Bitcoin managed to hold above $88,000, though active selling after Trump's remarks led to a weekly low. Trading is now taking place around $90,000, which keeps the chances of a market recovery alive. Ethereum continues to fight for the $3,000 level.

A catalyst for the crypto market's rise and the return of demand for risk assets in general were yesterday's statements by Trump about Greenland and the decision to cancel the imposition of trade tariffs on some EU countries. The market reacted to this news with noticeable optimism. Traders who had previously feared an escalation of the trade war and its negative impact on the global economy interpreted the tariff cancellation as a signal of easing tensions. This, in turn, reduced the outflow from risk assets, including Bitcoin. Trump's statements, which previously often caused market volatility, this time served instead as a catalyst for growth. His comments about a possible consensus on Greenland were perceived as potentially favorable for the crypto market.

A recovery of Bitcoin above $90,000 is an important technical indicator. It may signal the formation of a new support level and a weakening of the recent bearish trend. However, caution is required given the high volatility of the crypto market.

For an intraday strategy in the crypto market, I will continue to rely on large dips in Bitcoin and Ethereum, with a view to the long-term bullish market, which has not disappeared.

Short-term trading strategy and conditions are described below.

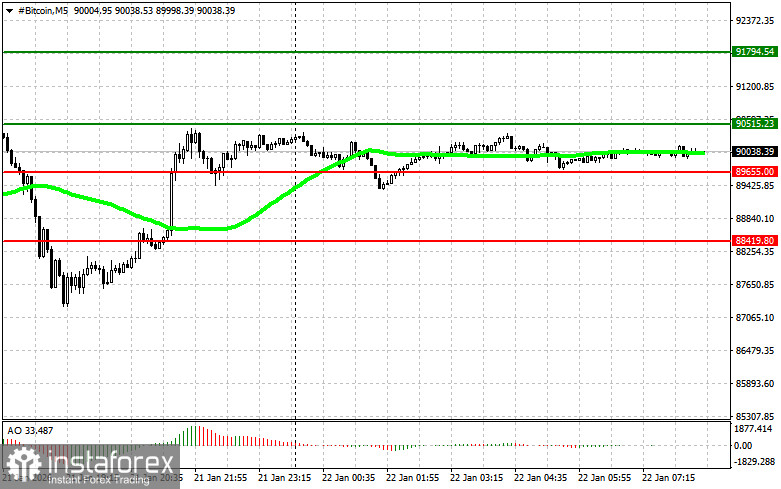

Bitcoin

Buy scenario

Scenario No.1: I will buy Bitcoin today on reaching an entry point around $90,500 with a target to rise to $91,800. Around $91,800, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No.2: Bitcoin can be bought from the lower boundary at $89,600 if there is no market reaction to a breakout below it, targeting $90,500 and $91,800 on the rebound.

Sell scenario

Scenario No. 1: I will sell Bitcoin today at an entry point around $89,600, with a target price of $88,400. Around $88,400, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No.2: Bitcoin can be sold from the upper boundary at $90,500 if there is no market reaction to a breakout above it, targeting $89,600 and $88,400 on the reversal.

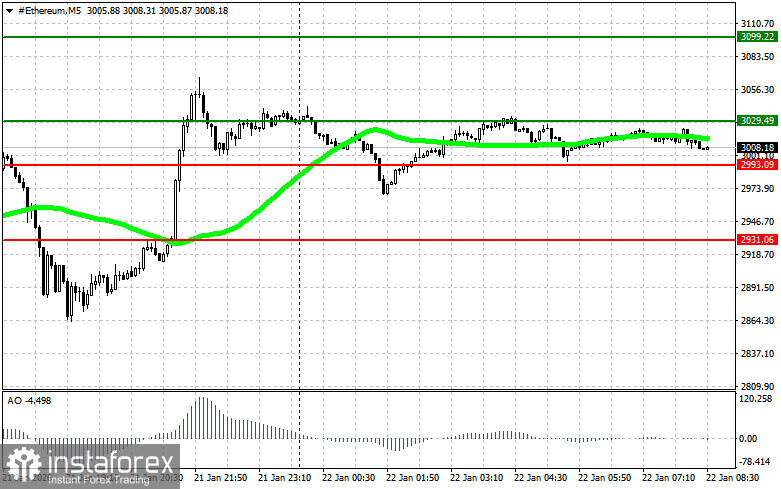

Ethereum

Buy scenario

Scenario No. 1: I will buy Ethereum today at an entry point around $3,029, aiming to rise to $3,099. Around $3,099, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No.2: Ethereum can be bought from the lower boundary at $2,993 if there is no market reaction to a breakout below it, targeting $3,029 and $3,099 on the rebound.

Sell scenario

Scenario No.1: I will sell Ethereum today at an entry point around $2,993, with a target fall to $2,931. Around $2,931, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No.2: Ethereum can be sold from the upper boundary at $3,029 if there is no market reaction to a breakout above it, targeting $2,993 and $2,931 on the reversal.