On Monday, the NZD/USD pair broke above the 0.5780 level, aiming for the round 0.5900 mark.

The New Zealand dollar is receiving support from positive economic data from China, a key trading partner. Fresh statistics show that China's GDP growth slowed to 4.5% year-on-year in Q4, down from 4.8% in the previous period, yet still beat the market consensus. This dynamic was largely driven by resilient exports, which offset ongoing weakness in domestic demand. Industrial production accelerated to 5.2% year-on-year, while retail sales growth slowed amid persistent pressure from the real-estate sector on consumer spending.

Despite the fundamental support from Chinese data, the impact on Australia- and New Zealand-linked currencies remains muted. Market participants are cautious amid rising global risk aversion, which traditionally pressures the New Zealand dollar. This negative effect is partially offset by the RBNZ's still restrictive stance, which continues to signal the future policy path and provides some support for the currency.

In the United States, the dollar weakened after US President Donald Trump threatened to impose new tariffs on several European countries. These threats, related to tensions over the Greenland issue, revived concerns about a possible escalation of trade conflicts and increased uncertainty about the US administration's economic policy. In these conditions, the dollar loses some of its appeal as a safe-haven asset, allowing NZD/USD to push toward the round 0.5800 level.

From a technical point of view, the pair has broken above the 100-day SMA, ready to reach the round 0.5800 level. The nearest support will now be the 100-day SMA. Daily-chart oscillators have moved into positive territory, supporting the bulls.

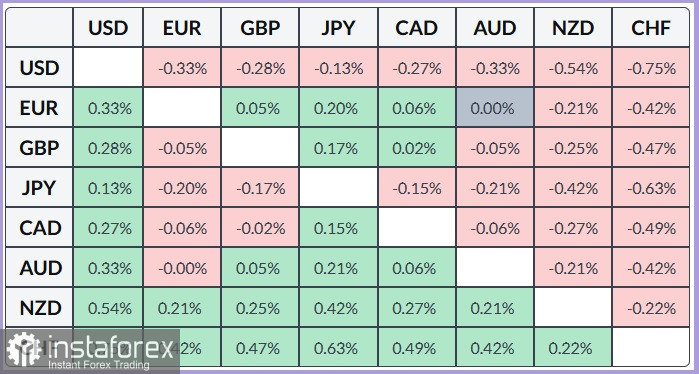

The table below shows the percentage change dynamics of the New Zealand dollar against major world currencies for the current day, with the largest gain recorded versus the US dollar.