Trade Review and Tips for Trading the British Pound

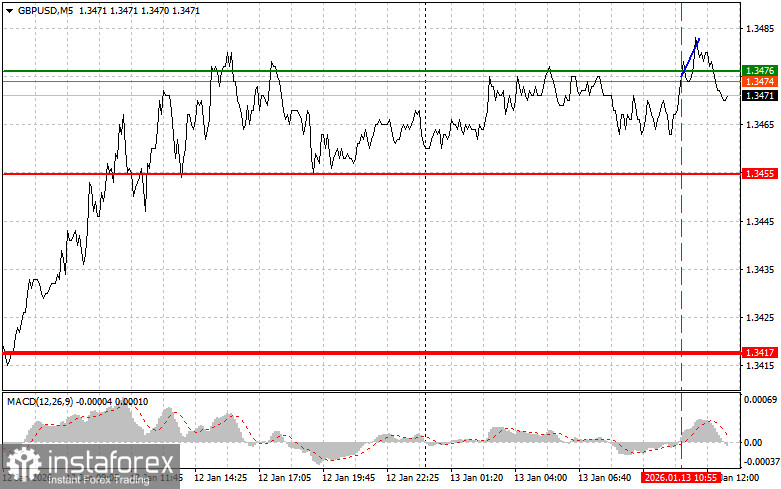

The test of the 1.3476 level occurred when the MACD indicator was just starting to move upwards from the zero line, which confirmed it as the correct entry point for buying the pound. As a result, the pair rose by only 7 points, and the bullish potential was exhausted.

The speech by Bank of England Governor Andrew Bailey did not significantly affect the British pound or support continued growth. Traders had expected clearer signals from the BoE chief regarding the future direction of monetary policy, but Bailey chose to maintain a neutral stance, offering no hints of either a rate hike or a rate cut. This cautious approach likely prompted market participants to adopt a wait-and-see attitude, which was reflected in the pound's price action.

Now, market participants are eagerly awaiting the release of US inflation data, as it may provide insight into the future path of Federal Reserve monetary policy. If the Consumer Price Index (CPI) comes in higher than expected, it could strengthen the case for more aggressive interest rate maintenance, which would support the US dollar.

US new home sales will also be closely monitored, as they are a key indicator of the housing market and overall economic activity. The data is expected to show how high interest rates and concerns over slowing economic growth are affecting demand for housing. Stronger-than-expected figures could signal resilience in the housing sector, while weaker data might increase fears of a broader economic slowdown. Additionally, a speech from FOMC member Alberto Musalem will draw attention, as investors will be looking for any clues on his views regarding the state of the economy and the likely trajectory of interest rates.

Regarding intraday strategy, I will focus more on implementing Scenario 1 and Scenario 2.

Buy Signal

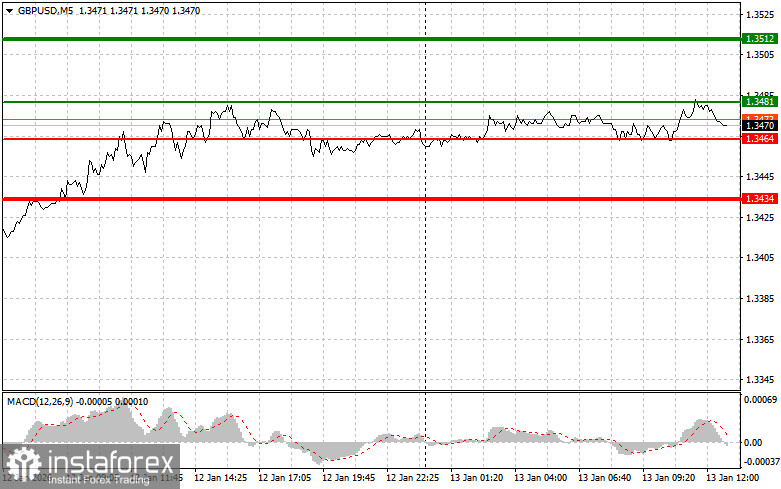

Scenario No. 1:

I plan to buy the pound today if the price reaches the 1.3481 entry point (green line on the chart), targeting a move to the 1.3512 level (thicker green line on the chart). At 1.3512, I will exit the buy positions and consider opening sell positions in the opposite direction, targeting a 30–35 point move back from the entry level. You can expect the pound to rise today only after a drop in US inflation.

Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2:

I also plan to buy the pound today if there are two consecutive tests of the 1.3464 level while the MACD is in the oversold zone. This would limit the downward potential of the pair and trigger a market reversal to the upside. Expect a move toward the opposite levels of 1.3481 and 1.3512.

Sell Signal

Scenario No. 1:

I plan to sell the pound today after the price updates to the 1.3464 level (red line on the chart), which could lead to a sharp decline in the pair. The key target for sellers will be the 1.3434 level, where I will exit the sell positions and immediately open buy positions in the opposite direction, aiming for a 20–25 point move back. Pressure on the pound could return today if US inflation rises.

Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2:

I also plan to sell the pound today if there are two consecutive tests of the 1.3481 level while the MACD is in the overbought zone. This would limit the pair's upward potential and trigger a reversal to the downside. A move toward the opposite levels of 1.3464 and 1.3434 can be expected.

Chart Explanation:

- Thin Green Line — Entry price for buying the instrument

- Thicker Green Line — The projected price level where you can place a Take Profit order or manually lock in profits, as further upside above this level is unlikely

- Thin Red Line — Entry price for selling the instrument

- Thicker Red Line — The projected price level where you can place a Take Profit order or manually lock in profits, as further downside below this level is unlikely

- MACD Indicator — When entering trades, it is important to pay attention to overbought and oversold zones

Important Notice for Beginner Traders

Beginner Forex traders must be very cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss protection, you can quickly lose your entire deposit, especially if you do not practice money management and trade with large position sizes.

Finally, remember that successful trading requires a clear trading plan, like the one I've outlined above. Making spontaneous trading decisions based solely on the current market situation is an inherently losing strategy for intraday traders.