopolitical conflicts, but now central banks and large investors are trying to get rid of the U.S. currency (as clearly evidenced by COT reports). Thus, the dollar is no longer a "reserve currency."

From a technical perspective, the pair has consolidated above the Ichimoku cloud on the daily timeframe, and the downward correction that lasted four full months has most likely ended. Everything indicates that the 2025 uptrend will continue. On the weekly timeframe, it is also clearly visible that the global uptrend may have begun as early as 2022, when the pound fell almost to price parity with the dollar.

This week, traders will still need to review the JOLTs, ADP, ISM, Non-Farm Payrolls, University of Michigan Consumer Sentiment, and unemployment rate reports. Thus, the market may have plenty of reasons to continue selling the U.S. currency by the end of the week. Of course, one should not expect all U.S. reports to disappoint. However, the probability of weak readings for most of them is high. At the same time, no important events are scheduled in the United Kingdom this week.

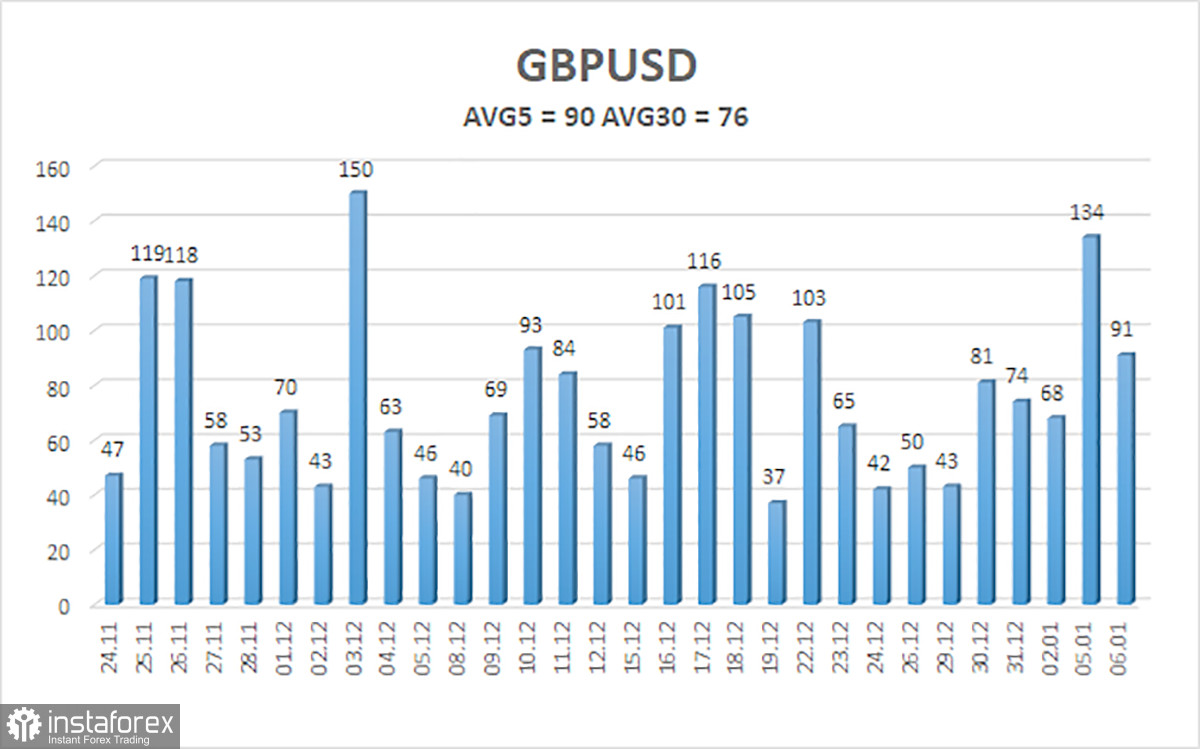

The average volatility of the GBP/USD pair over the last five trading days is 90 points. For the pound/dollar pair, this value is considered "average." On Wednesday, January 7, we therefore expect movement within the range bounded by the levels of 1.3403 and 1.3583. The higher linear regression channel has turned upward, indicating a recovery of the trend. The CCI indicator has entered the oversold zone six times over the past months and has formed numerous bullish divergences, which constantly warn traders of the continuation of the upward trend.

Nearest support levels:

S1 – 1.3428S2 – 1.3306S3 – 1.3184

Nearest resistance levels:

R1 – 1.3550R2 – 1.3672R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the 2025 uptrend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the U.S. economy, so we do not expect growth from the American currency. Thus, long positions with targets at 1.3583 and 1.3672 remain relevant in the near term while the price stays above the moving average. If the price is below the moving average line, small short positions with a target of 1.3403 may be considered on technical grounds. From time to time, the U.S. currency shows corrections (on a global scale), but for a trend-based strengthening it needs signs of the end of the trade war or other global, positive factors.

Explanations to the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong.

- The moving average line (settings: 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for price movements and corrections.

- Volatility levels (red lines) represent the probable price channel in which the pair is likely to trade over the next 24 hours, based on current volatility indicators.

- The CCI indicator entering the oversold zone (below ?250) or the overbought zone (above +250) signals that a trend reversal in the opposite direction may be approaching.