Review of trades and trading tips for the British pound

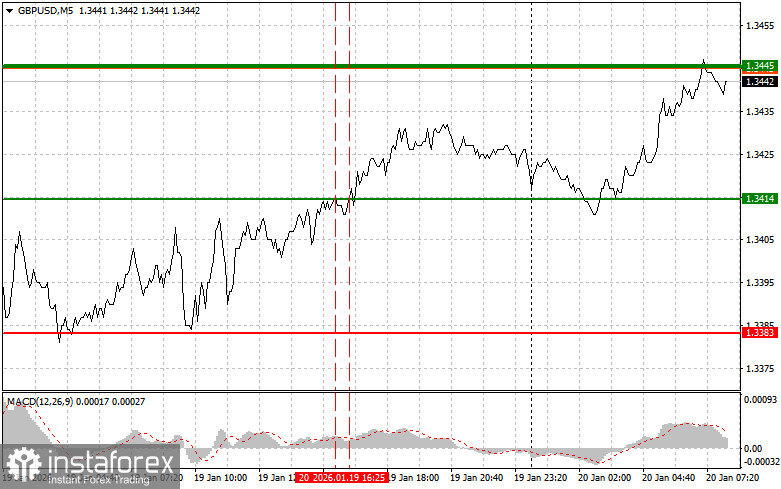

The first test of 1.3414 occurred when the MACD indicator had moved far above the zero line, limiting the pair's upside potential. The second test at 1.3414 coincided with the MACD being in the overbought area, prompting the implementation of Scenario No. 2 to sell, but the pound did not actually decline.

The pound, like other risk assets, was in demand yesterday — especially against the US dollar, which continued to weaken amid escalating geopolitical tensions over Greenland.

This morning, several significant economic data releases are expected, which could significantly impact market trends. An increase in unemployment benefit claims in the UK could signal a slowdown in economic growth and weaker employment, potentially affecting the pound. This will be followed by the unemployment rate, another important indicator of the country's economic health. A low unemployment rate signals a strong labour market and could prompt the Bank of England to keep interest rates unchanged to fight inflation. Conversely, high unemployment could force the central bank to take measures to stimulate the economy. At the same time, average earnings will be published, which also play an important role in assessing inflationary pressure. Wage growth outpacing productivity growth may lead to higher prices and inflation, putting additional pressure on the Bank of England.

The first half of the day will conclude with remarks by BoE Governor Andrew Bailey. Investors will closely analyze his comments for signs of future monetary policy.

As for the intraday strategy, I will rely mainly on the implementation of Scenarios No. 1 and No. 2.

Scenarios for buying

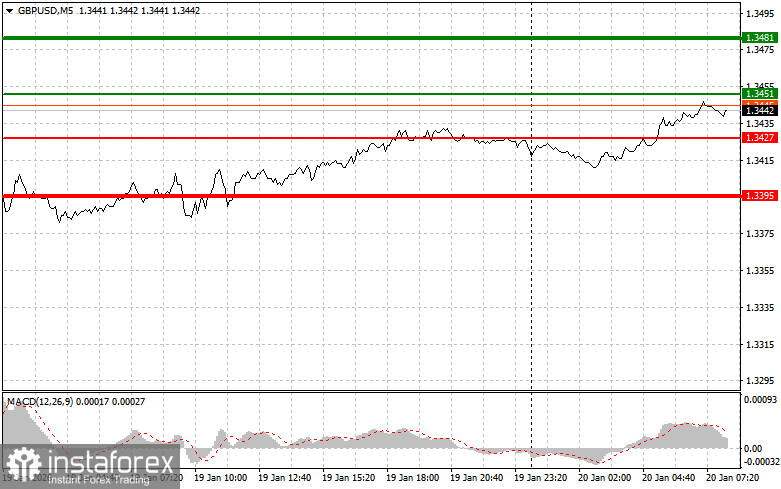

Scenario No. 1: I plan to buy the pound today upon reaching an entry point around 1.3451 (the green line on the chart), with a target to rise to 1.3481 (the thicker green line on the chart). Around 1.3481, I intend to exit longs and open shorts in the opposite direction (expecting a 30–35-pip move in the opposite direction from that level). Expect gains in the pound today only as a continuation of the morning trend. Important! Before buying, make sure the MACD indicator is above the zero line and is only just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today if two consecutive tests of 1.3427 occur while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. One can expect a rise to the opposite levels 1.3451 and 1.3481.

Scenarios for selling

Scenario No. 1: I plan to sell the pound today after the 1.3427 level is broken (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be 1.3395, where I intend to exit shorts and immediately open longs in the opposite direction (expecting a 20–25-pip move in the opposite direction from that level). Pound sellers can assert themselves at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and is only just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today if two consecutive tests of 1.3451 occur while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. One can expect a decline to the opposite levels 1.3427 and 1.3395.

What is on the chart

- Thin green line — entry price at which you can buy the instrument

- Thick green line — suggested Take Profit price or level at which to manually lock in profit, since further rise above this level is unlikely.

- Thin red line — entry price at which you can sell the instrument

- Thick red line — suggested Take Profit price or level at which to manually lock in profit, since further decline below this level is unlikely.

- MACD indicator — when entering the market, it is important to follow the overbought and oversold zones

- Important notes: Beginner forex traders must be very cautious when deciding to enter the market. It is best to be out of the market before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit quickly, especially if you do not use money management and trade large volumes.

- Remember that successful trading requires a clear trading plan like the one presented above. Spontaneous trading decisions based on current market noise are a losing strategy for the intraday trader.