Trade review from Friday:

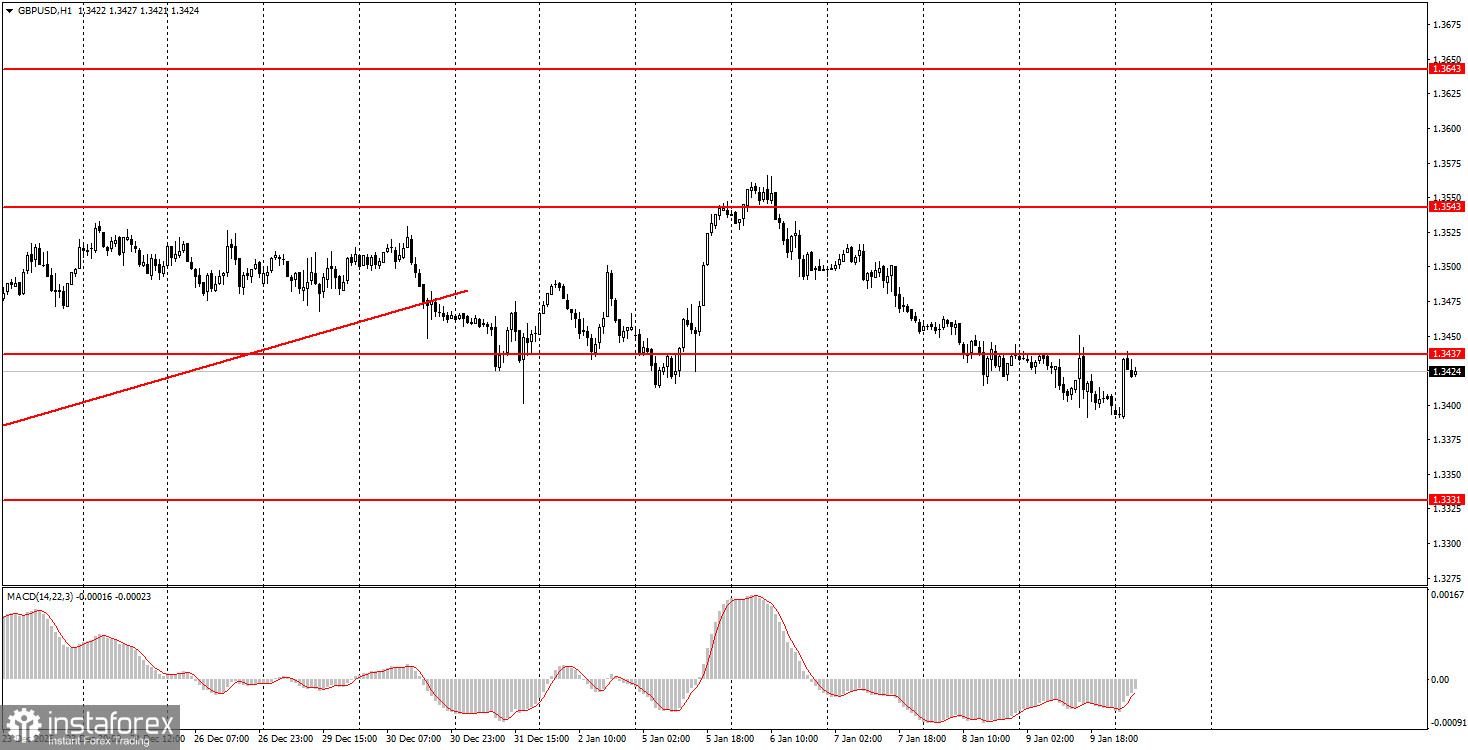

1H chart of the GBP/USD pair

The GBP/USD pair traded on Friday with minimal volatility, completely out of line with the macroeconomic information. On Friday, the US released Nonfarm Payrolls and the unemployment rate — the two most important reports — along with data on average wages and consumer sentiment. However, if the total daily volatility was 60 pips, did it trigger a reaction to those two reports? In our view, US labor-market and unemployment data were weak again. The number of new jobs in December was only 60,000, and the values for the two previous months were revised, naturally downward. The unemployment rate fell by 0.1%, but simply opening a five-year chart makes clear the medium-term direction of that indicator. Therefore, we consider the current decline in the pair (dollar strength) unjustified from a macroeconomic or fundamental perspective. Nevertheless, the euro failed to break out of its six-month sideways channel, which prevents the pound from continuing its northward move.

