Trade Analysis and Trading Tips for the British Pound

The test of the 1.3486 price level occurred at a time when the MACD indicator was just beginning to move downward from the zero line, which confirmed a correct entry point for selling the pound. As a result, the pair declined toward the target level of 1.3455.

The ADP data on private-sector employment in the United States for December came in higher than November's figures but below economists' forecasts, allowing the U.S. dollar to show confident growth against the pound.

In the short term, the dollar is likely to remain range-bound until new clear signals emerge from the Federal Reserve or from economic statistics. Today, in the first half of the day, the focus will shift to the UK housing price index from Halifax. These figures provide a current snapshot of real estate market dynamics and serve as an important indicator for assessing the overall health of the British economy. The housing market is closely linked to consumer confidence and spending, so price fluctuations can have a noticeable impact on household behavior and investment activity. Analysts and traders will closely examine the Halifax report to identify signs of cooling or, conversely, overheating in the market. A sharp decline in prices may signal looming economic problems, while steady growth may indicate a favorable environment supported by rising incomes and mortgage affordability.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

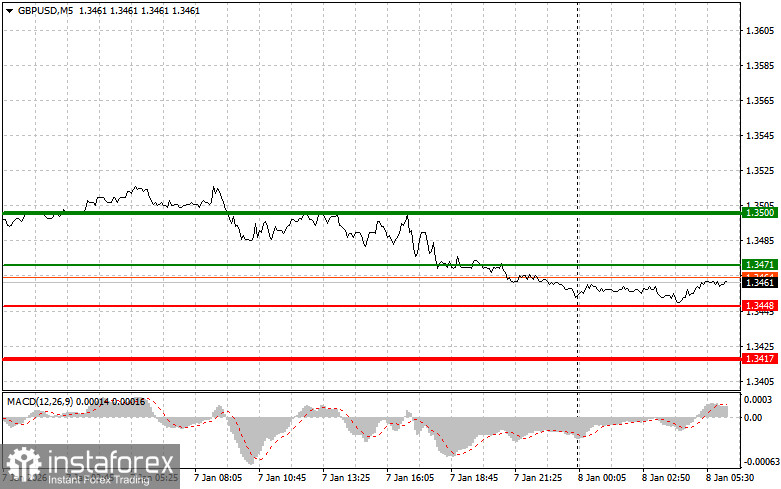

Scenario No. 1: Today, I plan to buy the pound when the price reaches the entry area around 1.3471 (thin green line on the chart), with a growth target at the 1.3500 level (thicker green line on the chart). Around 1.3500, I plan to exit long positions and open sell positions in the opposite direction, aiming for a 30–35 point move in the opposite direction from that level. Pound growth today can be expected after strong economic data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if there are two consecutive tests of the 1.3448 price level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to an upward market reversal. A rise toward the opposite levels of 1.3471 and 1.3500 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the pound today after the 1.3448 level is broken (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 1.3417 level, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point move from that level. Pound sellers may become active after weak economic data.Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of the 1.3471 price level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.3448 and 1.3417 can be expected.

What Is Shown on the Chart

- Thin green line – entry price at which the trading instrument can be bought.

- Thick green line – projected price level where Take Profit orders can be placed or profits can be manually secured, as further growth above this level is unlikely.

- Thin red line – entry price at which the trading instrument can be sold.

- Thick red line – projected price level where Take Profit orders can be placed or profits can be manually secured, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.