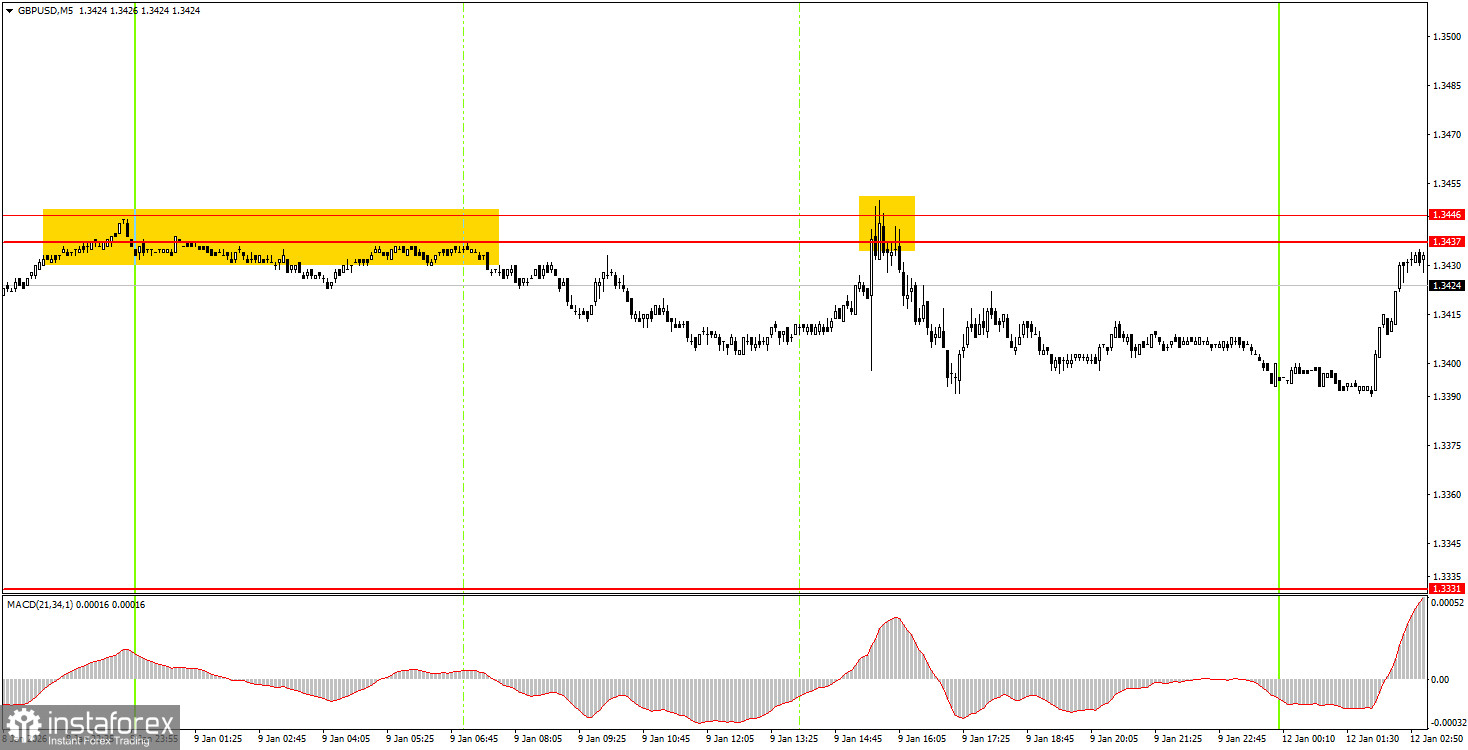

5M chart of the GBP/USD pair

On the 5-minute timeframe on Friday, two trading signals were formed. The price bounced twice from the 1.3437–1.3446 area, each time triggering a drop of several dozen pips. With current market volatility, one should not expect high profits a priori, but on the second trade, beginner traders could fairly easily have earned about 20–25 pips by manually closing the position on Friday evening. As a rule, we do not recommend carrying trades from Friday into Monday.

How to trade on Monday:

On the hourly timeframe, the pair has closed below the trendline; we see no clear downward trend at this time. Rather, another flat. There are no global grounds for medium-term dollar strength, so we expect movement to the north only. Overall, we also expect the resumption of the global 2025 uptrend, which could bring the pair to the 1.4000 level within the next couple of months.

On Monday, beginner traders may consider new short positions with a target zone of 1.3319–1.3331, since the price bounced twice from the 1.3437–1.3446 area on Friday and again overnight. Consolidation above the 1.3437–1.3446 area would make long positions relevant with a target of 1.3529.

On the 5-minute timeframe, you can trade the following levels: 1.3043, 1.3096–1.3107, 1.3203–1.3212, 1.3259–1.3267, 1.3319–1.3331, 1.3437–1.3446, 1.3529–1.3543, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763. No important data or events are scheduled in the UK or the US on Monday, so volatility is likely to remain very low.

Main rules of the trading system:

- Signal strength is judged by the time required to form the signal (rebound or breakout). The less time required, the stronger the signal.

- If two or more trades were opened on false signals near a level, then all subsequent signals from that level should be ignored.

- In a flat, any pair can generate many false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened between the start of the European session and the middle of the American session; after that, all trades must be closed manually.

- On the hourly timeframe, MACD-based signals should be traded only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too close to each other (5–20 pips), they should be considered a support or resistance area.

- After the price moves 20 pips in the correct direction, set the stop loss to breakeven.

What is shown on the charts:

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.